From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Oceania’s Steel Market: Satellite Data and Recent Developments Indicate Growth

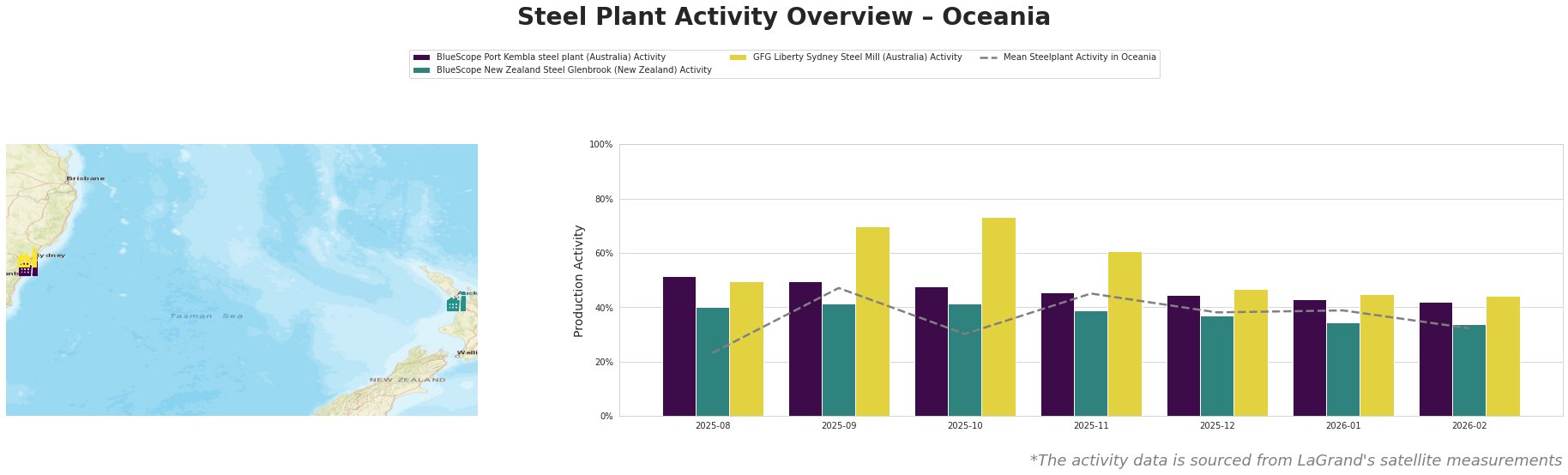

Recent satellite observations indicate a notable uptick in activity across major steel plants in Oceania, influenced by broader market sentiment. Reports like “European HRC steel producers are positive as the market leader insists on price increases” and “European steel HRC sentiment positive as market leader pushes for higher prices” reflect optimism among suppliers that could signal potential price movements impacting local markets.

Activity at the GFG Liberty Sydney Steel Mill peaked at 73% in September 2025, aligning with buoyant recovery narratives from the European market. This sentiment may provide leverage for increased procurement of local steel, as European prices are under pressure from rising input costs indicated in articles like “Suppliers, buyers still at odds in European steel HRC market.”

BlueScope Port Kembla has shown stable activity with a slight retracement to 42% in February 2026, yet consistently maintains higher operational levels compared to the average in Oceania, suggesting solid groundwork for addressing local demand amid European volatility.

Conversely, activity at BlueScope New Zealand Steel Glenbrook remained relatively stable but lower than peers, indicating potential for procurement opportunities given competitive pricing against looming European increases.

To navigate this landscape effectively:

– Buyers should anticipate price rises as demand from both domestic and European markets begins to consolidate, especially as European sentiment strengthens, which might push prices upward.

– Consider firm purchases from GFG Liberty Sydney Steel Mill where production is resilient and aligns with increased European demand trends.

– Monitor pricing closely in light of expected increases in European markets to mitigate exposure to sudden shifts.

These actions are justified based on observed increases in satellite activity and positive sentiment in European steel markets, suggesting that local procurement strategies might benefit from forward purchases.