From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineRising Scrap Exports and Stable Steel Production Signal Continued Strength in European Steel Market

Europe’s steel market remains very positive, influenced by shifting scrap dynamics and generally stable steel plant activity. Increased scrap exports from Ukraine, as highlighted in “Scrap exports from Ukraine exceeded 44,000 tons in July,” and Poland, reported in “Poland increased scrap exports by 8.6% y/y in 1H2025,” do not appear to be negatively impacting steel production currently, as observed through satellite data of key European steel plants. The news regarding the reduction of iron ore exports in “Ukraine reduced iron ore exports by 7% y/y in January-August” is not linked to steel plant activity.

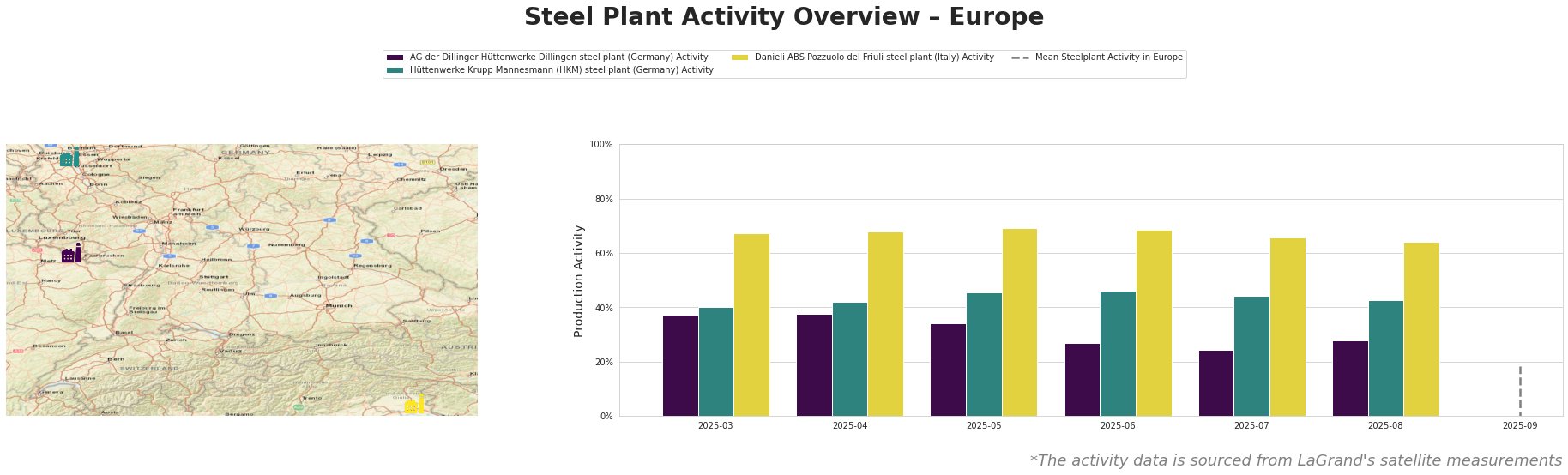

Observed Steel Plant Activity:

Across the monitored period, the average activity level in Europe displays negative values for the first six months before registering a positive value. AG der Dillinger Hüttenwerke shows a gradual decline from 37% in March to 24% in July, followed by a slight recovery to 28% in August. Hüttenwerke Krupp Mannesmann’s activity peaked at 46% in June but stabilized around 43-44% in July and August. Danieli ABS Pozzuolo del Friuli recorded the highest activity levels, maintaining a range between 64% and 69% throughout the period. It’s important to note that the fluctuations in scrap exports, as reported in the news articles, do not have a direct and clear correlation to activity levels based on satellite data.

Steel Plant Information:

AG der Dillinger Hüttenwerke, an integrated steel plant in Saarland, Germany, relies on BF/BOF technology with a crude steel capacity of 2.76 million tonnes. Satellite data shows a decline in activity from March to July, bottoming out at 24% before a slight increase to 28% in August. This activity drop cannot be directly linked to the news articles about scrap exports or iron ore, suggesting other factors may be influencing production.

Hüttenwerke Krupp Mannesmann (HKM), another major integrated steel plant in North Rhine-Westphalia, Germany, boasts a 6 million tonne crude steel capacity, also using BF/BOF processes. Its activity peaked at 46% in June and remained relatively stable around 43-44% in July and August. Like Dillinger, there is no immediate relationship between the news items about scrap or iron ore and observed plant activity.

Danieli ABS Pozzuolo del Friuli, an EAF-based steel plant in Italy with a 1.1 million tonne capacity, demonstrated the highest and most stable activity levels, ranging from 64% to 69%. As an EAF plant, increased scrap availability could positively influence output, but there is no way to prove such a link based on the provided news.

Evaluated Market Implications:

Despite increased scrap exports from Ukraine and Poland, the activity levels at the observed plants remain relatively stable, indicating no immediate supply disruptions.

Recommended Procurement Actions:

- Monitor Scrap Price Volatility: Steel buyers should closely monitor scrap prices, especially in Turkey, India, and Pakistan, the primary destinations for Polish scrap as reported in “Poland increased scrap exports by 8.6% y/y in 1H2025.” Any significant price fluctuations in these markets could influence scrap import costs and, subsequently, steel production costs in Europe, particularly affecting EAF-based producers like Danieli ABS Pozzuolo del Friuli.

- Evaluate Sourcing Options: Given the potential for future restrictions on scrap exports from Ukraine, as suggested in “Scrap exports from Ukraine exceeded 44,000 tons in July,” steel buyers reliant on Ukrainian scrap should evaluate alternative sourcing options to mitigate potential disruptions in the long term.

- Focus on Regional Suppliers: Given stable steel plant activity, focus on establishing or strengthening relationships with regional suppliers to ensure a steady supply amid potential shifts in global scrap and iron ore markets.