From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asian Steel Market as Activity Levels Trend Upwards

The Asian steel market is exhibiting a positive sentiment, driven by noticeable increases in plant activity across key players. Notably, recent trends in the operational levels of major steel manufacturers have been observed, correlating with insights from the news article titled Viewpoint: Indian term LNG to make 2026 imports pricier. This article details increasing cost pressures that may indirectly affect steel production economics in the region due to energy price dynamics.

Measured Activity Overview

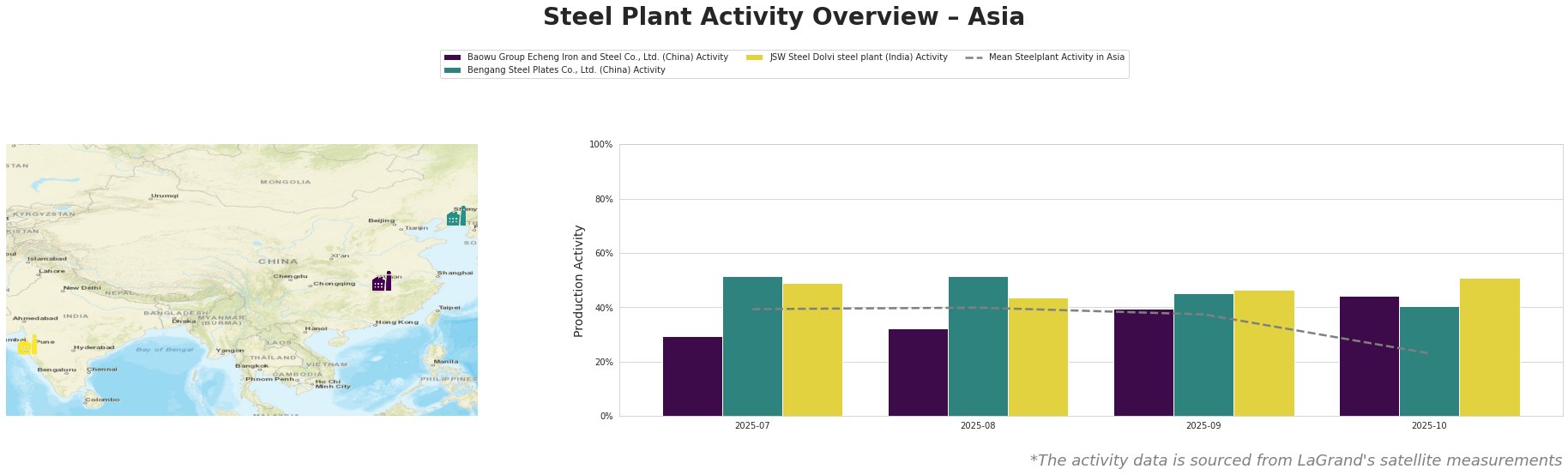

Activity levels have shown fluctuations over the past months, with a notable peak in Baowu Group Echeng Iron and Steel Co., Ltd. reaching 44.0% in October from 29.0% in July, indicating a significant operational ramp-up. In contrast, the Bengang Steel Plates Co., Ltd. has maintained relatively stable high activity levels around 52.0%. Meanwhile, JSW Steel Dolvi exhibited a drop from 49.0% in July to 44.0% in August, before recovering to 51.0% by October. The average activity across all observed plants suggests a slight decline by the end of October, yet still reflects overall vibrant production conditions.

Evaluated Market Implications

The upward trend in plant activity, particularly for Baowu Group, can be linked to potential shifts highlighted in Indian term LNG to make 2026 imports pricier, which may compel increased efficiency in steel production due to rising energy costs. This emphasizes the importance for procurement teams to closely monitor LNG pricing dynamics, as these may translate into production cost variations in steel manufacturing.

Steel buyers should consider strategic stockpiling from Bengang Steel Plates Co., Ltd. and JSW Steel Dolvi given their stable output levels, as any future disruptions in energy supply could heighten costs. Particularly, the high-capacity operation of Bengang Steel positioned in a lower-cost energy environment presents an opportunity for securing competitively priced steel products.

In summary, with the Asian steel market showcasing an uptick in operational activities amidst evolving energy cost landscapes, suppliers remain positioned favorably. Procurement strategies should integrate close monitoring of external cost pressures stemming from energy pricing to mitigate potential supply challenges.