From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trajectory in India’s Steel Sector Post India-US Trade Deal

India’s steel market is witnessing a strong positive sentiment driven by the recently finalized India-US trade deal, which is set to enhance economic relations and create opportunities for industrial sectors, including steel. Articles such as “India-US Trade Deal: From Laptops To Dairy – Here’s What Gets Cheaper In India“ and “India-US Trade Deal Will Pave Way For Stronger Ties, Mutual Growth: Amit Shah“, elucidate how reduced tariffs and trade friction will benefit multiple sectors, although satellite-observed data from selected steel plants does not overtly link this news to immediate changes in activity levels.

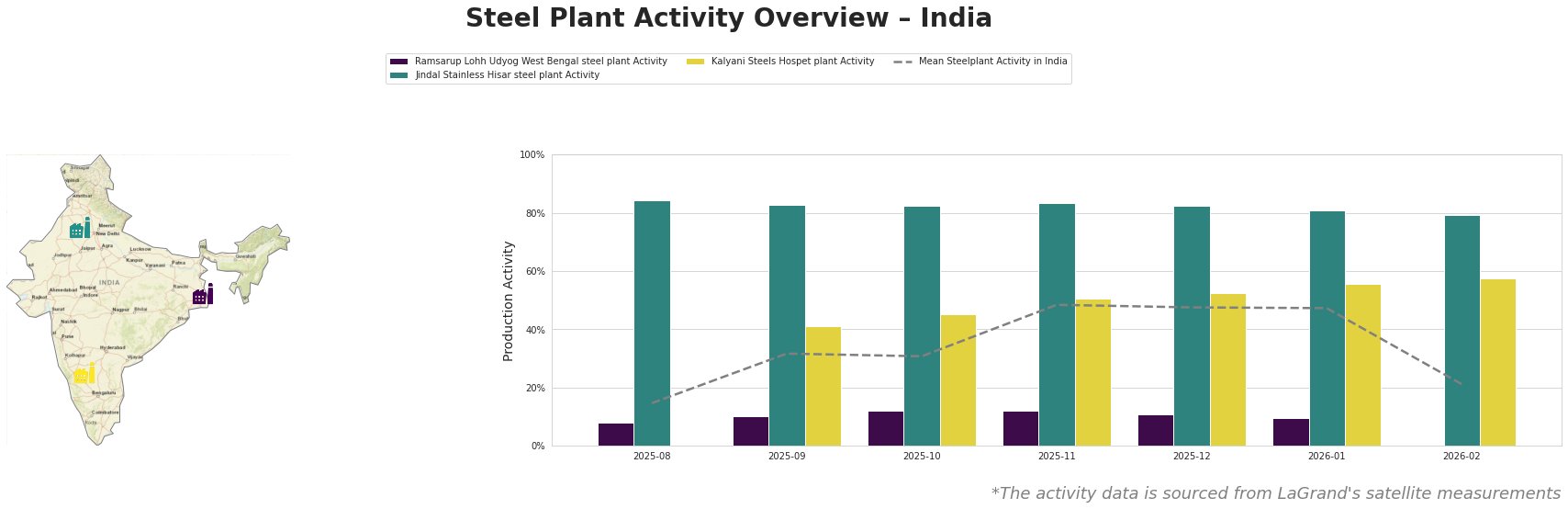

The activity levels of Jindal Stainless Hisar, with a consistent range around 81-84%, have shown stability despite broader market fluctuations. In contrast, Kalyani Steels Hospet’s activity rose from 41% in September to 58% in February, reflecting gradual improvements reflective of increased demand. Conversely, Ramsarup Lohh Udyog showed a concerning drop from 12% in October to non-active status in February, indicating potential operational challenges. Currently, there appears to be no direct link between this operational drop and the recent trade deal, highlighting a need for focused interventions in plant management.

The India-US trade deal, binding India to purchase over $500 billion in American goods, including steel-related products, is expected to foster a more dynamic market attitude, encouraging buyers to consider forward procurement strategies to capitalize on anticipated price reductions and improved supply chains.

Given this landscape:

– Immediate Action: Buyers should secure contracts with Kalyani Steels Hospet, leveraging its upward trajectory to stabilize procurement amid potential price fluctuations from the trade deal.

– Risk Mitigation: Close monitoring of Ramsarup Lohh Udyog’s activity is crucial, as its drop to inactivity poses a disruption risk; forming alternative supply arrangements would be prudent.

– Strategic Sourcing: Engage with Jindal Stainless Hisar for stable supply options, particularly in finished and semifinished products, to benefit from consistent operational levels.

In summary, while the broader market sentiment remains very positive due to the trade deal, actionable steps should focus on stable suppliers and strengthening relationships with active plants to navigate potential market uncertainties effectively.