From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Market Trends in Ukraine’s Steel Industry Amid Ongoing Challenges

Ukrainian steel production is witnessing a positive sentiment driven by significant developments. “Scrap exports from Ukraine reached a four-year high in 2025” and “Zaporizhstal reduced steel production by 15.8% m/m in January” link recent operational shifts in steel plants to market dynamics, particularly in scrap metal exports which are crucial for the industry amidst conflict-induced production challenges.

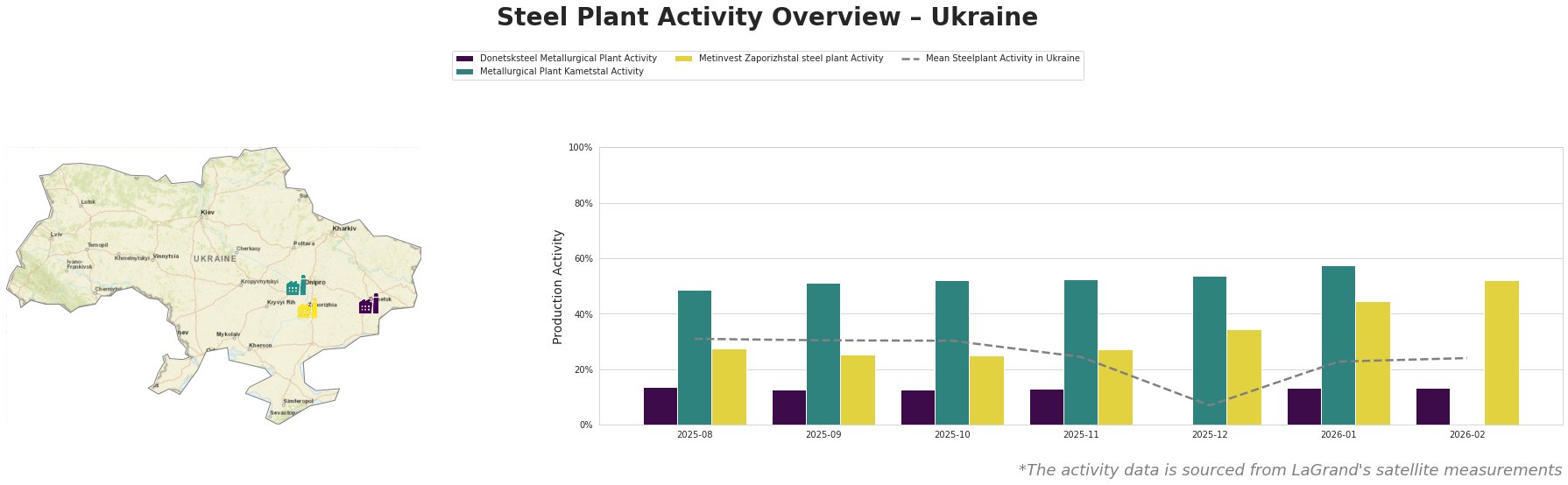

The Mean Steelplant Activity in Ukraine has shown considerable fluctuations, especially dropping to a significant low of 7% in December 2025. This aligns with “Zaporizhstal reduced steel production by 15.8% m/m in January”, where production setbacks were attributed to ongoing disruptions. Conversely, January saw a rebound in activity to 23%, highlighting a recovery despite operational hurdles.

Zaporizhstal steel plant is showcasing a complicated operational landscape, experiencing a 15.8% reduction in January steel production to 234,400 tons amidst infrastructure challenges. Despite these setbacks, 2025 total finished steel production witnessed a 15.1% year-on-year growth, signifying resilience and potential in future output. Metallurgical Plant Kametstal displayed relatively stable operations with a peak activity of 58.0% observed in January 2026 as production diversifies towards finished products, leading to its crucial role in supporting domestic needs as scrap duties broaden.

Conversely, Donetsksteel Metallurgical Plant lingers at low operational capacity with no significant production reported, showing hesitance amidst uncertainty. Interestingly, activity patterns at these facilities suggest a competitive positioning where increased scrap metal exports could augment domestic processing capabilities, particularly beneficial post the governmental restrictions noted in “Scrap exports from Ukraine reached a four-year high in 2025”.

Given the observed satellite data and recent news developments, potential procurement strategies are clear. Steel buyers should:

- Focus on sourcing from Zaporizhstal, whose production of finished steel increased in the previous year despite January hiccups.

- Anticipate Kametstal’s stable output for semi-finished products, ensuring a consistent supply chain despite broader industrial fluctuations noted in “Industrial production in Ukraine fell by 2.4% y/y in 2025”.

- Monitor scrap metal availability, especially with ongoing shifts in regulation from January 2026 restricting exports to bolster domestic processing, likely impacting pricing and availability.

Strategic procurement in this evolving market landscape will be crucial, balancing supply disruptions against emerging domestic opportunities.