From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Sentiment in China’s Steel Market: Activity Trends, Regulatory Changes, and Future Insights

China’s steel industry shows optimistic recovery signals, buoyed by regulatory shifts and upcoming market dynamics. Recent articles such as “Licensing of steel exports from China should ease trade tensions” indicate a government move to introduce an export licensing system that will commence on January 1, 2026. This development coincides with heightened activity levels at key steel plants, although “Fitch Ratings expects global steel market to recover in 2026” suggests potential domestic production declines.

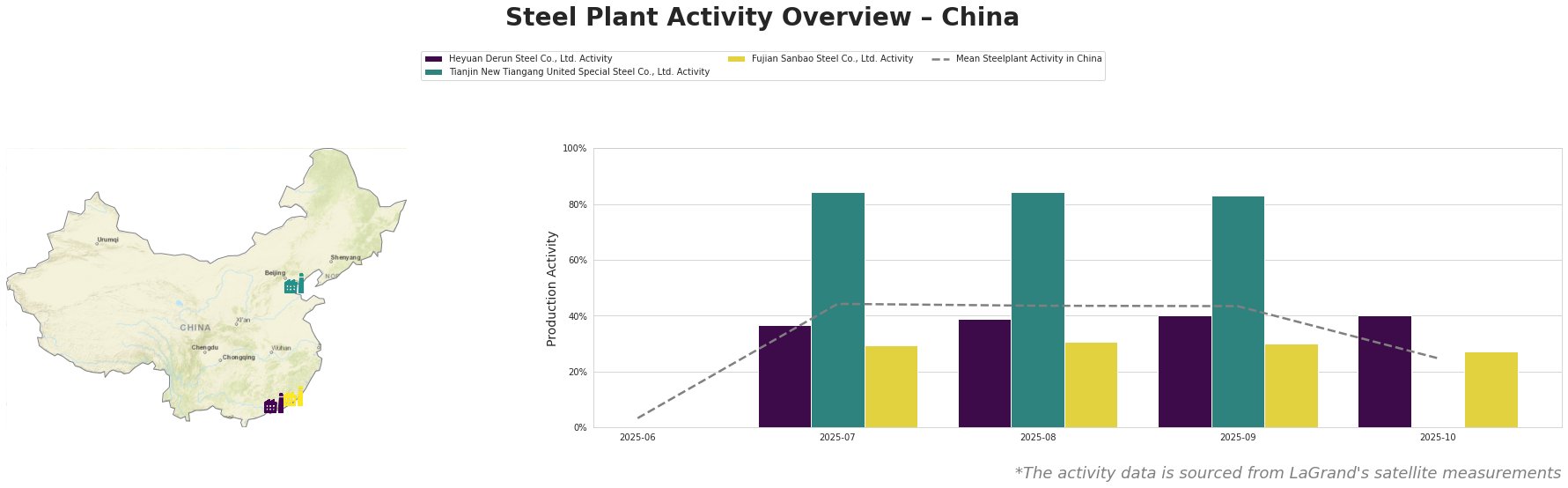

Measured Activity Overview

Recent activity levels indicate a peak across most plants around July and August 2025, aligning with robust demand amid recovering export conditions. However, the overall mean activity has experienced a decline to 25% by October, matching the predicted 5.4% drop in rolled steel consumption reported by “Rolled steel consumption in China will fall by 5.4% y/y in 2025 – forecast”.

Plant Insights

Heyuan Derun Steel Co., Ltd. (located in Guangdong) is primarily focused on electric arc furnace (EAF) production of finished and semi-finished steel. Activity remained consistent at 37-40% from July to September, but fell to 40% in October, showing a dip amid continuous concerns about local market demand. While no direct correlation with news articles can be established for this decline, overall market contraction from government policies may impact long-term production rates.

Tianjin New Tiangang United Special Steel Co., Ltd. maintains a substantial capacity of 4,500 kt through blast furnace (BF) processes. The plant operated at peak activity of 84% in September, but activity is noticeably absent for the following month. This preliminary drop may relate to broader regulatory shifts outlined in “Licensing of steel exports from China should ease trade tensions”, hinting at adjustments in production to align with impending export licensing regulations.

Fujian Sanbao Steel Co., Ltd. operates with mixed technologies, yet witnessed an activity decrease to 27% in October after consistent production through September. Such a drop underscores predictions of reduced consumption—trending in line with the 10.9% decrease in steel output also highlighted by recent forecasts.

Evaluated Market Implications

The regulatory changes coming with the export licensing system pose significant implications for supply dynamics, particularly as active plants adjust their production strategies. Important procurement considerations for steel buyers include:

- Potential supply disruptions are anticipated at Tianjin New Tiangang due to abrupt policy changes, necessitating strategic sourcing options or stockpiling.

- Targeted procurement actions should focus on securing contracts with Heyuan Derun for semi-finished products while also monitoring shifts in pricing post-legal changes regarding exports. Engaging in negotiations preemptively could mitigate risks associated with potential supply constraints.

In summary, while the market sentiment remains positive, the interplay between government regulations and plant output creates an environment ripe for strategic procurement intervention.