From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSerbia Steel Market Faces EU Tariff Threat; HBIS Activity Declines

Serbia’s steel market faces uncertainty due to potential EU trade measures impacting the Chinese-owned HBIS Group Serbia Iron & Steel plant. Several news articles highlight this concern: “Serbia eyes EU negotiations over proposed trade measure,” “Serbia seeks talks with EU on new steel safeguard measures,” “Serbia is closely following the EU negotiations on the proposed trade measures,” and “Serbia to seek exemption from EU’s proposed steel safeguards.” These articles detail President Vucic’s efforts to negotiate exemptions or quotas to mitigate the negative impact on Serbian steel exports. Satellite data shows a clear downtrend in activity at HBIS, possibly related to weak global demand as reported, but there is no explicit connection between the EU measure proposals and the plant activity.

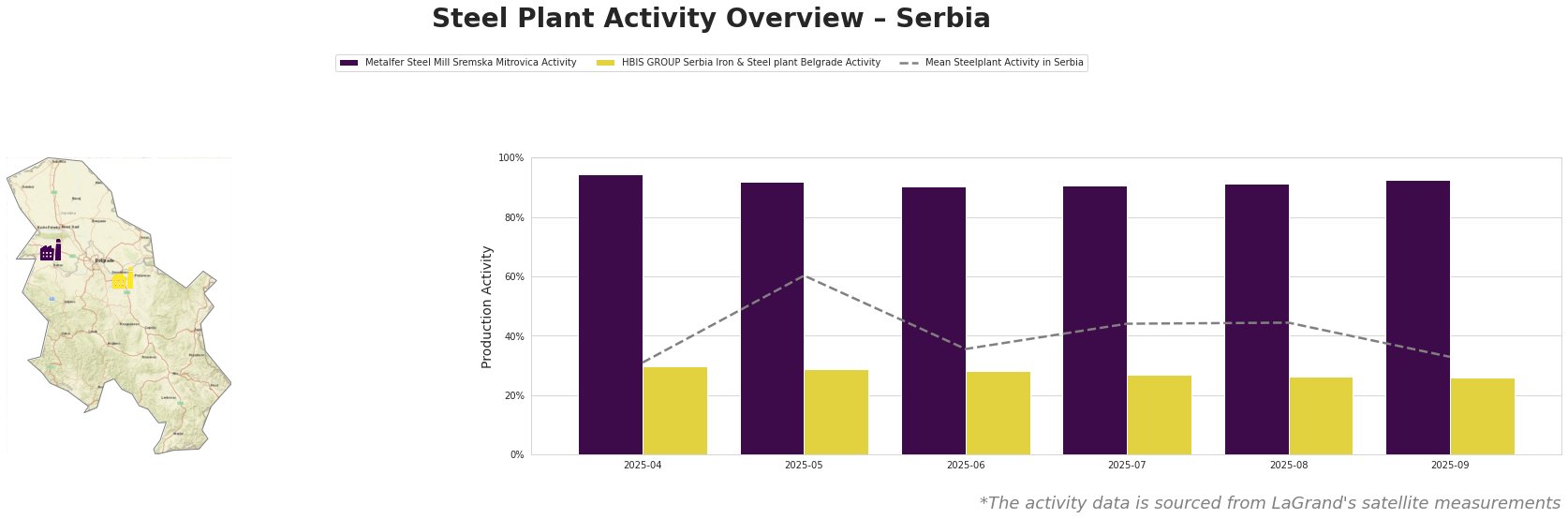

Overall, the mean steel plant activity in Serbia shows fluctuations, peaking in May at 60.0 and then declining to 33.0 by September. The HBIS plant activity consistently declined from April (30.0) to September (26.0), while Metalfer’s activity remained consistently high, between 90 and 94. This divergence suggests plant-specific factors are at play, with the HBIS plant exhibiting a potential decline even before the EU measures are implemented.

Metalfer Steel Mill Sremska Mitrovica, located in Vojvodina, has a crude steel capacity of 500 ttpa using electric arc furnace (EAF) technology and produces semi-finished and finished rolled products, including rebar and billets. Notably, satellite data reveals consistently high activity levels (90-94%) between April and September. This suggests stable operations unaffected by the issues impacting HBIS or broader market concerns. While Metalfer is powered by renewable energy, according to its profile, it is not explicitly mentioned in any of the provided news articles, therefore no direct connection can be established between its activities and the news articles provided.

HBIS GROUP Serbia Iron & Steel plant Belgrade, situated in Podunavlje, is an integrated steel plant with a crude steel capacity of 2200 ttpa using blast furnace (BF) and basic oxygen furnace (BOF) technologies. It produces hot-rolled and cold-rolled products. The plant’s activity has steadily decreased from 30% in April to 26% in September. The news articles “Serbia eyes EU negotiations over proposed trade measure,” “Serbia seeks talks with EU on new steel safeguard measures,” “Serbia is closely following the EU negotiations on the proposed trade measures,” and “Serbia to seek exemption from EU’s proposed steel safeguards” directly link potential EU tariffs to a negative impact on this plant and its exports, and also mention reduced operations due to weak global demand. While the exact link cannot be established, the observed downtrend aligns with these concerns.

Given the potential for EU tariffs and the declining activity at HBIS, Serbian steel buyers should:

- Diversify Sourcing: Reduce reliance on HBIS steel and explore alternative suppliers, potentially including increased procurement from Metalfer, to mitigate potential supply disruptions from HBIS.

- Monitor EU Policy: Closely track the ongoing negotiations between Serbia and the EU as mentioned in “Serbia eyes EU negotiations over proposed trade measure” and “Serbia seeks talks with EU on new steel safeguard measures” to anticipate potential tariff implementations and their impact on steel prices.

- Assess Inventory Levels: Evaluate current steel inventory levels and consider increasing stockpiles to buffer against potential supply shortages resulting from reduced HBIS output, should the EU measures be enacted.