From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Sentiment in South America’s Steel Market Amid EU-Mercosur Developments

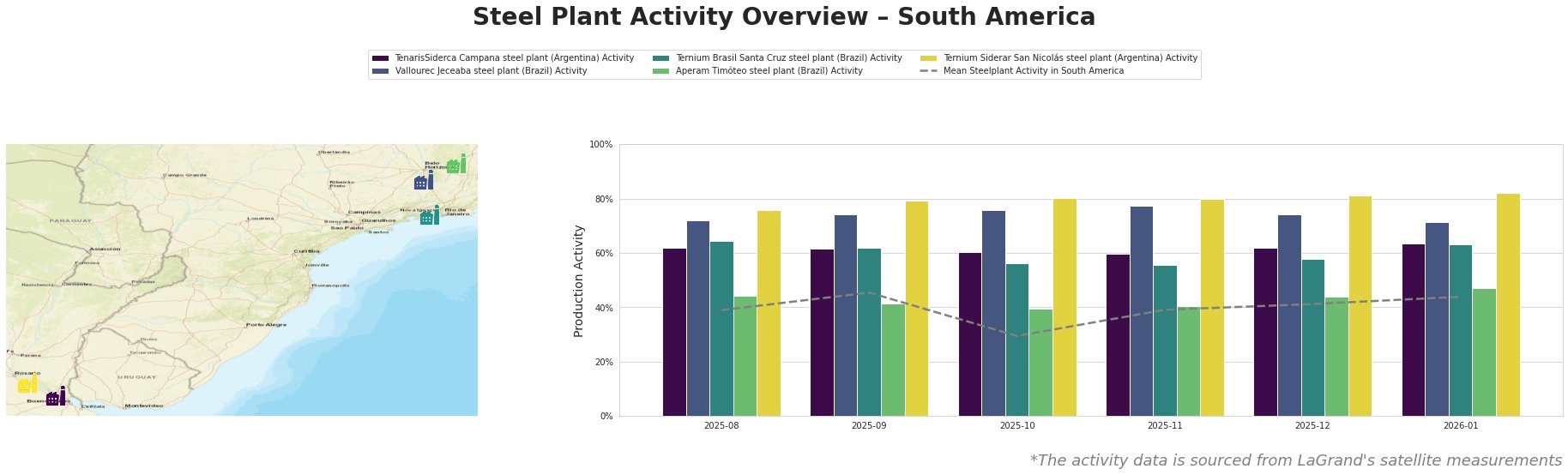

Recent developments in South America’s steel market indicate a positive trend as evidenced by rising activity levels in several key steel plants. The EU, Mercosur ‘arriving at political accord’: EC has highlighted advancements in trade negotiations aimed at raw materials, and the European Parliament initiates legal process for the EU–Mercosur trade agreement reinforces this progression, suggesting improvements in market accessibility for steel products. Notably, concurrent satellite-observed data shows an uptick in operational activity in major steel plants.

The TenarisSiderca Campana plant has shown consistent activity at 64% as of January 2026, with minor fluctuations, attributed to positive sentiment following the EU-Mercosur accord, enhancing trade flow for raw materials. The Vallourec Jeceaba plant, while stable, recorded a slight dip to 71% amid uncertainty in local markets; no direct linkage to the news articles can be established. Conversely, Ternium Brasil Santa Cruz has maintained a robust operational capacity at 63%, indicative of stable demand, while Aperam Timóteo and Ternium Siderar San Nicolás both surged to 47% and 82%, respectively, corroborating improved production outlooks expected from new trade agreements.

In terms of procurement actions, steel buyers should focus on leveraging the recent EU-Mercosur trade developments, particularly by engaging with Ternium Siderar San Nicolás, which is now functioning at optimal capacity levels and poised to meet the anticipated demand increases. Meanwhile, re-evaluating supply contracts with those plants showing less stability, like Vallourec Jeceaba, may mitigate risks associated with fluctuating production reliability.

In conclusion, the overall positive sentiment in South America’s steel market, driven by recent trade agreements and increasing operational activity, suggests an advantageous climate for procurement initiatives, with strategic opportunities resting with high-capacity plants.