From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in India’s Steel Market: Satellite Insights and Agricultural Trends

Recent observations reveal an increase in steel plant activity in India, correlating positively with agricultural developments. Notably, “India’s Rabi sowing picks up“ has ignited optimism in the steel sector, linking increased domestic fertilizer demand to higher overall plant utilization. Meanwhile, pressing issues in the agricultural sector, detailed in articles like “Indian urea stocks fall by 2.24mn t in December“ and “India urea stocks under further pressure in January,” indicate a continuing demand for urea that supports steel production indirectly through enhanced agricultural outputs and requirements.

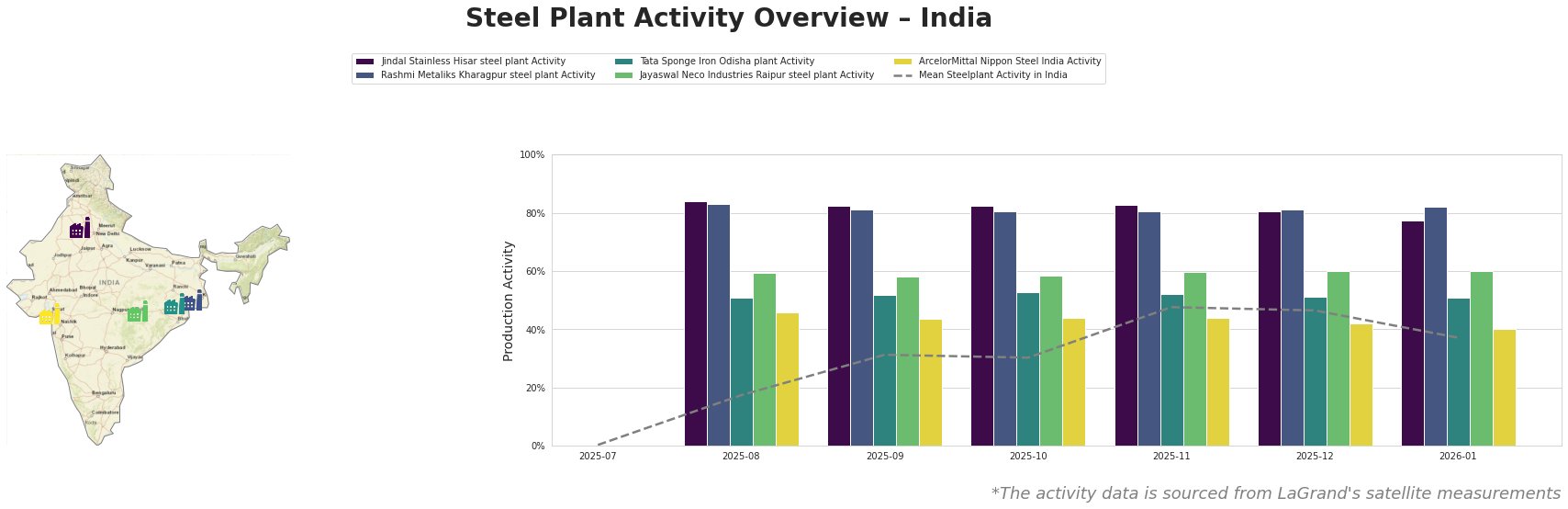

Jindal Stainless Hisar maintained high activity levels at 84% in August but has since slipped to 77% in January, with no direct links to mentioned articles established. On the other hand, Rashmi Metaliks Kharagpur experienced a sustained activity level of 82% in January, reflecting a possible alignment with fertilizer demand growth from the agricultural sector. Tata Sponge Iron and Jayaswal Neco Industries show stable activity levels at 51% and 60%, respectively, while ArcelorMittal Nippon Steel saw a decline from 44% to 40%.

The spike in urea sales and anticipated demands, as seen in “Indian urea stocks under further pressure in January,” logically supports increased activity at Rashmi Metaliks, which is generally aligned with infrastructure improvements tied to agricultural growth. This connection underlines the potential for procurement readiness in anticipation of heightened market competition.

Market implications suggest a tighter supply for urea could hinder steel production in regions reliant on fertilizer inputs. Buyers should prepare for potential supply disruptions specifically in areas where integrated steel production is common, such as Gujarat with ArcelorMittal, which might face delays as agricultural inputs are prioritized.

Steel buyers are recommended to secure procurement options for steel in the short term, especially for products aligned with agricultural machinery, as rising crop acreage is expected to drive demand. Given the activity levels in January, attention should be focused on Rashmi Metaliks and Tata Sponge Iron for timely acquisitions, while remaining cognizant of fluctuations related to urea stock levels and their operational impacts on production capacities across the sector.