From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for India’s Steel Market: Export Surge Amidst Declining HRC Prices

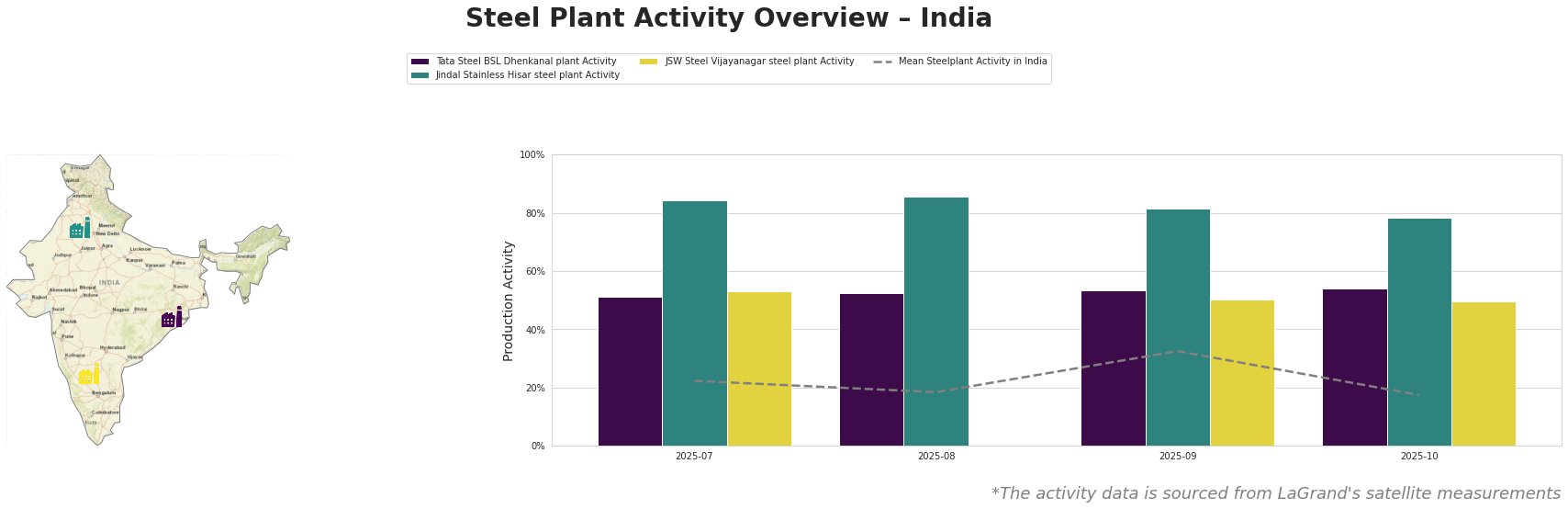

India’s steel market exhibits a positive sentiment driven by significant export increases, despite recent price corrections in hot rolled coils (HRC). Notably, “India increased steel exports by 31% y/y in April-November“ indicates robust demand from European buyers who preemptively stocked up before the mitigation of the Carbon Border Adjustment Mechanism (CBAM). This uptick is corroborated by satellite data showing resilience in plant activity levels, despite a recent dip linked to seasonal oversupply detailed in “Oversupply and rains will lead to lower prices for HRC in India in 2025“.

Tata Steel BSL Dhenkanal exhibited a peak activity of 54% in October 2025, aligning with increasing domestic output, as mentioned in “Oversupply and rains will lead to lower prices”. Jindal Stainless Hisar remained stable around 84–86% until September but showed a decline to 78% by October without a direct connection to any cited news. JSW Steel Vijayanagar’s activity fluctuated around 50% amidst general oversupply concerns, which did not display direct correlation to the news reports.

Tata Steel BSL Dhenkanal’s integrated capabilities and focus on HRC and flat products may benefit from the anticipated demand growth projected at 8% in FY2025/2026, as noted in “Demand for steel in India will grow by 8% in FY2025/2026 – ICRA“. However, potential supply risks exist due to fluctuating raw material costs and impending large-scale capacity expansions that could exceed demand growth, especially from 2026 onward.

For steel procurement professionals, it’s prudent to consider sourcing strategies focused on high-demand segments like HRC, particularly from Tata Steel and Jindal Stainless, while being vigilant about price volatility influenced by supply fluctuations and legislative changes. Engaging in forward purchasing may mitigate the risks associated with potential downturns from increased production rates and the oversupply forecasted as production ramps up to 300 million tons by 2030/2031.