From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market: Insights from Recent Activity and Developments

In Asia, the steel market is exhibiting a Positive sentiment influenced by significant recent developments. Notably, “Emissions in China’s steel industry increased by 7.1% y/y in November“ and “Rolled steel consumption in China will fall by 5.4% y/y in 2025 – forecast“ highlight shifts in production and consumption dynamics. These changes are directly connected to observed satellite-derived activity fluctuations across several steel plants.

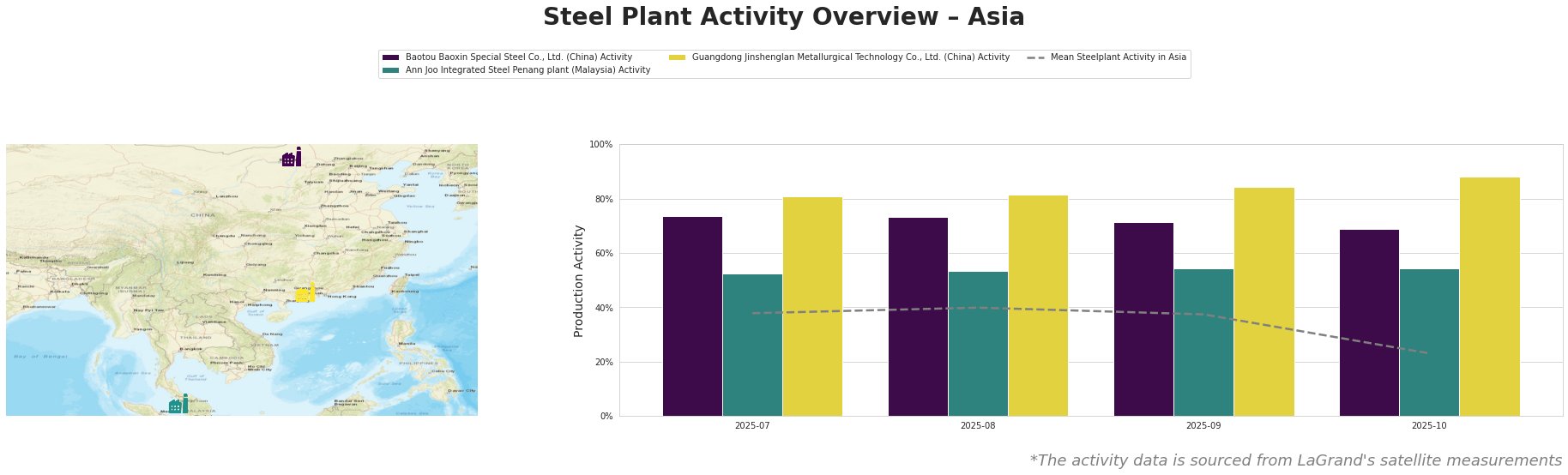

The overall activity of steel plants in Asia has fluctuated notably, particularly dropping to 23% by October 2025. The drop aligns with China’s forecasted decline in rolled steel consumption, indicating a reaction to diminished demand, especially in construction, linked to current economic conditions. Baotou Baoxin showed resilience with activity peaks around 74%, though it declined by 5% to 69% in October, likely reflecting the increase in emissions reported earlier. Ann Joo’s activity remained comparatively stable around 52-54%, indicating consistent operational capacity.

The Baotou Baoxin Special Steel Co., Ltd., located in Inner Mongolia, has primarily operated using integrated blast furnace technology. Observing a drop from 74% to 69% correlates with the national emissions rise and the broader steel consumption decline in China. Despite these issues, the plant’s capacity for special steel production may allow it to pivot towards sectors with stronger demand.

The Ann Joo Integrated Steel Penang plant shows stable operations averaging around 54% throughout the observed period. With a focus on crude and semi-finished products for infrastructure, its consistent activity levels suggest resilience against market fluctuations and a potential opportunity for procurement given its stable production environment.

Contrarily, Guangdong Jinshenglan Metallurgical Technology Co., Ltd. saw escalating activity levels, peaking at 88% in October. This increase might be attributed to a transition in production strategies or a response to market conditions prioritizing high-quality special steel, despite the overall market demand declining.

The Indian government’s initiative as reported in “The Indian government will increase its focus on steel industry and raw material security“ showcases plans for enhanced steel production capabilities which could alter supply dynamics. Should these initiatives bear fruit, procurement strategies should account for the anticipated rise in regional supply capacity.

Recommended Actions

- For Buyers: Consider securing contracts with rising producers like Guangdong Jinshenglan, as their responsiveness to market trends indicates potential reliability.

- For Analysts: Monitor the projected shifts in Chinese steel regulations outlined in “China will maintain control over steel production and exports in 2026-2030“, which may introduce volatility into supply chains, necessitating proactive sourcing strategies.

- Attention should also be directed towards Indian developments for potential procurement opportunities stemming from the expected growth in production capacity amidst domestic challenges.

These actionable insights derived from observed activity and current news trends provide a roadmap for navigating the evolving steel market landscape in Asia.