From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asia’s Steel Market Amidst Rising Activity

Asia’s steel market sentiment remains positive, bolstered by significant satellite-observed activity in key plants. Recent reports, including the Indonesian coal output, exports decline in 2025 and Australian coal exports from Gladstone rose in December, underscore shifting dynamics that are echoing through the steel industry, particularly in response to demand fluctuations in major markets like China and India.

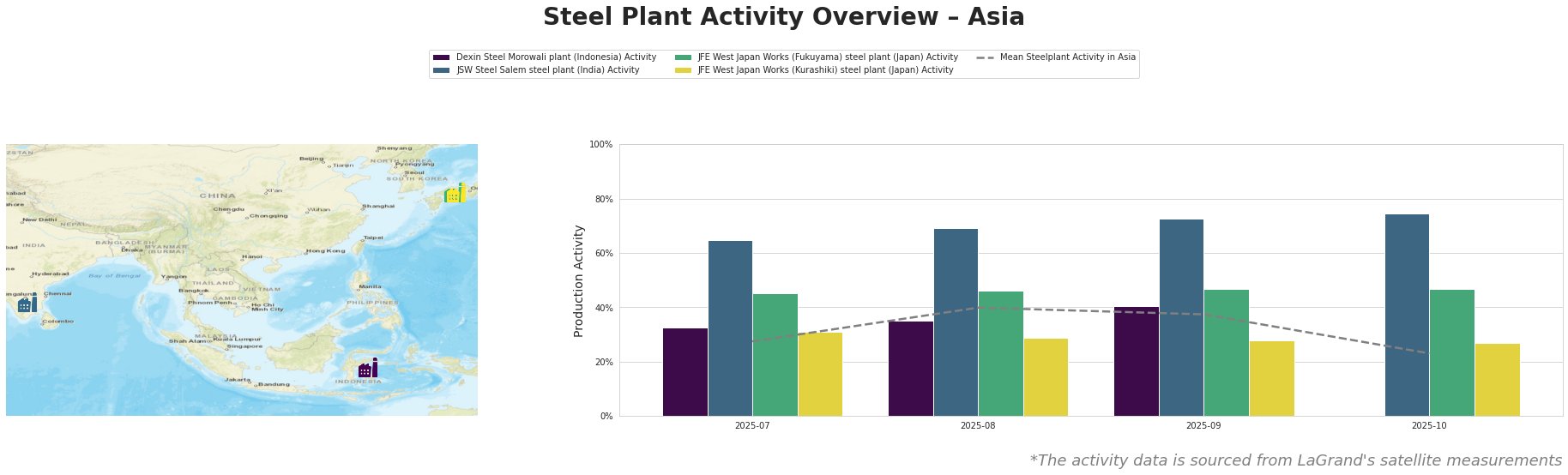

The decline in Indonesian coal production and exports (a 5.5% decrease in production and a 7.9% drop in exports) is attributed to weak demand from these markets. Despite this, activity levels at the Dexin Steel Morowali plant in Indonesia rose to 40% in September 2025, aligning with increased production trends observed globally.

The JSW Steel Salem steel plant in India witnessed substantial activity, peaking at 75% in October 2025, indicating robust operational efficiency. This rise correlates with trends in the regional market, particularly as Indian demand strengthens against external supply challenges highlighted in the Viewpoint: Thailand’s LNG demand poised to remain slow article, suggesting a focus on local energy sources.

JFE’s Fukuyama and Kurashiki plants maintained stable activity levels, averaging 46% and 28% respectively in recent observations, indicating steady production amidst fluctuating global coal prices and demand variations. However, the potential mine operations suspension at Gladstone could present supply disruptions, particularly for Japan’s steel sector, further impacting the supply chain as noted in the Australian coal exports from Gladstone rose in December article.

Steel buyers should consider the following actionable insights:

– Monitor Indonesia’s coal supply situation closely, as ongoing reductions in coal exports may lead to localized increases in steel prices due to tighter coking coal availability.

– Prioritize procurement from JSW Steel Salem as indicated by its rising activity levels, ensuring supply continuity amid fluctuations in imports.

– Watch for potential impacts from Gladstone’s coal export dynamics; operational suspensions may necessitate alternative sourcing strategies.

By leveraging these insights, steel procurement professionals can strategically position themselves in a market that remains favorably disposed toward stable growth.