From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Despite Ukrainian Export Shifts: Activity Stable Amidst Supply Chain Adjustments

Europe’s steel market shows overall positive sentiment despite shifts in Ukrainian exports. Declining exports of semi-finished products, as reported in “Ukrainian steel companies reduced exports of semi-finished products by 36% y/y in January-July,” and iron ore, detailed in “Ukraine reduced iron ore exports by 8% y/y in January-July,” do not appear to be directly impacting activity levels at key European steel plants at this time. Similarly, the increase in Ukrainian ferroalloy exports discussed in “Ukraine’s ferroalloy industry exported 63.5 thousand tons of products in January-July,” does not show a direct relationship to any observed fluctuations in plant activity.

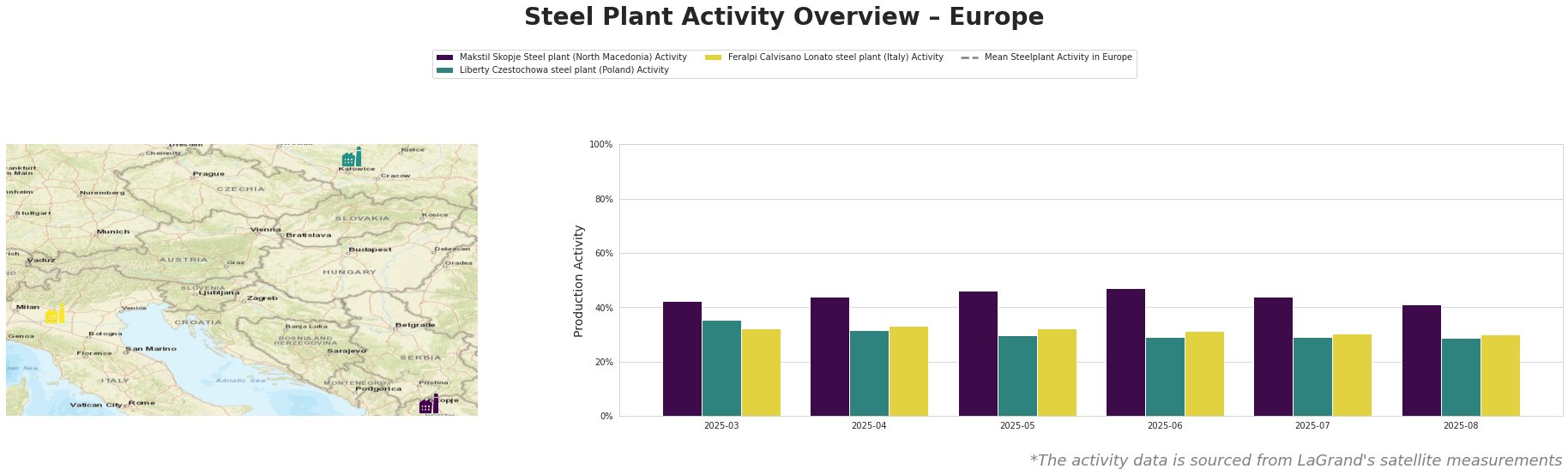

Activity levels at the observed steel plants show a relatively stable trend from March to August 2025. Makstil Skopje Steel plant, an EAF-based producer of semi-finished slabs with a 550 ttpa capacity, experienced a peak activity of 47% in June before dropping to 41% in August. Liberty Czestochowa steel plant, a semi-finished plate producer utilizing EAF technology with an 840 ttpa capacity, exhibited a gradual decline from 35% in March to 29% in August. Feralpi Calvisano Lonato steel plant, an EAF-based billet producer with a 600 ttpa capacity, also shows a gradual decline from 32% in March to 30% in August. The mean activity level across all observed plants exhibits high volatility and therefore is no point of comparison. There is no discernible direct correlation between the Ukrainian export trends described in the provided news articles and the observed activity changes at these plants.

Evaluated Market Implications:

Despite the decline in Ukrainian steel and iron ore exports, the satellite data indicates that there are currently no directly correlated supply disruptions at Makstil Skopje Steel plant, Liberty Czestochowa steel plant and Feralpi Calvisano Lonato steel plant. However, the news article “Ukrainian steel companies reduced exports of semi-finished products by 36% y/y in January-July” highlights a significant shift in export destinations, specifically mentioning Bulgaria, Turkey, and Poland. Steel buyers should monitor supply dynamics in these countries closely, as increased demand from these regions may impact availability and pricing in the broader European market. Procurement professionals focusing on semi-finished products should proactively engage with suppliers in Bulgaria, Turkey, and Poland to assess potential shifts in lead times and pricing structures. Also, it is recommended to re-evaluate existing supplier agreements, particularly those relying on Black Sea shipping routes, considering that the increase in Ukrainian export in 2024 was due to the opening of the maritime corridor.