From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineRobust Steel Market Growth in the Netherlands: Satellite Data Reflects Rising Activity Levels

Recent developments in the Netherlands’ steel market reflect a very positive sentiment, driven by notable regulatory changes and increasing demand for sustainable fuels. Articles such as “Viewpoint: Dutch ticket move to help low-emission fuels,” and “Viewpoint: Biogas growth uneven, shipping drives 2026,” underscore the potential for market expansion, particularly as the country transitions to a GHG savings-based renewable fuel ticket system. This shift appears to correlate with increasing activity levels at major steel plants, particularly Tata Steel IJmuiden.

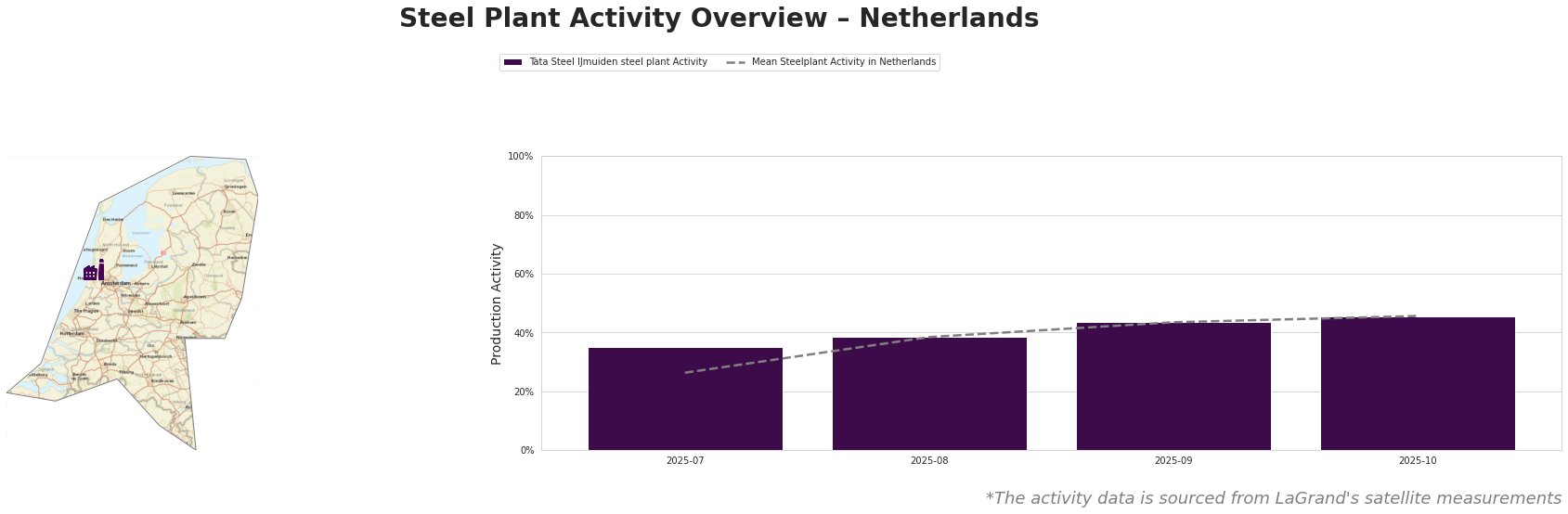

Tata Steel IJmuiden, North Holland’s significant steel producer, has consistently reflected stable or increasing activity levels, matching the mean activity in the Netherlands as it climbed from 35% in July to 46% by October 2025. This stability may be connected to the regulatory environment aimed at boosting sustainable fuel production and usage; however, no direct link between these specific activity changes and the articles could be established.

Tata Steel IJmuiden operates with a crude steel capacity of 7,500 tons, primarily through blast furnace (BF) and basic oxygen furnace (BOF) processes. This integrated method allows for the production of both semi-finished and finished rolled products, positioning the plant as a critical player amidst evolving fuel regulations.

The implications of these findings signal potential supply disruptions in the market. As the Netherlands pivots towards stricter GHG regulations, steel buyers should actively engage with Tata Steel IJmuiden to ensure consistent procurement strategies that align with emerging low-emission frameworks. Securing contracts now may mitigate risks associated with fluctuating activity and supply interruptions as the industry adapts to new regulations. The market’s increasing activity suggests that steel procurement strategies should also prioritize sustainable practices, as future demands may hinge on compliance with GHG mandates and shifts towards more environmentally friendly production processes.