From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Europe’s Steel Market Driven by Tariff Withdrawal and Plant Activity Resurgence

In Europe, the recent announcement by President Donald Trump to withdraw the proposed tariffs on imports from the UK and seven EU countries, detailed in the news article “Trump withdraws EU, UK tariff threat,” is likely to lead to a boost in steel production activity across the region. This sentiment aligns with satellite-observed data indicating a recovery in operational activity levels at various steel plants, reflecting increased market confidence.

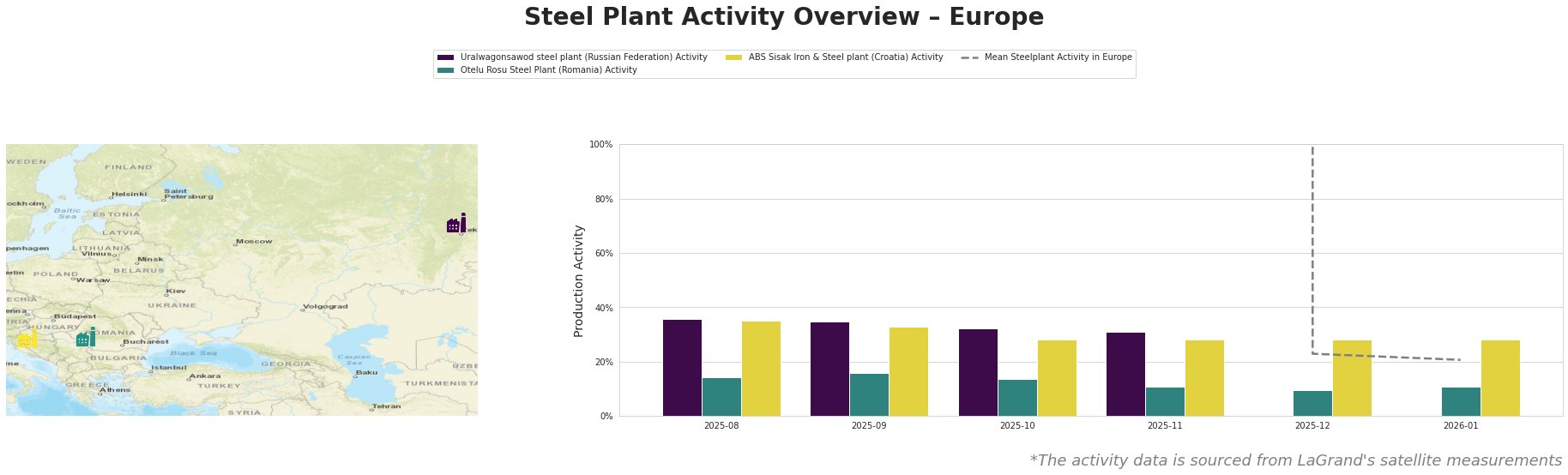

Measured Activity Overview

The activity levels of steel plants in Europe showed significant fluctuations. Notably, Otelu Rosu experienced a drop to 9.0% in December before rising to 11.0% in January, potentially reflecting responses to improved sentiment following Trump’s tariff withdrawal. Meanwhile, both the Uralwagonsawod and ABS Sisak plants maintained activity in the low to mid-thirties percentage range except for a significant dip in December, linking their downturn to the heightened trade tensions reflected in “Trump scraps plans for additional tariffs on a number of European countries.”

Uralwagonsawod, located in Rostov, primarily focuses on defense products but saw steady activity levels around 31-35% throughout the analyzed period. The absence of a tariff threat, following Trump’s announcements, could stabilize operations and promote future production gains.

Otelu Rosu, producing semi-finished and finished steel products using EAF technology, reached its peak activity of 16.0% in September but saw declines as low as 9.0% in December. The announcement of tariff withdrawals could signal improved market conditions, propelling activity upward in January.

The ABS Sisak plant, with a focus on billets, reflected similar trends with activity levels stabilizing in the mid to high twenties. This consistency suggests resilience against the backdrop of fluctuating market conditions.

Evaluated Market Implications

The recent announcements regarding tariff withdrawals eliminate the immediate threat of price volatility and potential supply chain disruptions across Europe. For buyers, this provides a favorable environment to secure procurement from the Otelu Rosu plant, whose activity shows potential for recovery, aligning production with market demand for construction and energy sectors.

It is advisable for steel buyers to monitor the recovery patterns closely, especially from Otelu Rosu and Uralwagonsawod, as production levels may increase in response to stabilizing trade relations. Engaging in timely purchasing agreements and establishing firm relationships with these suppliers could streamline operations and mitigate risks associated with sporadic supply disruptions.

In summary, the current market sentiment is quite positive, with productivity expected to rise, especially in regions formerly threatened by tariffs. This proactive approach will be crucial for navigating any future uncertainties.