From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Europe’s Steel Sector: Price Increases Despite Cautious Demand

The European steel market is exhibiting a positive sentiment, further bolstered by recent news articles highlighting key developments. In “The EU steel market starts 2026 on a cautious note,” it is noted that while demand remains subdued, price increases are being driven primarily by cost pressures. Additionally, “European HRC markets restart slowly; mills push prices up as CBAM creates structural strain on imports“ emphasizes the rising domestic prices due to the Carbon Border Adjustment Mechanism (CBAM), correlating with increased supply reliability concerns and rising activity in domestic steel plants.

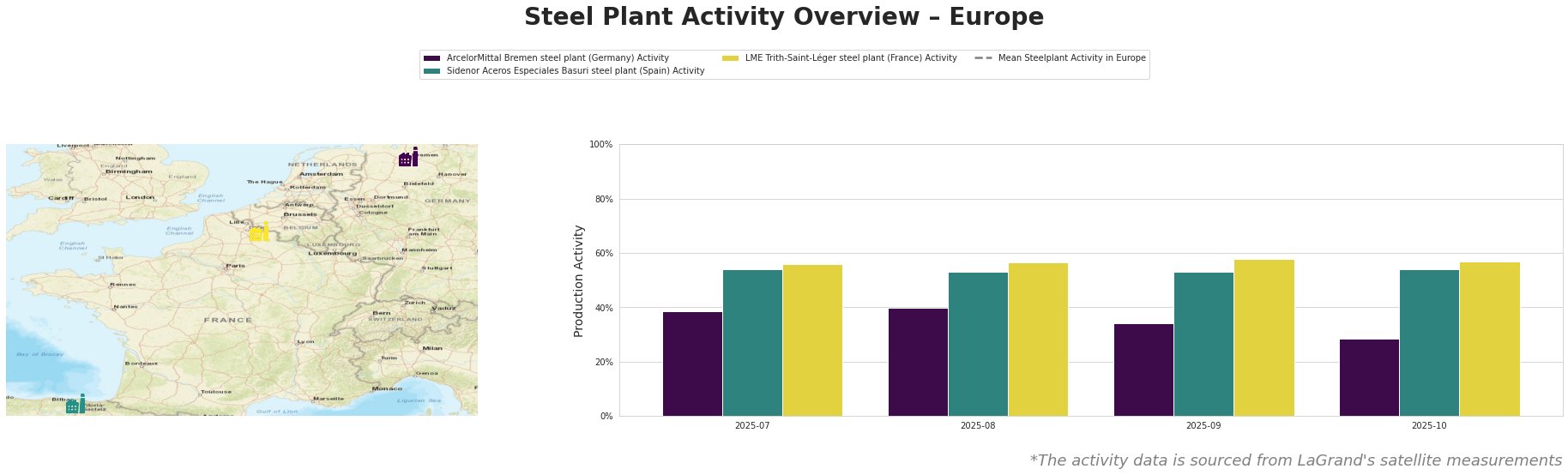

Measured Activity Overview

The observed activity metrics indicate a decline in overall steel plant activity in Europe, particularly between September and October, where the mean activity dropped from 30.58% to 27.19%. However, both the ArcelorMittal Bremen and Sidenor Aceros plant activities showed notable stability with minor fluctuations.

The ArcelorMittal Bremen plant showed a decrease to 29.0% in October from 34.0% in September, suggesting the ongoing restructuring and cost-cutting measures mentioned in “The EU steel market starts 2026 on a cautious note.” There is, however, relative steadiness in the Sidenor and LME Trith-Saint-Léger plants, which maintained activity levels above their mean even amidst overall declines, reflecting local demand strength in specific product categories. No explicit connection could be established for these activities correlating to specific news developments.

Evaluated Market Implications

Rising prices driven by regulatory pressures and stabilizing supply from local plants signal potential supply disruptions in regions heavily reliant on imports, particularly as outlined in “European HRC markets restart slowly; mills push prices up as CBAM creates structural strain on imports.” Buyers should anticipate tighter supply chains and adjust procurement strategies accordingly.

Given the positive momentum and the rising home-grown production promise, steel buyers should favor domestic mill sourcing to hedge against escalating IF imports driven by CBAM costs, especially with notable price increases expected in the upcoming months. Specific recommendations include:

- Procurement from ArcelorMittal Bremen: Adjust timelines to align purchases as production stabilizes.

- Focus on sourcing CRC and HRC from local suppliers: Mitigate risks associated with import clearances and fees instigated by CBAM.

- Monitor Sidenor Aceros and LME Trith-Saint-Léger’s activity levels: Align buying strategies with production stability indicators from these plants.

Such tailored actions will enable procurement professionals to navigate the evolving landscape effectively.