From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Europe’s Steel Market: Domestic Focus Shifts Activity Levels

Recent developments in Ukraine and Russia are impacting the European steel market positively, driven by domestic processing initiatives. The articles titled “The Cabinet of Ministers of Ukraine has extended the ban on the export of timber and scrap metal until the end of 2026,” and “Ukraine imposes a total ban on the export of scrap metal from 2026,” illustrate a strategic pivot towards domestic processing that is fostering increased activity in the region’s steel production. The Ukrainian government aims to retain vital raw materials, resulting in a notable uptick in scrap metal collection and processing. In parallel, Russia’s extension of scrap export quotas, as detailed in “Russia Extends Scrap Metal Export Quotas Until 2026, Raising the Limit to 2.2 Million Tons,” may influence regional dynamics, although its direct implications on EU-based facilities remain ambiguous.

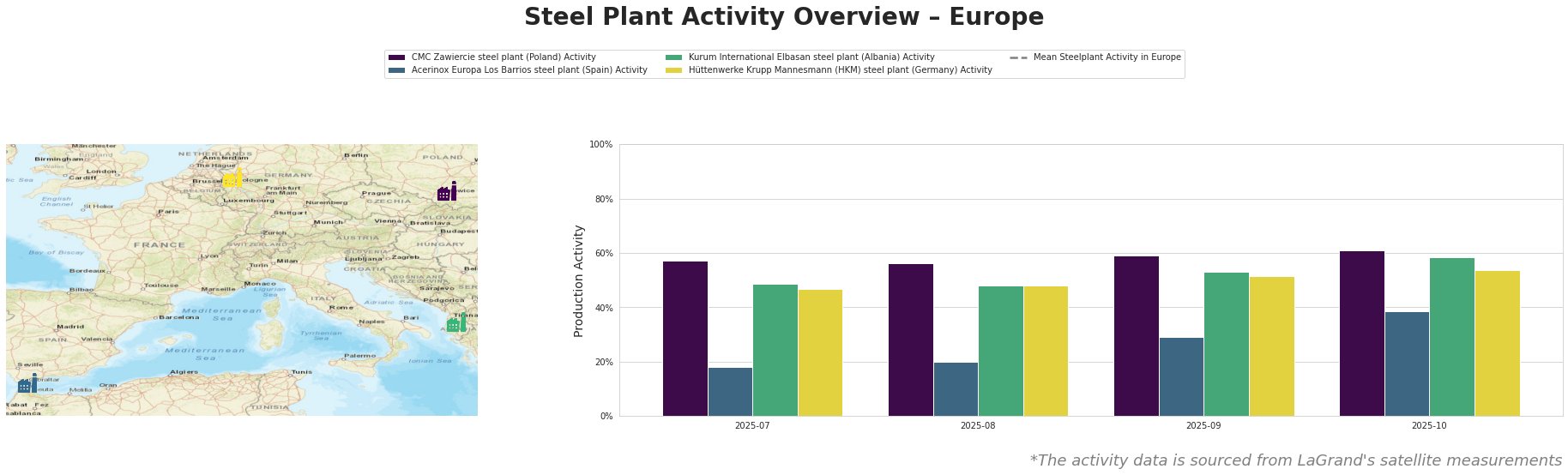

The overall activity levels have shown a slight decline in the third quarter of 2025, with a mean activity of 50.3% by September, indicative of typical seasonal fluctuations. However, CMC Zawiercie’s activity increased to 61% by October, suggesting that local dynamics may be benefiting from domestic sourcing strategies as highlighted in the news articles. In contrast, Acerinox and Kurum International experienced modest increases, but overall stayed relatively low, particularly in August, indicating a need for further alignment with rising domestic demand.

At the CMC Zawiercie steel plant, an uptick in activity from 57% in July to 61% by October aligns with the ongoing emphasis on domestic processing fostered by Ukrainian export bans. This plant specializes in the electric arc furnace (EAF) method and primarily supplies diverse end-user sectors, including automotive and infrastructure. The increase signals a regional readiness to adapt to policy changes favoring local scrap utilization.

Acerinox Europa Los Barrios steel plant exhibited a rise from 18% to 39% within the same timeframe, but its lower levels reflect strategic adjustments rather than a direct influence from the news articles. Its focus on stainless steel production could benefit in the long-term as Ukraine’s domestic processing becomes robust in addressing EU environmental standards.

Kurum International Elbasan’s steel plant experienced a growth in activity, peaking at 58%. However, without a direct connection to the news, this increase suggests local opportunities tied to regional sourcing potential rather than explicit ties to Ukrainian policies.

The Hüttenwerke Krupp Mannesmann (HKM) plant’s consistent outputs of 47% to 54% show resilience, but like Acerinox, no direct links to recent developments can be established.

Given the recent scrap metal export restrictions and a growing domestic processing focus in Ukraine, procurement professionals should consider increasing their contracts with European producers, notably CMC Zawiercie and possibly Kurum International, both of whom exhibit potential for a steady supply of domestically sourced materials. This shift is also essential to mitigate risks associated with dependence on imported scrap, particularly as uncertainties in Russian export quotas loom.