From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asian Steel Market Amid Rising Activity Levels

Recent observations indicate a positive resurgence in steel production across Asia, driven by evolving market dynamics. Notably, the article Dollar Falls Amid Japan Intervention Risk, Gold Up: Markets Wrap highlights ongoing currency fluctuations and trade tensions impacting investor sentiment. Specifically, this has fostered an uptick in steel plant activities, subtly aligning with the mentioned economic factors.

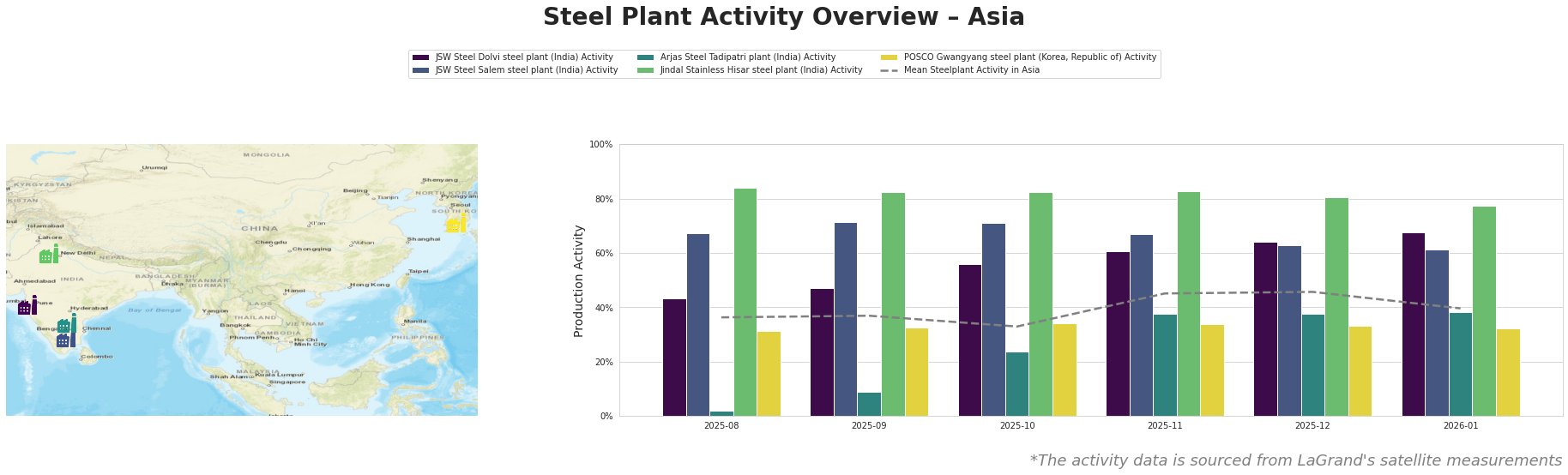

Measured Activity Overview

The average mean activity has shown noteworthy fluctuations, with significant peaks observed in December (46.0%) and January (40.0%), suggesting an upward trend post-holiday season. Notably, the JSW Steel Dolvi plant saw consistent activity growth from 43.0% in August to 68.0% in January, implying an aggressive ramp-up in production.

Plant-Specific Insights

JSW Steel Dolvi (Maharashtra) demonstrates a significant recovery in activity, climbing from 43.0% to 68.0%, reflecting its strategic positioning amidst a favorable global market backdrop. Elevated activity levels can be partly attributed to increasing demand for finished products in automotive and infrastructure, although no direct link to recent news articles could be established.

JSW Steel Salem (Tamil Nadu) has remained relatively stable, hitting a peak of 71.0% in September, yet tapered to 61.0% by January. Its offerings span a wide range of finished and semi-finished steel products that cater to energy and construction sectors. Despite the fluctuations, no explicit connection to the currency volatility mentioned could be identified.

Arjas Steel Tadipatri (Andhra Pradesh) exhibited a limited activity expansion, rising to 38.0% in November before stabilizing. The plant’s low activity rates (2.0% in August) mirror broader market sentiments but were unaffected by the cited news articles.

Jindal Stainless Hisar (Haryana) has been another standout, though no significant movement was linked to external economic factors. The plant’s activity level remained high, peaking at 84.0% in August, reflecting steady customer demand in the automotive sector.

POSCO Gwangyang (South Korea) has seen marginal activity, remaining under the mean activity level. With recent geopolitical tensions hinted at in Forex markets, however, no defined correlation with specific news developments is evident.

Evaluated Market Implications

The positive market sentiment, driven by a favorable shift in steel plant activity levels, signals increasing production readiness across major steel producers in Asia. However, the fluctuating dollar and ongoing trade negotiations could still pose risks, particularly to exports.

Recommended Procurement Actions:

-

JSW Steel Dolvi and Salem: Given their performance improvements, buyers should consider lifting purchase commitments for future delivery to capitalize on favorable pricing and availability in the upcoming quarter.

-

Arjas Steel: Lighten procurement volumes based on current low activity levels while monitoring the impact of trade dynamics for November and beyond.

Continued observation of the interplay between currency movements and production capacities will be crucial for making informed procurement decisions in this evolving landscape.