From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in Europe: Insights from Recent Activity and News

In Europe, recent analyses indicate a positive sentiment in the steel market characterized by consistent production levels in Ukraine, as detailed in “Ukraine’s 2026 steel output may match 2025: GMK”. This stability aligns with observed satellite data indicating ongoing activity across major plants. Notably, the reported decline in Ukrainian production due to external factors, such as the upcoming carbon management regulations referenced in “The volume of steel production in Ukraine in 2026 may correspond to the level of 2025: GMK”, impacts export opportunities but opens avenues for domestic utilization.

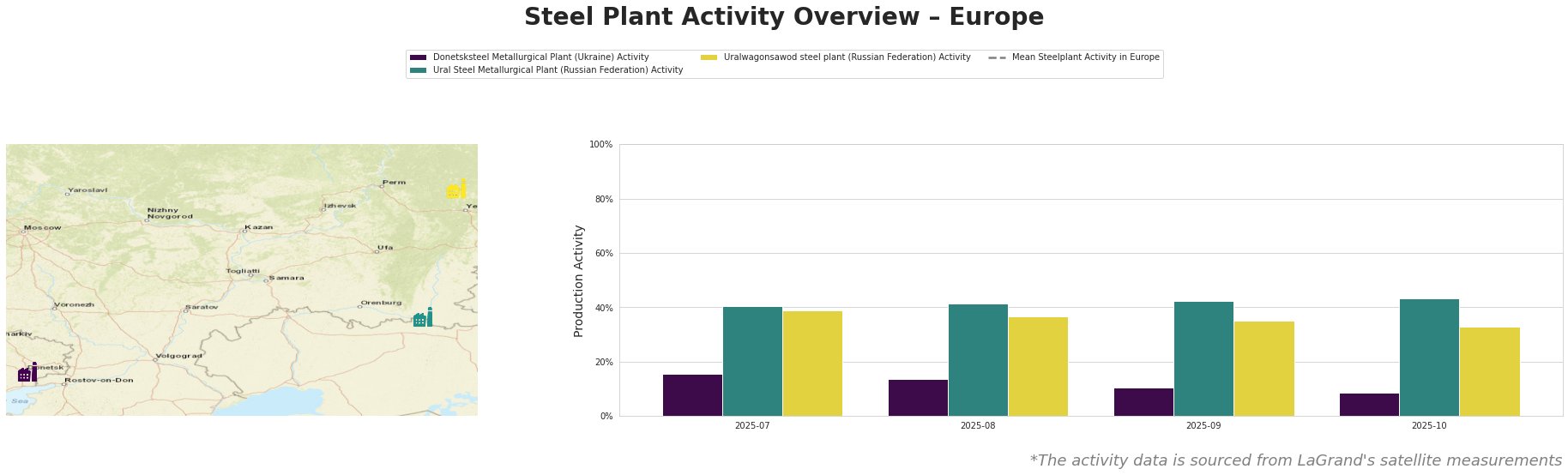

Activity levels across the Donetsksteel and Ural plants have shown significant variability. Donetsksteel’s output peaked at 15.0% in July but declined to 9.0% by October, correlating with article insights indicating production capacity constraints amid external pressures, particularly from export markets. This plant’s lack of operational blast furnaces further complicates its output stability. In contrast, Ural Steel’s activity has remained comparatively higher, peaking at 43.0% in October, reflecting its integrated production capacity and adaptability in its manufacturing processes.

The Uralwagonsawod steel plant, though lacking concrete activity data due to unspecified operational status, has implications for the defense sector, which is indirectly referenced in the market outlook.

Given this context, supply disruptions are anticipated, particularly for steel derived from Ukraine. The potential for competitive disadvantage stemming from carbon management regulations necessitates a proactive approach for procurement teams.

Actionable Recommendations for Steel Buyers and Analysts:

1. Diversify Procurement Sources: Given Ukraine’s unstable output forecasts, consider widening the supplier base beyond traditional channels to mitigate risks.

2. Focus on Premium Products: With increasing local demand spurred by domestic defense and reconstruction projects, prioritize sourcing high-quality steel products from stable producers like Ural Steel.

3. Monitor Regulatory Changes: Stay informed about the implications of the CBAM regulations which may affect import capacities from Ukraine and other key supply regions.

These strategies, based on the current landscape and satellite data trends, can enhance procurement resilience amidst ongoing market shifts.