From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Spain’s Steel Market: Activity Increases Amid Upgrades and Restart Efforts

ArcelorMittal’s recent developments in Spain signal a positive trend in the steel market, driven primarily by operational adjustments at its Gijón and Avilés plants. The articles “ArcelorMittal Spain shuts Avilés pickling line as part of €18 million upgrade” and “ArcelorMittal makes new attempts to restart blast furnace B at its plant in Gijón” indicate a strategic pivot focused on enhancing production efficiency despite transient challenges.

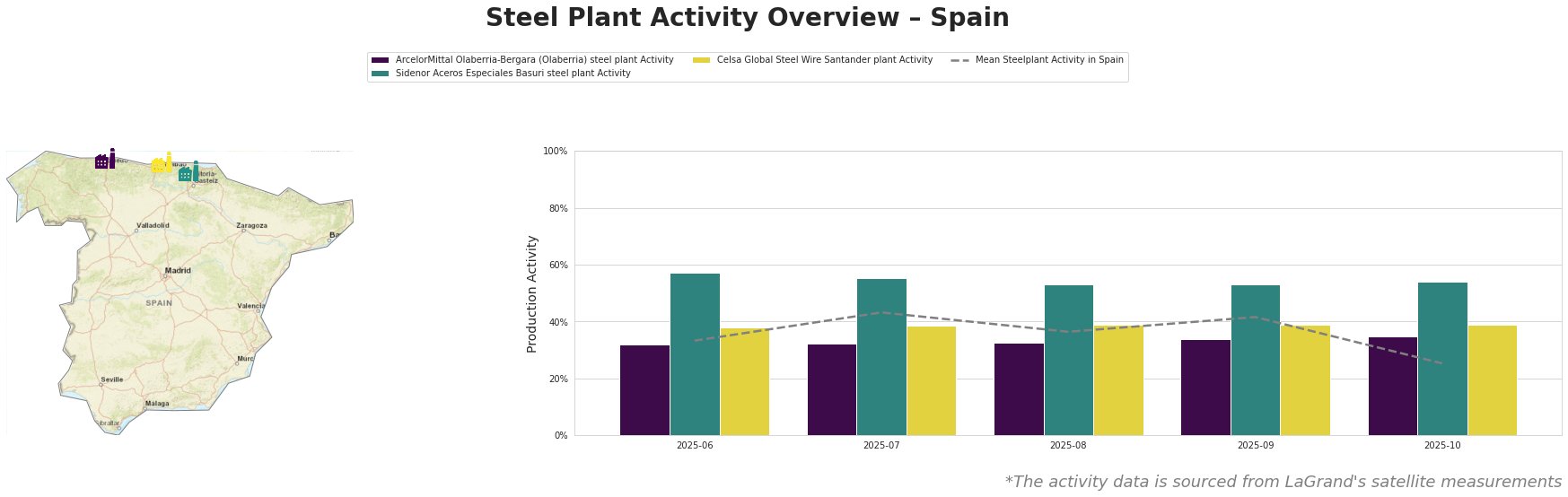

Recent satellite data indicates the following activity levels for key steel plants in Spain:

Olaberria-Bergara’s activity remained relatively stable, peaking at 35.0% in October, while Sidenor’s operations showed remarkable resilience, maintaining a strong activity level of 57.0% in June. Celsa Global Steel Wire observed consistent operational levels, fostering stability in wire and section manufacturing critical for the automotive and infrastructure sectors.

The Avilés plant’s operational challenges stem from a hot metal shortage, primarily driven by maintenance issues at Gijón. The article “ArcelorMittal Spain shuts Avilés pickling line as part of €18 million upgrade” details upgrades impacting production schedules, resulting in a temporary operational capacity decrease to 60%. Sidenor and Celsa’s higher activity levels indicate their ability to fulfill market demands for specific end-user sectors, potentially offsetting shortfalls from ArcelorMittal during this upgrade period.

Given the ongoing attempts highlighted in “ArcelorMittal in Spain is testing a new BF restart solution”, where the Gijón blast furnace B is targeted for revival, there lies potential for increased output as early as late January. Successful activation could revitalize ArcelorMittal’s capabilities, enabling better fulfillment of their automotive and rail production commitments.

Market Implications:

- Supply Disruptions: The temporary shutdowns and maintenance at ArcelorMittal’s Avilés reduce overall outputs, potentially impacting supply in the automotive and rail sectors.

- Procurement Recommendations: Steel buyers should prioritize securing contracts with Sidenor and Celsa for immediate requirements to mitigate risks of supply delays from ArcelorMittal. Maintaining flexible procurement strategies will be vital to ensure continuity amid potential fluctuations tied to Gijón’s anticipated restart and Avilés’s upgrades.

By anticipating shifts and aligning procurement strategies with current market dynamics, professionals in the steel industry can navigate the evolving landscape effectively.