From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Shifts in Europe’s Steel Market: ArcelorMittal Leverages Nuclear Power for Decarbonization

Activity levels in the European steel market are experiencing positive trends as a result of significant investments and contracts aimed at enhancing sustainability. Recent developments, particularly “EDF to Deliver Nuclear Power to ArcelorMittal in France“ and “ArcelorMittal and EDF sign long-term power deal,” indicate ArcelorMittal’s commitment to decarbonization, which is mirrored in satellite-observed activity data showing upward trends in production levels across key steel plants.

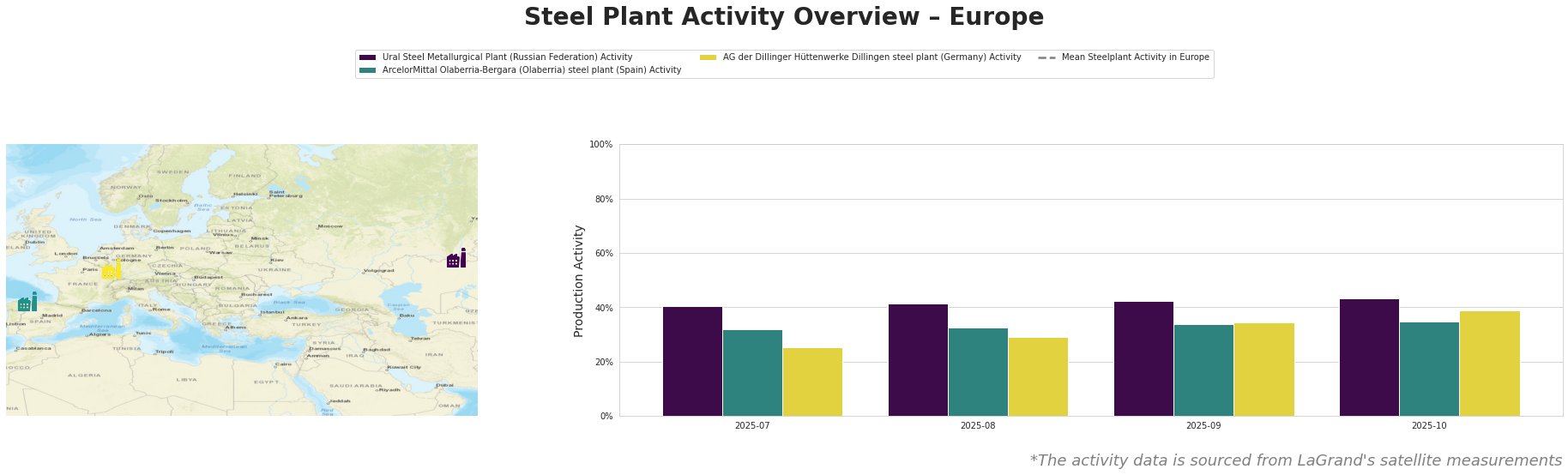

Ural Steel Metallurgical Plant shows a gradual increase in activity from 41% to 43% between July and October 2025. However, there is no direct link between this increase and the recent news articles. ArcelorMittal Olaberria-Bergara recorded a steady rise from 32% to 35% over the same period, supporting the notion that the energy agreement with EDF, ensuring low-carbon electricity, is vital for operational efficiency. The AG der Dillinger Hüttenwerke Dillingen experienced fluctuations, ending at 39% in October, aligning with plans for ongoing investments but lacking a direct connection to the recent developments.

In terms of operational profiles, Ural Steel operates primarily with integrated processes and is focused on producing semi-finished and finished rolled products. Its activity rise may indicate improved supply chain stability, although specific connections to new contracts could not be established. ArcelorMittal Olaberria implements BOF technology, producing substantial volumes of flat and galvanized products. The increase in activity level here supports the efficacy of the power contracts as discussed. AG der Dillinger’s diversification in product offerings positions it well for the automotive and infrastructure markets, yet the correlation of its recent activity shifts to the news remains undetermined.

To mitigate any potential supply disruptions, particularly with rising contract-backed demands for low-carbon steel products, steel buyers should prioritize procurement from ArcelorMittal facilities benefiting from the secured EDF energy deal. Given the current positive market sentiment, maintaining a robust supplier relationship with factories like Olaberria that demonstrate increased output capabilities will ensure competitive pricing and product availability in the evolving European steel landscape.