From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in North America’s Steel Market: Insights from Recent Activity

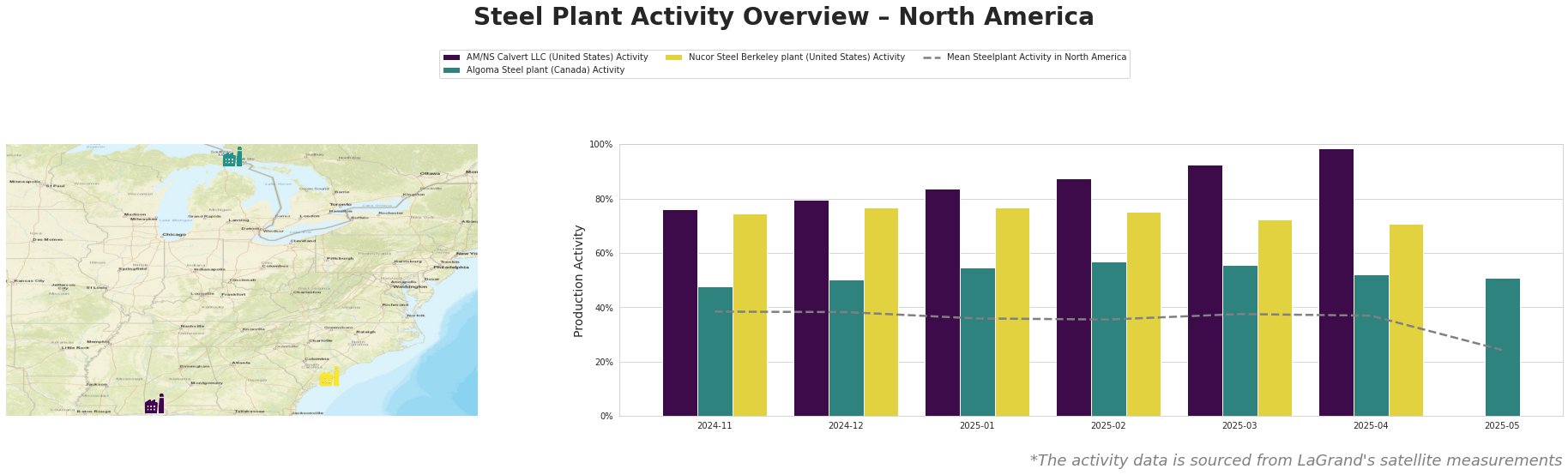

Recent developments in the North American steel market indicate a positive sentiment, driven by robust stock rallies reported in the article, Stocks close sharply higher, lifted by Microsoft, Meta earnings. Concurrently, satellite-observed activity data reflects noteworthy increases in plant productivity, especially for major producers like AM/NS Calvert LLC.

Activity levels at AM/NS Calvert LLC have remained significantly above the mean, peaking at 99% in April 2025, coinciding with optimistic market sentiment driven by corporate earnings as highlighted in Stocks close sharply higher, lifted by Microsoft, Meta earnings. This growth trajectory reflects its position as a prominent electric arc furnace (EAF) operator in Alabama, primarily serving sectors like automotive and infrastructure. However, the recent drop to N/A in May 2025 raises flags for potential disruptions that steel buyers should monitor closely.

Algoma Steel in Ontario has seen a more stable performance, although it recorded a notable rise to 57% in February before settling at 51% in May. This stability can be linked to general market optimism surrounding its integrated production capabilities, yet, no explicit connection to the cited news articles regarding ongoing earnings reports could be established.

Nucor Steel Berkeley’s activity also mirrors the upward trend, maintaining a strong output until it reached 72% in March before a slight decline. Nucor’s operations, primarily driven by EAF technology, effectively align with rising demand in sectors like energy and building infrastructure. Nonetheless, similarly to Algoma, no direct links to the recent news articles could be conclusively drawn.

The recent surge in productivity at AM/NS Calvert LLC indicates it is well-positioned to meet increased market demand, backed by favorable economic conditions. In light of this, steel buyers should prioritize sourcing from this facility to leverage its production capabilities while remaining vigilant regarding the downturn noted for May 2025.

To mitigate potential supply disruptions, buyers are advised to ramp up procurement efforts from AM/NS Calvert LLC in May and June while closely monitoring emerging trends from Algoma and Nucor. Maintaining flexibility in sourcing strategies may be necessary due to the evolving landscape influenced by tariff impacts discussed in Apple earnings updates: Wall Street watching for trade-war impact, iPhone production and external trade negotiations highlighted in Morning Bid: Bright signs from Beijing, bad omens from Apple.