From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSerbia’s Steel Market: Import Quotas Stabilize Activity Amid Positive Sentiment

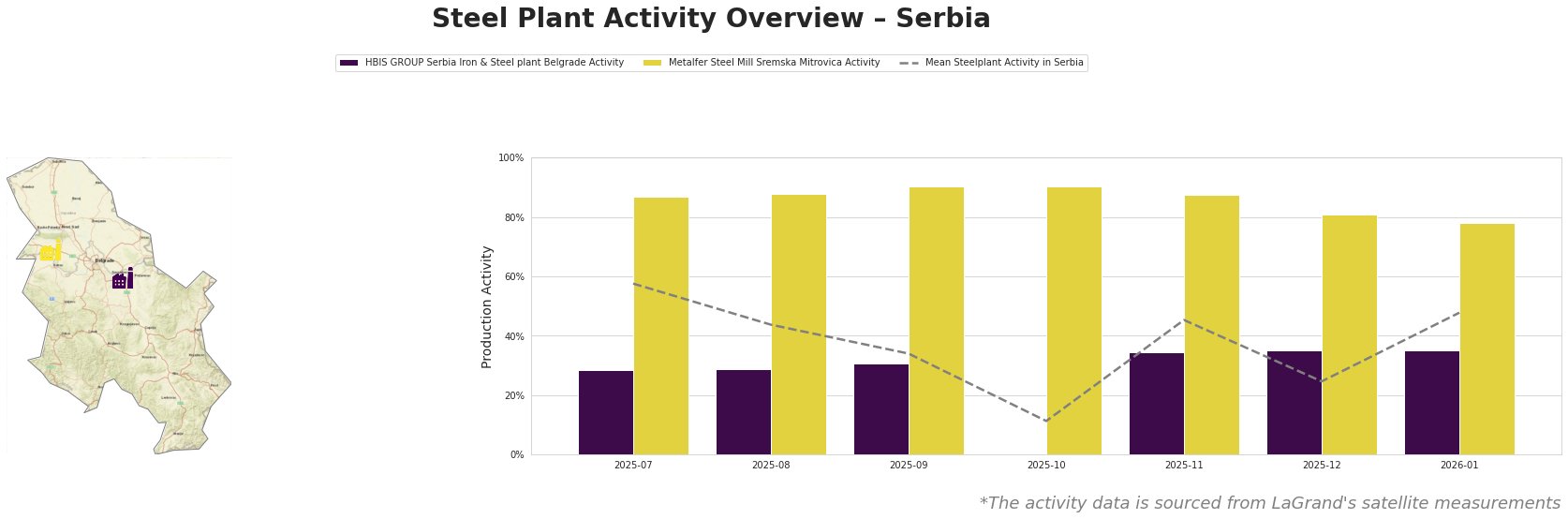

Serbia’s steel industry is responding dynamically to recent regulatory changes, notably the Serbia imposes import quotas on certain iron and steel products and Serbia introduces six-month import quotas on certain steel products, both effective January 1, 2026. These measures are directly correlated with increases in plant activity levels observed through satellite data, signaling enhanced market stability.

In January 2026, the mean activity level rose to 48.0%, a notable improvement compared to the lows recorded in October 2025 (11.0%). The HBIS GROUP plant showed stable activity at 35.0%, while Metalfer Steel Mill peaked at 90.0% in September 2025, though it has gradually declined since.

The implementation of import quotas appears responsible for curtailing excess supply, thereby stabilizing operations at critical production facilities. Specifically, the introduction of import tariffs aligns with the spikes observed in late 2025, reinforcing the manufacturing activities at Metalfer, which consistently operated above 80% in the latter part of the year.

HBIS GROUP Serbia Iron & Steel Plant Belgrade

The HBIS GROUP Serbia Iron & Steel plant in Belgrade, with a crude steel capacity of 2200 tonnes, primarily uses a Basic Oxygen Furnace (BOF) process. Notably, its activity level maintained at 35.0% in January 2026, consistent following a marked increase from a low of 11.0% in October 2025. This steadiness may be attributed to the protective measures from the recent import quotas impacting market dynamics.

Metalfer Steel Mill Sremska Mitrovica

Metalfer Steel Mill, which leans on Electric Arc Furnace (EAF) technology with a capacity of 500 tonnes, exhibited significant and sustained activity, reaching 90.0% last September, before tapering to 78.0% in January. The recent import policies may assure a stable procurement input for Metalfer, crucial for its semi-finished and finished rolled products.

Evaluated Market Implications

The new import quota regulations aim to balance supply-demand dynamics, potentially curtailing disruptions in steel supply—critical for buyers focusing on long-term sourcing strategies. For procurement professionals, a proactive approach towards steel purchases during the quota periods (January to March and April to June 2026) is advisable, prioritizing orders with Metalfer due to its higher operational reliability and production capacity. Conversely, buyers should monitor the fluctuating activity levels of HBIS GROUP to avoid potential stock shortages, as their operational steadiness could dictate shifts in market availability.

In summary, tightly managing procurement timelines in alignment with the observed plant activities and regulatory landscape could mitigate risks linked to supply fluctuations.