From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in Asia Driven by Increased Plant Activities and Supply Developments

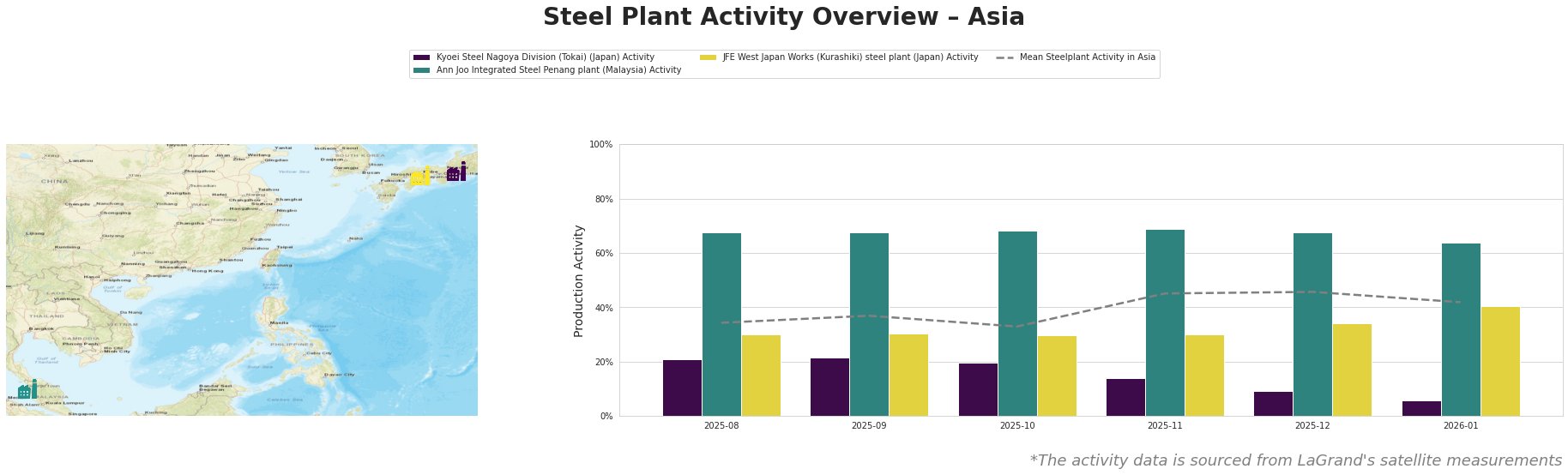

Recent satellite observations indicate a positive shift in steel plant activity levels across Asia, particularly following recent articles that highlight supply dynamics. Specifically, the news article titled US braces for gas freeze-offs, ice storm outlines significant disruptions in U.S. natural gas production and increasing prices, potentially affecting steel manufacturing costs in Asia through heightened energy prices. However, the direct relationship between this situation and plant activity levels in Asia remains unconfirmed.

Kyoei Steel Nagoya Division (Tokai)

Kyoei Steel’s activity has seen a significant downturn from 21.0% in August to a troubling 6.0% in January 2026. This decline is noteworthy and, while it reveals a deteriorating operational status, it cannot be directly linked to the reported supply issues in the U.S. However, the increased energy costs from the US braces for gas freeze-offs, ice storm article may pose future risks should the upward trend in energy prices persist.

Ann Joo Integrated Steel Penang Plant

Contrastingly, the Ann Joo plant showcased relative stability with only modest fluctuations, registering 68.0% in August and dipping slightly to 64.0% in January 2026. This slight decline does not correlate with the recent supply alerts but indicates that regional influences might be offsetting global disruptions, making it a strategic procurement option.

JFE West Japan Works (Kurashiki)

JFE’s activity level improved to 40% in January from 30% in December, suggesting a rebound that may reflect regional demand despite global supply chain disruptions noted in US LPG exports, production slowed due to freeze. The indication of resilience at JFE could make it a focal point for buyers looking to secure consistent materials amidst wider market volatility.

Evaluated Market Implications

Potential supply disruptions are particularly pronounced for Kyoei Steel due to its significant drop in activity, which could lead to constraints in supply if the trend continues. Steel buyers should closely monitor price trends in energy sectors tied to recent weather-related disruptions in natural gas production, as escalated costs could ultimately be passed down through the steel supply chain.

For procurement professionals, it is advisable to:

– Increase engagement with Ann Joo and JFE to secure supplies while they demonstrate operational stability.

– Monitor energy cost fluctuations and adjust purchasing strategies accordingly, as rising costs could prompt manufacturers to re-evaluate pricing structures.

– Consider diversifying steel sources to mitigate risk caused by disruptions related to severe weather events affecting U.S. supply dynamics.

In conclusion, awareness of these dynamics will be key to navigating procurement strategies effectively in the coming months.