From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Sentiment in Europe’s Steel Market Amid Stable Prices and Rising Activity

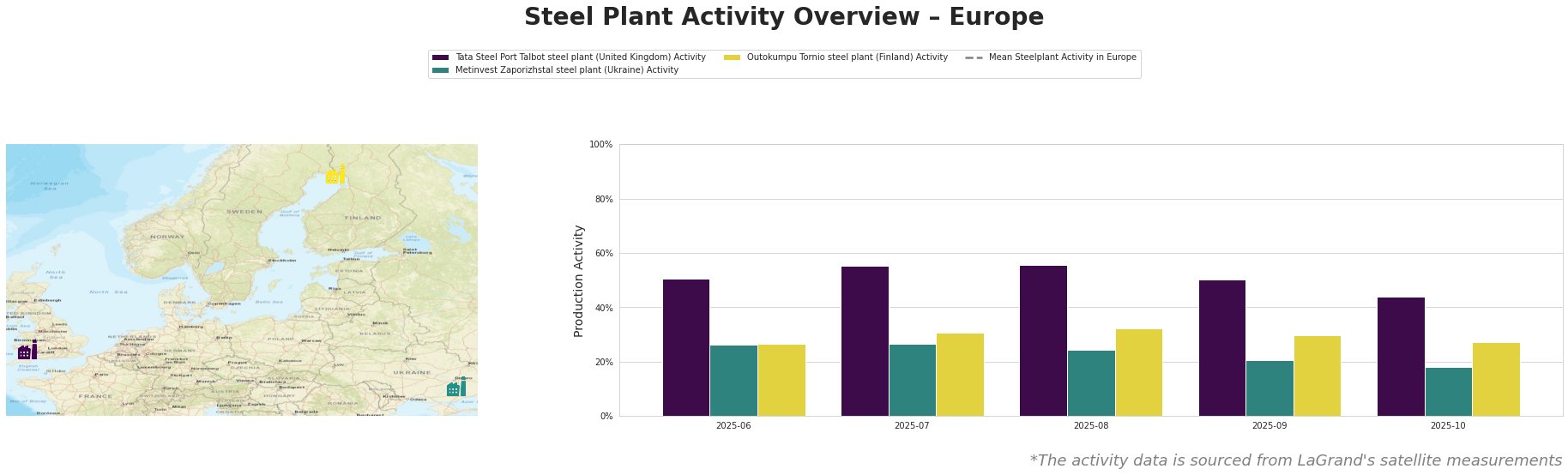

Trading in the European steel market shows positive momentum as steel prices stabilize and some production activities rise, particularly highlighted in the news article High stocks keep trading in European domestic HRC market muted. Recent satellite data reflects evolving operational levels at various steel plants, notably the Tata Steel Port Talbot and Outokumpu Tornio facilities.

Measured Activity Overview

The mean activity across major plants declined from 407.78 million in July and August to 271.85 million in June and October, indicating fluctuating operational trends. Tata Steel Port Talbot’s activity peaked at 56% in August but fell to 44% by October, likely influenced by the subdued demand and the recent pricing dynamics illustrated in the articles European steel prices hold flat as market awaits january shift and European steel prices remain at the same level as the market expects January changes. Both emphasize low demand impacting trading decisions.

At the Metinvest Zaporizhstal plant, activity dipped to 18% in October, interpreted as a response to broader economic pressures and demand concerns, as noted in the same articles. Outokumpu Tornio showed modest recovery, fluctuating between 27%, and 32% but did not correspond directly to any cited news developments.

Evaluated Market Implications

Given the current production levels and market sentiment, buyers should brace for potential supply disruptions, particularly from Metinvest Zaporizhstal, which may struggle to recover activity levels in the near term. Procurement strategies should capitalize on stable pricing trends noted across regions, especially in Northwest Europe, where offers are stabilizing between €600-620 per tonne, potentially benefitting from anticipated restocking in January.

Contrarily, buyers should be cautious about engaging with Tata Steel Port Talbot as it faces operational challenges linked to demand fluctuations, reflected in its declining activity levels. Recommended procurement actions include locking in prices where stability has been observed and preparing for increased costs associated with the upcoming CBAM regulations impacting imports, as stated in the High stocks keep trading in European domestic HRC market muted. This proactive approach will secure more favorable terms ahead of potential price increases tied to demand recovery in early 2026.