From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Asia’s Steel Market: Insights from Recent Trends and Plant Activity

Asia’s steel market exhibits a positive sentiment with significant developments across the region. Notable headlines such as “China’s semi-finished steel exports up 292% in January-August 2025“ and “India Raises Steel Exports by 22% in April–August 2025“ indicate robust export growth. This growth is mirrored by satellite observations revealing fluctuating plant activity levels in key locations.

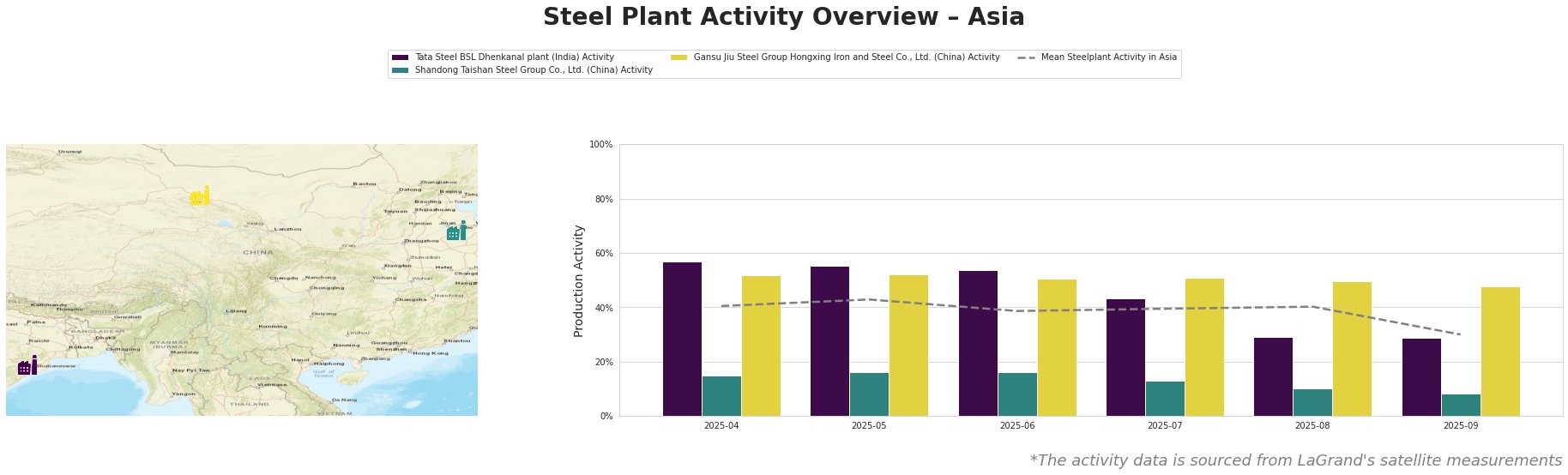

The Tata Steel BSL Dhenkanal plant in India maintained a relatively higher activity rate, peaking at 57% in April 2025 with significant production capacities in both finished and semi-finished products. However, activity levels decreased to 29% by September, which may correlate with the overall market conditions as reported, but no direct news connection was observed.

Conversely, the Shandong Taishan Steel Group faced a severe decline in activity, dropping to just 8% by September 2025. This reduction aligns with the decrease in demand for finished products in China attributed to competition and market saturation, as highlighted by “China’s coke exports decrease by 20 percent in January-August 2025,” signaling weaker domestic consumption.

In Gansu Jiu Steel Group, consistent activity levels were noted, remaining above 50% until September, though showing a slight downward trend. This plant’s robust capabilities in high-grade products appear somewhat insulated from the fluctuations in semi-finished steel exports.

The recent increase in finished steel stocks by 2.3% according to “Stocks of main finished steel products in China up 2.3 percent in mid-Sept 2025,” indicates that while exports are buoyant, there may be an impending oversupply situation influencing plant operations.

The observed fluctuations in plant activity throughout Asia suggest potential supply disruptions, particularly from the Shandong Taishan Steel Group and overall Chinese producers, as they struggle to balance between export demands and weakened domestic needs.

Steel buyers and market analysts should prioritize sourcing from India, where exports are rising, backed by robust production capacity, and consider diversifying supply from Tata Steel BSL, despite its recent activity dip, to secure competitive prices amidst shifting market conditions. The painted landscape indicates a cautiously optimistic export scenario; however, maintaining an agile procurement approach against possible disruptions in China is vital.