From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market: Increased Exports and Production Capability

In Asia, particularly India, the steel market is experiencing a positive shift driven by an increase in export activity and production capacity. Recent insights from the articles “India increased steel exports by 31% y/y in April-November“ and “The Indian government will increase its focus on steel industry and raw material security“ reveal significant growth in steel exports and strategic support from the government for production enhancements. These developments correlate with satellite-observed increases in production activities, particularly among select plants in the region.

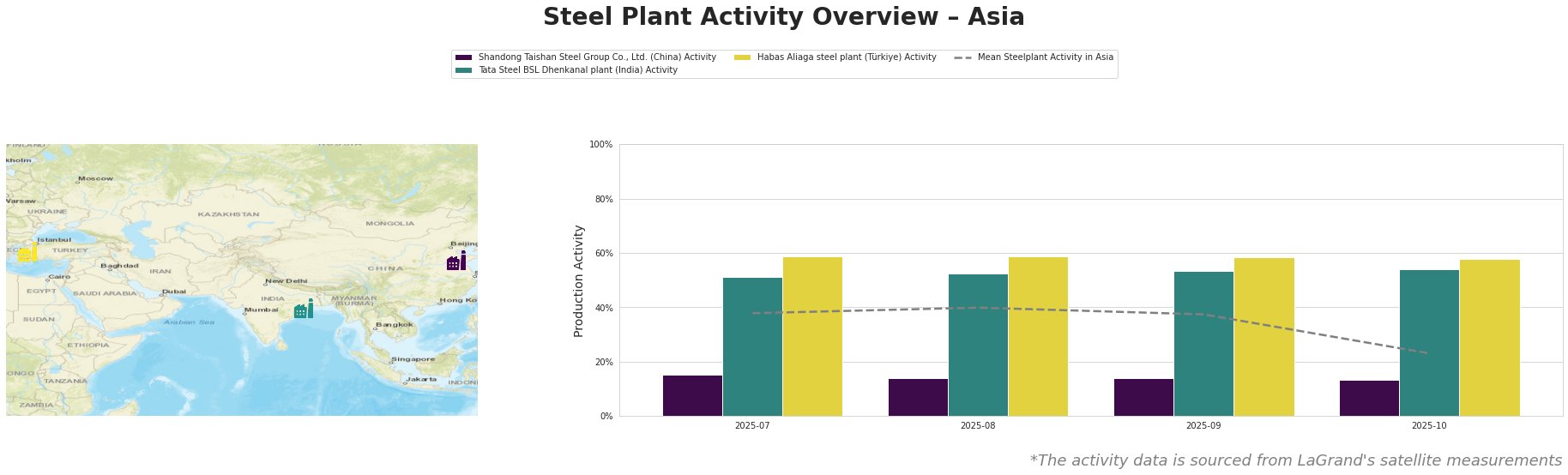

The activity levels across observed plants show some fluctuations, with the mean activity level dropping to 23.0% by October 2025. Notably, Tata Steel BSL Dhenkanal demonstrated strong activity, reaching as high as 54.0% in October. In contrast, Shandong Taishan Steel’s activity fell to 13.0%, reflecting challenges possibly tied to “Oversupply, rains drag Indian HRC prices lower in 2025“, which outlines market pressures and reduced demand affecting production plans.

For Tata Steel BSL, the strong production levels align with the article titled “India increased steel exports by 31% y/y in April-November,” indicating its capacity to leverage strong export demand, particularly towards the EU, leading to higher operational activity levels. This is further underscored by the Indian government’s strategic focus to ramp up steel production and secure raw material, as discussed in “The Indian government will increase its focus on steel industry and raw material security.”

Habas Aliaga has maintained relatively stable productivity levels, suggesting resilience amidst market fluctuations linked to regional demands.

Given these developments, steel buyers should consider increasing procurement from Tata Steel BSL to capitalize on its heightened export capabilities and government support towards production. There exists, however, a risk of supply disruptions from Shandong Taishan Steel due to its recent activity declines, warranting cautious engagement with suppliers from this region. Immediate exploration into alternative suppliers within India, particularly focusing on Tata Steel BSL and Habas Aliaga, is recommended to mitigate any potential procurement risk.