From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Italy’s Steel Market Amid Rising Prices and Stable Demand

Italy’s steel industry is witnessing a positive market sentiment as evidenced by the substantial increase in heavy plate prices and a notable uptick in order volumes. The recent articles titled “Italian heavy plate rises on CBAM slab costs“ and “The cost of Italian heavy rolled products has increased amid rising prices for CBAM plates“ directly correlate with satellite-observed activity levels showing mixed trends but overall stability in production orders.

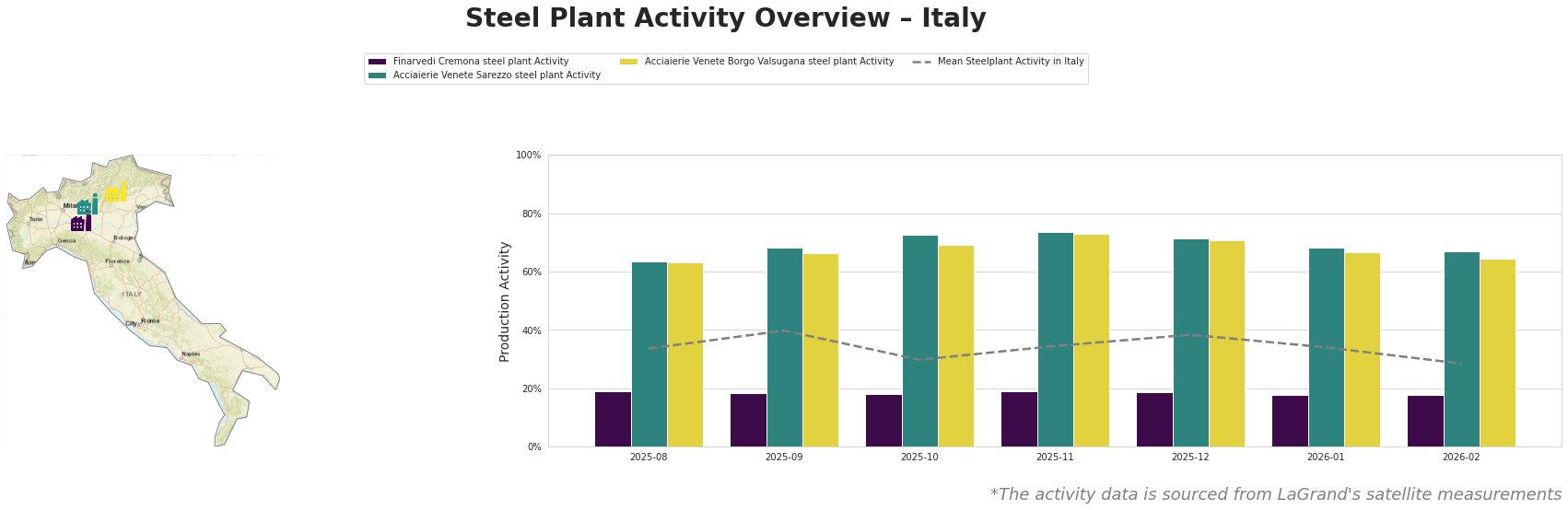

Measured Activity Overview

Activity levels across Italy’s steel plants have shown fluctuations; however, the overall mean activity has stabilized around the mid-30% mark. Notable peaks were observed in September 2025 (40.0%), while February 2026 recorded a dip to 28.0%. This decline correlates with rising slab prices linked to the CBAM, as reported in “The cost of Italian heavy rolled products has increased amid rising prices for CBAM plates.”

Plant Information

Finarvedi Cremona Steel Plant in the Province of Cremona operates with a capacity of 3,850 tonnes of crude steel primarily through Electric Arc Furnaces (EAF). Recent activity shows a stable involvement in semi-finished and finished rolled products, however, the plant’s activity dropped to 18.0% in January 2026. This decrease may reflect the heightened prices detailed in the article “Italian heavy plate rises on CBAM slab costs,” where rising slab costs have put pressure on local production capabilities.

At Acciaierie Venete Sarezzo, with a production capacity of 540 tonnes, activity levels peaked at 74.0% in November 2025 but receded to 68.0% by January 2026. This stability and slight decline indicate a robust order intake but also suggest a sensitivity to rising prices, aligning with insights from both referenced news articles regarding escalating rolled steel costs impacted by CBAM.

Acciaierie Venete Borgo Valsugana operates at a similar capacity to Sarezzo and has shown a consistent activity level, though it also dipped to 64.0% in February 2026. The connection to CBAM-induced cost pressures, as highlighted in the articles, implies that the industry may see continued challenges balancing price increases with production efficiency.

Evaluated Market Implications

Steel buyers should prepare for potential supply disruptions as rising slab costs linked to the CBAM impact production dynamics. Noteworthy plants like Finarvedi Cremona and Acciaierie Venete Sarezzo may be influenced by international slab prices that could trigger further domestic price adjustments.

Based on the analysis of pricing trends and activity levels, steel buyers are advised to:

– Strategically hedge procurement before anticipated price hikes potentially reaching €800/ton discussed in the articles.

– Engage with suppliers proactively to secure favorable terms amidst fluctuating market dynamics.

– Monitor CBAM developments closely, as continued regulatory changes could introduce new variables impacting supply availability and price stability.

These steps are crucial to navigating the complexities emerging from price surges linked to the CBAM, which have significant implications for the Italian steel market’s future.