From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Europe’s Steel Market: Increased Activity Amid Market Shifts

In Europe, the steel market exhibits a positive sentiment driven by recent developments in plant activities and trade dynamics. Specifically, articles titled “Ukraine’s pig iron exports rise by 49% y/y in January-November” and “Ukraine reduced semi-finished exports by 30.5% y/y in January-November“ illustrate contrasting trends in export levels that directly correspond to satellite-observed changes in steel plant activities within the region.

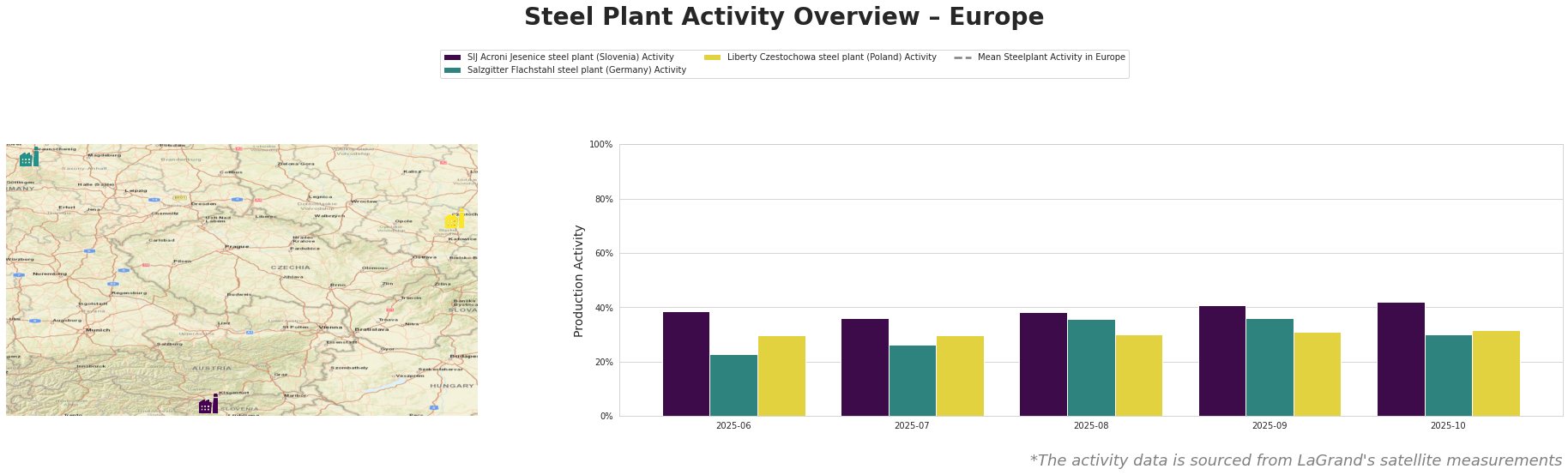

The significant increase in activity in plants like SIJ Acroni Jasenice reached 42% in October 2025, aligning with heightened demand for semi-finished and finished rolled products, while the Salzgitter Flachstahl plant observed a drop to 30% in October amid ongoing integration projects for low CO2 steel production. The Liberty Czestochowa plant maintains a steady activity level of 31%, reflecting resilience in its operational performance amidst fluctuating market demands.

Activity at SIJ Acroni Jasenice is notably linked to the rising demand for pig iron exports, as highlighted in “Ukraine exported 1.73 million tons of pig iron in January-November“. This demand correlates with heightened activity, particularly as European markets turn towards Ukrainian sources for supply amid shifting trade relationships. In contrast, the decrease in semi-finished steel exports, as reported in “Ukraine reduced semi-finished exports by 30.5% y/y in January-November”, may indicate potential shortages for specific products, notably affecting downstream sectors relying on these exports.

Given these dynamics, procurement actions should focus on securing contracts with plants showing positive activities, such as SIJ Acroni Jesenice, while closely monitoring production adjustments at Salzgitter Flachstahl. The substantial reductions in Ukraine’s semi-finished steel exports present clear opportunities for steel buyers to capitalize on existing domestic supply advantages. Conversely, attention must be given to mitigate risks associated with the observed declines in Ukraine’s exports, which may tighten availability as demand shifts.

In conclusion, the proactive engagement of steel buyers in leveraging these developments through targeted supplier relationships will be crucial in navigating the evolving landscape of the European steel market.