From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in China: Export Growth Amid Capacity Challenges

China’s steel industry is experiencing notable growth in export volumes despite significant overcapacity issues. Recent insights from the articles “China’s excess capacity problem has no quick fix – WorldSteel“ and “Worldsteel: The problem of excess steel production capacity in China will not be easy to solve“ indicate a projected demand decline of 2% in 2025 and 1% in 2026. These trends significantly influence plant activity levels, with exports reaching record highs of over 100 million tons within eleven months—indicating substantial operational activity at numerous steel facilities, despite constraints.

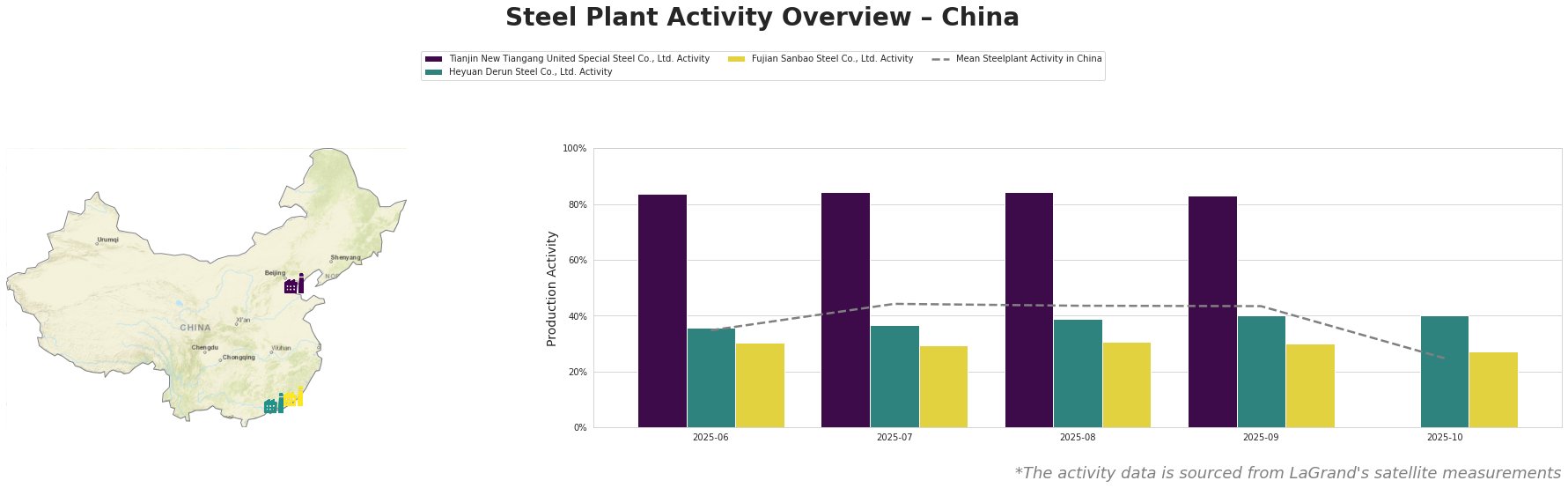

Activity levels for Tianjin New Tiangang United Special Steel Co., Ltd. have remained relatively strong, maintaining around 84% utilization through mid-2025, reflecting stability in operations despite broader market challenges. The slight drop to 83% in September aligns with signals from “Worldsteel: China’s steel surplus becoming increasingly difficult to address,” where the impact of overcapacity on production was discussed.

In contrast, Heyuan Derun Steel Co., Ltd. shows a healthy spike to 40% activity in October from a low of 36% in June, emphasizing resilience amid capacity constraints. This rebound could suggest effective market adaptation efforts, as from “China issues new regulations for exports of steel products,” the introduction of new regulations potentially stabilizes local supply and enhances export quality.

Fujian Sanbao Steel Co., Ltd. has consistently operated around 30-31% capacity, with a minor decrease to 27% in October. The lack of significant fluctuations can be viewed in light of the anticipated shifts mentioned in “Worldsteel: China’s steel overcapacity won’t be easy to resolve,” which outlines challenges for facilities amid domestic demand dips.

The substantial growth in finished steel exports (up 6.7% to 107.717 million metric tons) suggests ongoing demand for Chinese products, which is facilitated by substantial infrastructure projects as reported. However, the potential for global trade tensions increases as anti-dumping measures proliferate, potentially disrupting supply chains.

Given these dynamics, steel buyers should consider procurement strategies that emphasize flexibility, especially with the anticipated regulatory shifts impacting exports from China. It may also be prudent to establish firm contractual obligations with suppliers to hedge against potential supply disruptions from plants demonstrating significant activity fluctuations, specifically Tianjin New Tiangang and Fujian Sanbao. Monitoring these developments closely will be essential in navigating the evolving landscape, ensuring procurement teams remain agile and proactive.