From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook: Europe’s Activity Rises Amid Geopolitical Adjustments

Recent developments in Europe’s steel market indicate a positive sentiment, particularly influenced by significant legislative actions and evolving trade dynamics. The article “The government has set zero quotas for scrap exports from Ukraine for 2026“ directly correlates with a reported increase in domestic scrap collection, which ultimately benefits local steel production capacities. Notably, Ukraine’s restriction on scrap exports is seen as a protective measure that could enhance domestic processing, aligning with a recent surge in activity at several European steel plants.

Additionally, data from the article “EU imported 4.19 million tons of steel products from Russia in January-October“ indicates a shift in sourcing strategies within the EU, as imports have decreased by 10.7% year-on-year, further bolstering local production amid rising demand for semi-finished products.

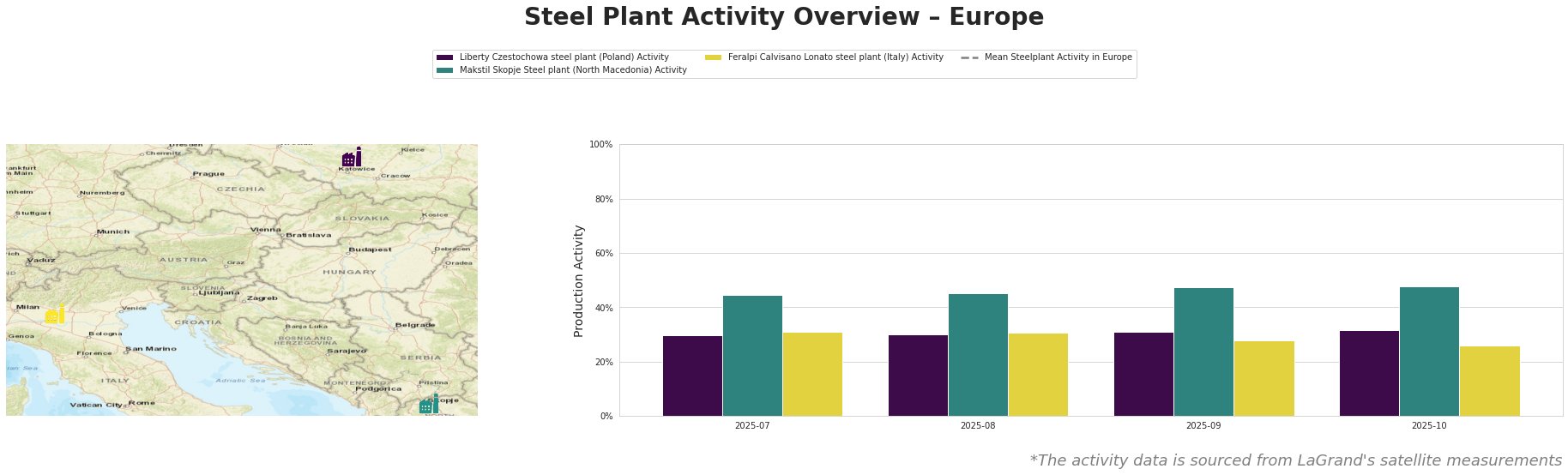

Liberty Czestochowa’s activity remained stable in July and August but began to rise, reaching 32% by October, despite a broader EU average decline. This reflects the local adaptation to supply shifts and underscores resilience against ongoing pressures faced, as articulated in the news articles. Makstil Skopje consistently demonstrated higher activity levels, peaking at 48%, possibly capitalizing on increased regional demand.

Feralpi Calvisano’s slight downward trend, reducing to 26% in October, signals potential vulnerability amidst evolving market conditions influenced by competition and changing scrap dynamics. With the increased volumes from Turkey—“Turkey accounts for up to 60% of Ukraine’s rolled steel import market in 2025“—the local competition may intensify in the short term.

Liberty Czestochowa, operating at 840,000 tons capacity through electric arc furnace (EAF) technology, is pushing against higher operational efficiencies to adapt to decreases in imported steel. Furthermore, the plant’s strategic pivot may align closely with domestic consumption as the EU modifies import strategies in response to external pressures like sanctions.

Makstil Skopje’s robust activity can be attributed to its strategic positioning in semi-finished products, particularly slabs for regional markets. The increasing demand from Turkey for these products as evident in ongoing trade patterns strengthens its production outlook.

For steel procurement professionals, specific recommendations include:

1. Prioritize domestic sourcing, especially for semi-finished products from Liberty Czestochowa and Makstil Skopje to mitigate risks linked with fluctuating import tariffs and sanctions on external suppliers.

2. Monitor production shifts closely at Feralpi Calvisano, potentially leading to opportunities for procurement at competitive rates if production stabilizes.

3. Engage actively with Ukrainian suppliers, leveraging the increased domestic scrap availability stemming from the recent legislative changes, ensuring alignment with anticipated increases in local processing capabilities.

In summary, Europe’s steel market is evolving positively with local initiatives fostering increased activity, making it imperative for procurement professionals to remain agile and responsive to these changes.