From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in South America’s Steel Market: Insights from Plant Activity and Key Developments

Brazil’s steel market is currently undergoing significant changes, marked by a positive sentiment as reflected in recent news. The article “Viewpoint: Brazil seeks gas growth and price cuts“ indicates a potential boost in industrial demand driven by increased natural gas production up to 127 million m³/d by 2035. This development aligns with recent increases in steel plant activity, notably at Simec Pindamonhangaba and CSN Volta Redonda, where operational trends are shifting positively.

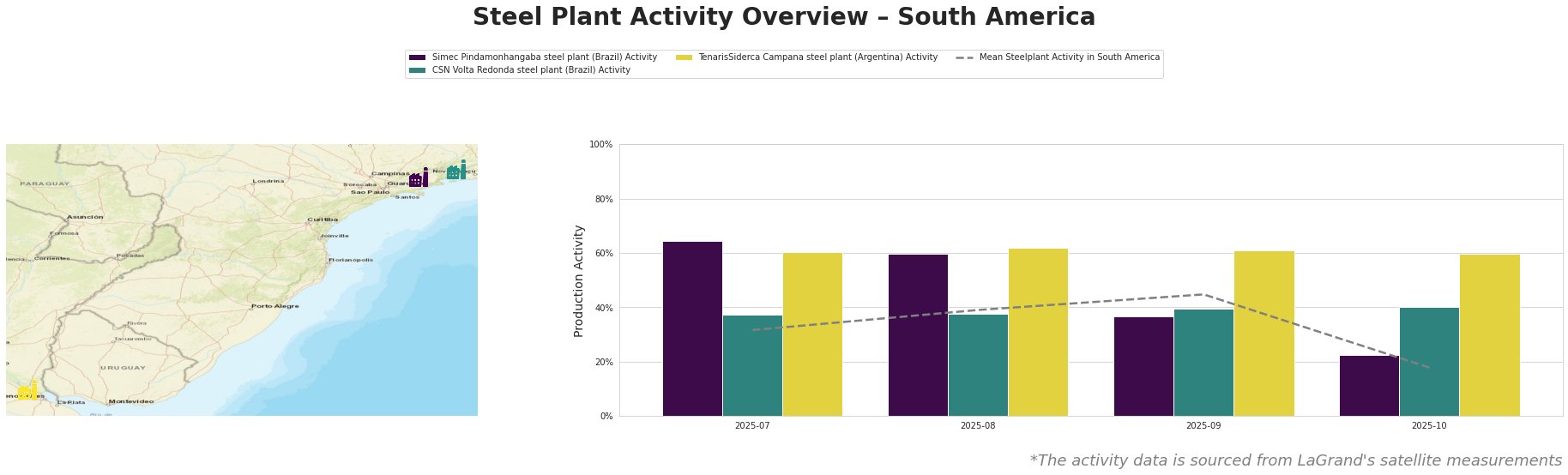

Significant fluctuations in plant activity were recorded, with mean activity levels demonstrating notable peaks in July (32.0%) and August (39.0%), while September showed further improvement at 45.0%. Conversely, an activity drop to 18.0% in October raises concerns, particularly for Simec, which fell to 23.0% down from 65.0%. The transition towards gas-fueled production is anticipated to positively impact overall capacity utilization, particularly at symbiotic or dependent refiners, potentially linked to upstream project expansions as noted in the gas growth article.

At the Simec Pindamonhangaba steel plant in São Paulo, activity peaked at 65.0% in July but decreased to 23.0% by October. This decline cannot be directly correlated to an external market factor but may be linked to temporary operational adjustments in anticipation of increased natural gas capabilities, potentially improving cost structures and efficiency in the long run. Simec’s predominant production of finished rolled products, like wire rod and rebar, may further benefit from rising industrial demand indicated in the natural gas narrative.

The CSN Volta Redonda plant, with a notable production capacity of 6,250 tons of crude steel, saw a modest fluctuation in activity, staying around the mid-30s to low-40s percentile. However, its versatile product offerings across multiple sectors including automotive and infrastructure suggest it can adapt rapidly to changing market demands, especially with the anticipated uptick in natural gas supply.

Finally, the TenarisSiderca Campana facility in Buenos Aires maintained its activity levels consistently around 60% but displayed resilience amid the fluctuations noted elsewhere. As major players leverage new energy mandates and seek lower pricing structures, Tenaris might pivot more towards its energy sector linkages as these markets expand.

For steel buyers and analysts, the positive sentiment and evolving factors suggest now may be an opportune moment to reassess procurement strategies. Focusing on securing contracts associated with plants demonstrating strong activity, like CSN Volta Redonda and TenarisSiderca, could hedge against potential supply disruptions stemming from Simec’s recent adjustments. Engaging with suppliers whose operations are directly supported by Brazil’s burgeoning natural gas growth may enhance negotiation leverage, ensuring favorable pricing and delivery timelines amidst the competitive landscape.