From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Asia’s Steel Market: Trends and Insights for Buyers

Asia’s steel industry is witnessing a positive market sentiment, supported by recent developments in steel plant activities as observed through satellite data. Notably, “Thailand’s LNG demand poised to remain slow” and “Indonesian coal output, exports decline in 2025“ highlight the ongoing challenges in energy sectors affecting steel production capabilities indirectly. However, satellite data reveals upward activity trends among specific steel plants, indicating stronger operational performance compared to previous periods.

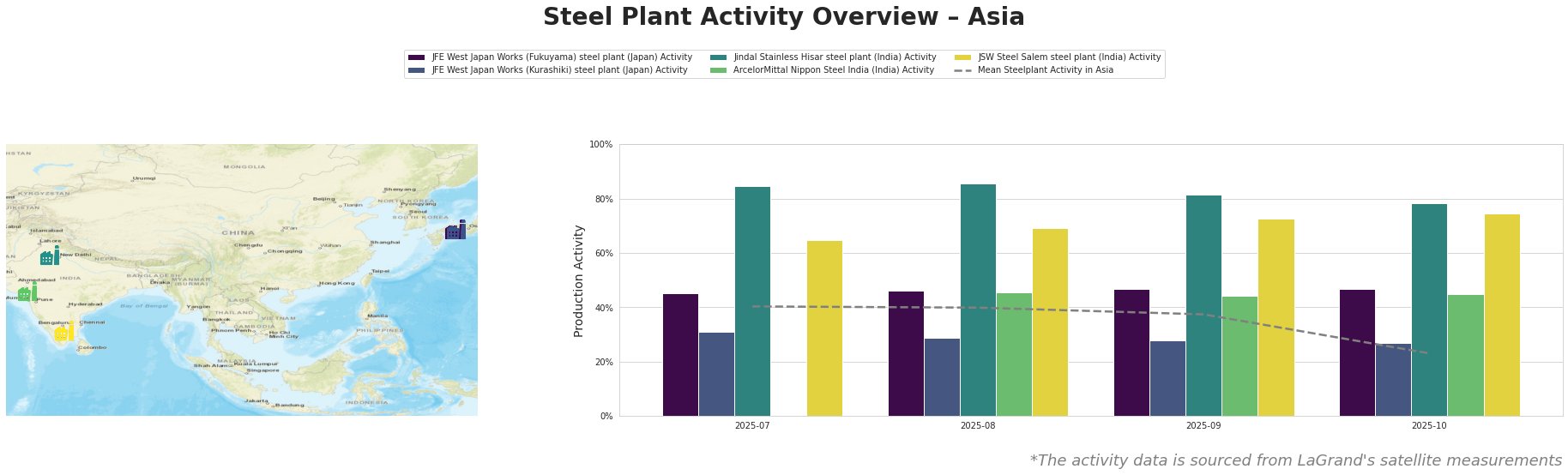

Recent satellite observations show steady activity levels in select steel plants. Below is a summary of the activity trends for the month ending October 2025:

The Jindal Stainless Hisar steel plant performed strongly, maintaining an 85% activity level in July. However, the recent drop to 78% in October coincides with the declining coal exports in Indonesia, indirectly affecting raw material availability.

At JFE West Japan Works (Fukuyama), activity remained robust, slightly increasing from 45% in July to 47% in October, indicating a stable production capacity amidst fluctuating energy demands discussed in “Japan utilities keep LNG stocks above average into 2026“. Meanwhile, both JSW Steel Salem and ArcelorMittal Nippon Steel India demonstrated similar resilience, although their production rates showed minor fluctuations likely affected by regional market variables not directly linked to the recent news articles.

As for supply implications, the downturn in Indonesian coal output may lead to potential feedstock constraints influencing overall steel production. Buyers in regions heavily reliant on imported coal should consider procurements now to mitigate risks regarding the availability of steel within the next quarter.

Procurement professionals should favor contracts with suppliers maintaining consistent activity levels, particularly those evident in the Jindal Stainless and JFE plants, while remaining alert to any shifts leading to supply disruptions stemming from the Indonesian coal market. Leveraging the current upward trend in activity may yield favorable pricing and availability situations in Asia’s competitive steel landscape.