From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for North America’s Steel Market Amid Economic Challenges

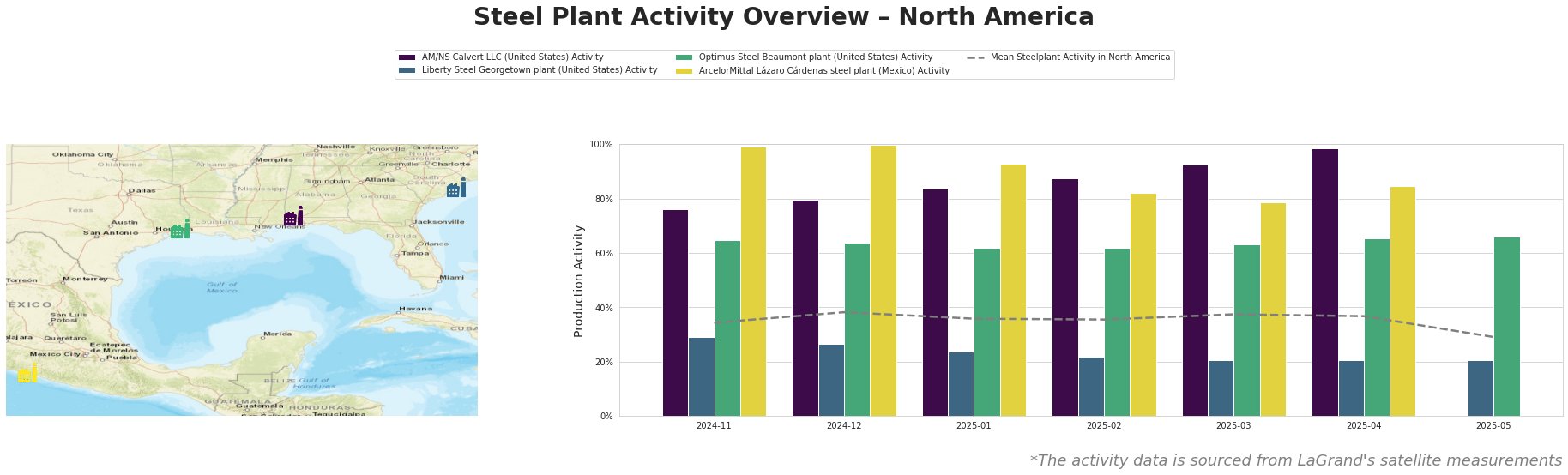

In North America, ongoing developments in the steel industry are characterized by notable activity shifts in major plants, as highlighted in articles such as “Trump’s economy at 100 days: Unprecedented uncertainty reigns“ and “Morning Bid: U.S. economy creaking even before tariffs.” These articles discuss the potential recession and tariffs’ impact on business confidence yet indicate resilient consumer metrics, aligning with satellite-observed increased activity at select steel plants.

The AM/NS Calvert LLC plant in Alabama has exhibited strong activity, peaking at 99% in April, driven by robust market performances notwithstanding national economic uncertainty as cited in “Morning Bid: U.S. economy creaking even before tariffs.” This suggests increased production adaptability, potentially aiding steel buyers in securing reliable supply streams.

Liberty Steel Georgetown in South Carolina presented a notable decline in April, holding at 20% activity. This fluctuation aligns without any explicit cause in the cited news sources, indicating an independent operational challenge rather than systemic economic factors.

Optimus Steel Beaumont showed stable activity around 65% in April, adhering closely to the average mean, likely preserving cohesion in supply against potential disruptions discussed in “Trump’s economy at 100 days: Unprecedented uncertainty reigns.”

In contrast, ArcelorMittal Lázaro Cárdenas remains a formidable player, reaching a significant peak of 100% in December, emphasizing its role in fulfilling regional demand despite broader economic pressures detailed in the news discussions.

Given these observations, one potential supply disruption could arise from Liberty Steel Georgetown’s instability, warranting close monitoring. Steel buyers should consider increasing procurement from AM/NS Calvert LLC and ArcelorMittal Lázaro Cárdenas, leveraging their current production capacity and resilience against economic variability. These strategies may mitigate risks and ensure supply continuity in an uncertain market landscape.