From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Europe’s Steel Market Amid Carbon Policy Changes

Europe’s steel market displays a very positive sentiment as trends indicate rising activity levels across several key steel plants. Recent news articles such as “UK issues second draft of CBAM rules ahead of January 2027 rollout“ and “Australia should consider introducing CBAM for certain goods – overview“ underscore significant regulatory developments related to carbon border adjustments that are expected to impact steel production dynamics. Although the direct linkage between these news articles and the activity levels of specific steel plants is yet to be fully established, the direction of regulatory changes promises supportive market conditions.

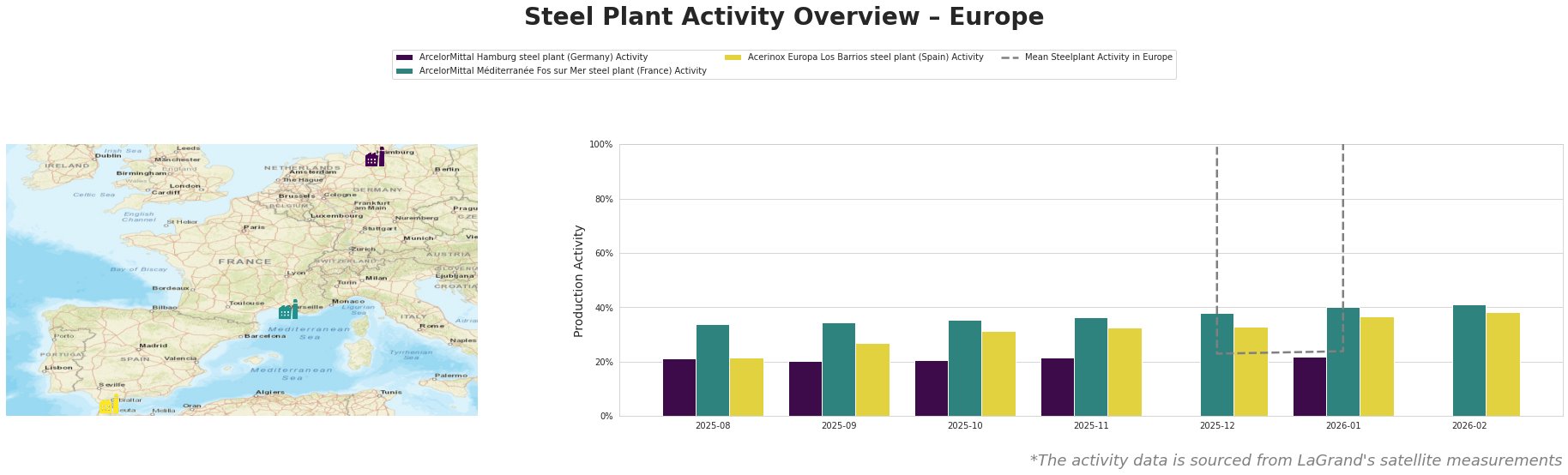

The data reflects a varied performance among the observed steel plants. The ArcelorMittal Hamburg steel plant exhibited a peak activity of 22% in November 2025, while it fluctuated slightly thereafter without significant downward shifts. This stable trend aligns with the UK’s renewed focus on carbon policies as per “UK issues second draft of CBAM rules ahead of January 2027 rollout,” suggesting regulatory responses could sustain ongoing operations.

The ArcelorMittal Méditerranée Fos sur Mer steel plant shows consistent upward growth peaking at 41% in February 2026, indicating robust engagement in production amid rising demands, potentially driven by anticipations around the forthcoming CBAM initiative. Notably, its operational resilience may contribute positively to the anticipated European market shifts highlighted in the articles.

In contrast, Acerinox Europa Los Barrios fluctuated, hitting a higher activity of 38% in February 2026, but remains below the average activity levels of its peers. Its variable performance underscores a more cautious approach in production scaling, which could be reassessed in light of the evolving carbon policies and market sentiment.

Procurement professionals should closely monitor supply disruptions particularly from the Acerinox Europa Los Barrios plant, as noted activity trends suggest it may struggle to keep pace with rising demands. Buyers should consider adjusting procurement schedules to capitalize on expected growth from ArcelorMittal facilities, especially in response to the regulatory adjustments under the CBAM framework. Identifying partnerships with plants showing stable growth trends will be essential for mitigating potential supply chain risks linked to carbon compliance adjustments.