From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Asia’s Steel Market: Increases in Turkey’s CRC Imports Amid Regional Plant Activity Trends

In Asia, the steel market exhibits a positive sentiment, highlighted by Turkey’s recent import surge in cold rolled coil (CRC), as detailed in the article Turkey’s CRC imports up 40.8 percent in Jan-Oct 2025. This surge aligns with observed increases in activity levels in various steel plants across the region, indicating robust market conditions.

Measured Activity Overview

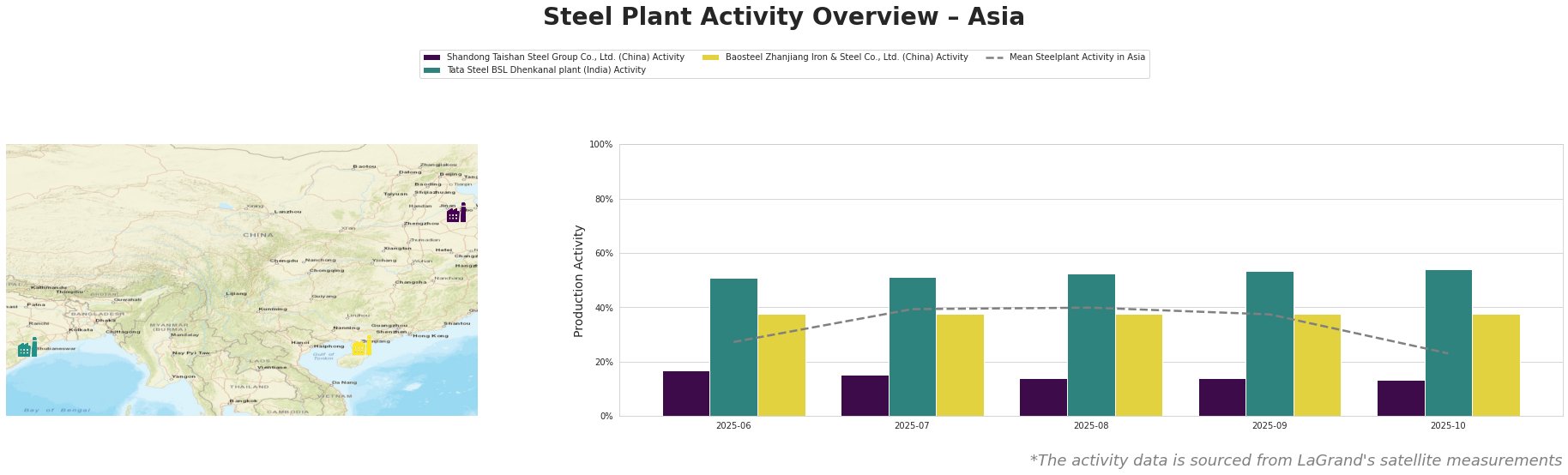

The activity levels in the Shandong Taishan Steel Group have seen a significant decline, dropping from 17.0% in June to only 13.0% in October. Conversely, Tata Steel’s Dhenkanal plant has maintained a relatively stable output, peaking at 54.0% in October, aligning with stronger demand signals from the region. Baosteel’s activity level remained constant at 38.0%, ensuring steady output amidst shifting dynamics.

Plant Insights

Shandong Taishan Steel Group Co., Ltd. operates as an integrated steel producer with a crude steel capacity of 5 million tonnes. The dramatic decline in activity to 13.0% by October likely reflects reduced production responses to market conditions that could have been influenced by Turkey’s notable import increases, though no direct linkage is essential.

Tata Steel BSL’s Dhenkanal plant has been performing well with a production capacity of 5.6 million tonnes, observing activity reaching 54.0% by October. This increasing trend may reflect stronger demand aligned with Turkey’s 40.8 percent increase in CRC imports, potentially indicating an uptick in regional consumption that buyers could capitalize on.

Baosteel Zhanjiang Iron & Steel Co., Ltd., with a capacity of 12.5 million tonnes, has consistently maintained a solid activity level of 38.0%. The stability here could position itself effectively to cover any potential rise in demand catalyzed by Turkey’s increased imports, although a direct connection could not be established.

Evaluated Market Implications

Steel buyers should prepare for potential supply disruptions from Shandong due to its significant activity drop, affecting its immediate ability to fulfill orders. Conversely, Tata Steel BSL’s strong performance signals a reliable source for procurement, especially in light of heightened demand as indicated by Turkey’s ongoing increase in imports. Moreover, Baosteel’s stable output suggests steady supply amidst fluctuating demands.

In this context, steel procurement professionals should prioritize sourcing from Tata Steel BSL to align with market demands post-Turkey’s CRC import surge, while monitoring Shandong Taishan Steel’s activity for potential recovery strategies.