From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Market: Price Hikes Anticipated Amid Stable Activity

As observed in the European steel market, recent developments signify an uptick in activity levels and optimism regarding price adjustments. The news articles “Northwest European rebar market debates hike attempt success“ and “European longs market cautious at end of winter holidays, but talk about increases persists“ indicate a prevailing discussion among key industry players about potential price increases amid market fluctuations. The satellite data mirrors these sentiments, showing notable improvements in plant activity levels.

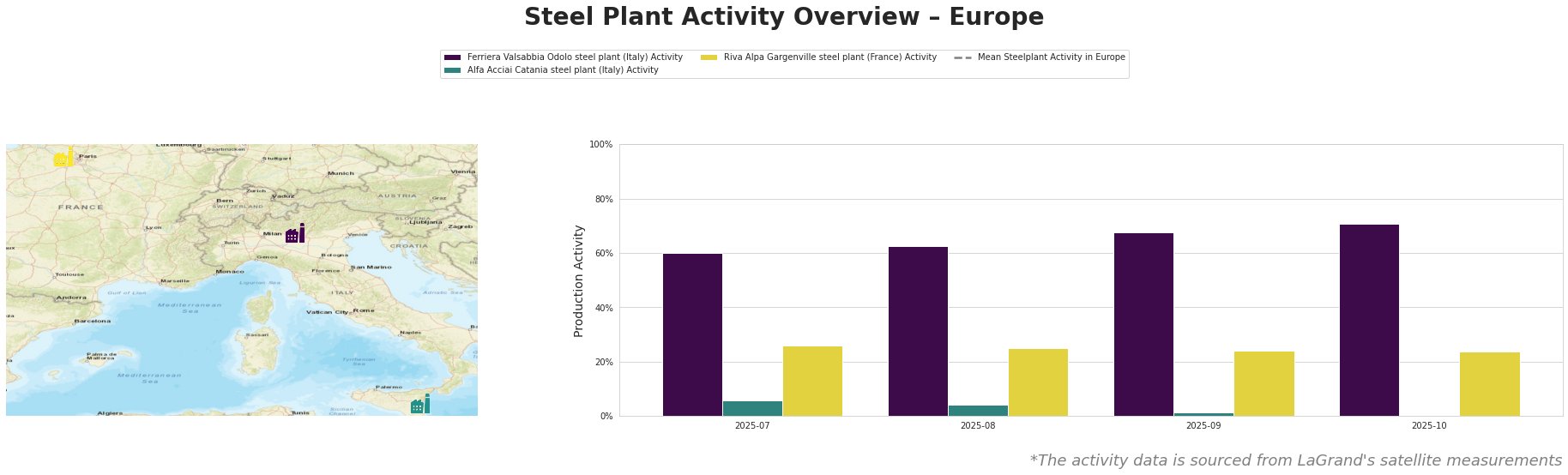

From July to October 2025, the mean activity level across European steel plants rose steadily from 60% to 71%. The Ferriera Valsabbia Odolo plant consistently demonstrated activity levels above the mean, reaching 71% in October, likely responding to the market’s favorable expectations for rebar pricing as noted in the articles. Conversely, the Alfa Acciai Catania plant began at 6% and peaked at 4%, aligning with seasonal behaviors and instability in pricing driven by holiday impacts, without a direct linkage to the price expectations discussed in the articles. The Riva Alpa Gargenville plant showed a declining trend, remaining considerably below mean activity levels, which may suggest operational challenges that could hinder responsiveness to impending price adjustments.

The Ferriera Valsabbia Odolo steel plant employs Electric Arc Furnace (EAF) technology and focuses on producing semi-finished and finished rolled products like billets and rebar. Its stable increase in activity from 60% to 71% aligns well with discussions around pricing strategies in the region, particularly the anticipated price hikes as highlighted in “The debate on the rebar market in Northwestern Europe has shown the success of the price increase attempt.” The robust production capacity positions it to adapt quickly to market demands.

In terms of procurement implications, buyers should focus on establishing agreements with Ferriera Valsabbia Odolo due to their increased output and potential capability to fulfill upcoming demand spikes effectively linked to price adjustments discussed in the recent articles.

Conversely, buyers should closely monitor Riva Alpa Gargenville’s outputs, where sustained low activity levels may indicate potential supply disruptions, especially tied to the anticipated price increases. Should market conditions favour upward trend dynamics due to the wider discussions reflected in articles like “European longs market cautious at end of winter holidays, but talk about increases persists,” procurement strategies should prioritize hedging against these expected fluctuations.

In summary, informed procurement decisions should leverage insights drawn from both the latest market news and observed activity data to secure advantageous pricing and supply continuity in the evolving European steel landscape.