From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook in Asia: Increased Activity and Price Stability

The Asian steel market is experiencing a very positive shift, particularly due to significant activity growth in steel plants. The article Nucor raises prices for hot-rolled coil in the US for the second week in a row highlights improved market sentiment and demand recovery, aligning with increased operational efficiencies in Asia. Additionally, the report from Tariffs, demand boost US steel outlook: Nucor further signals an upward trend driven by demand in relevant sectors, although no direct link between these sentiments and specific Asian plant activities is established.

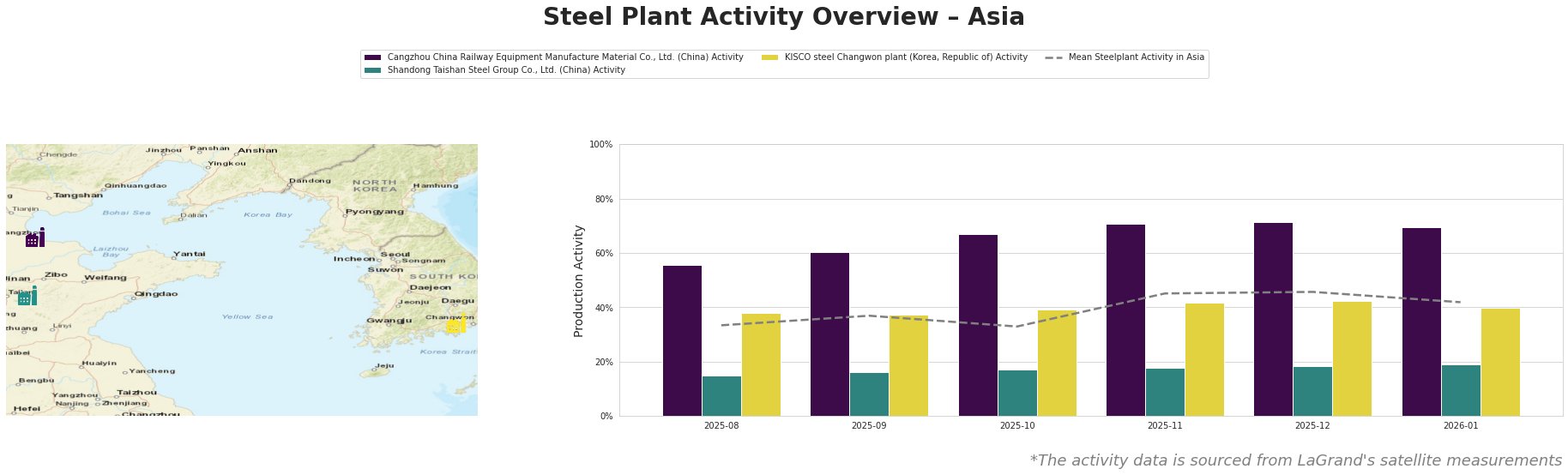

Measured Activity Overview

In recent months, the Cangzhou China Railway Equipment Manufacture Material Co., Ltd. has shown a notable increase, peaking at 71% activity in November and December. This rise may reflect broader market stability as mentioned in Nucor raises prices for hot-rolled coil in the US for the second week in a row. Conversely, Shandong Taishan Steel Group Co., Ltd. remains at lower activity levels, only reaching 19% in January—potentially impacted by competitiveness and supply chain dynamics. Meanwhile, the KISCO steel Changwon plant shows stable output in the low 40% range, suggesting a consistent operational approach that aligns with ongoing demand, although no specific news article connects these levels directly.

Evaluated Market Implications

The observed increase in activity, particularly at Cangzhou China Railway Equipment, indicates a potential for enhanced production capacity, which may mitigate supply disruptions particularly in rolled products. Steel procurement professionals should consider this plant as a viable source for future purchases, especially given its upward trajectory in activity. Conversely, the stagnation at Shandong Taishan Steel Group may pose a risk for buyers seeking a diversified supply chain. It would be prudent to diversify procurement strategies away from this facility unless demand increases or operational efficiencies improve.

Given the growing demands in infrastructure and energy sectors as highlighted by Nucor, buyers should prioritize contracts with facilities demonstrating stable and high activity levels, like Cangzhou, to ensure timely and stable deliveries. Engaging suppliers now could lead to favorable contracts before potential shifts in supply dynamics occur.