From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Growth in European Steel Market: Notable Advances and Strategic Upgrades

Recent developments in Europe’s steel industry paint an optimistic picture, highlighted by significant investments and advancements in technology. The article Pittini revamps southern Italian plant discusses Pittini’s investment in its SiderPotenza rolling mill aimed at boosting efficiency and sustainability, anticipated to positively influence production capacity. Simultaneously, Primetals upgrades pickling and tandem mills at voestalpine plant indicates ongoing modernization at voestalpine Stahl’s facilities, enhancing their capacity to produce high-strength steels. These activities are corroborated by satellite observations demonstrating improved operational levels in several key plants.

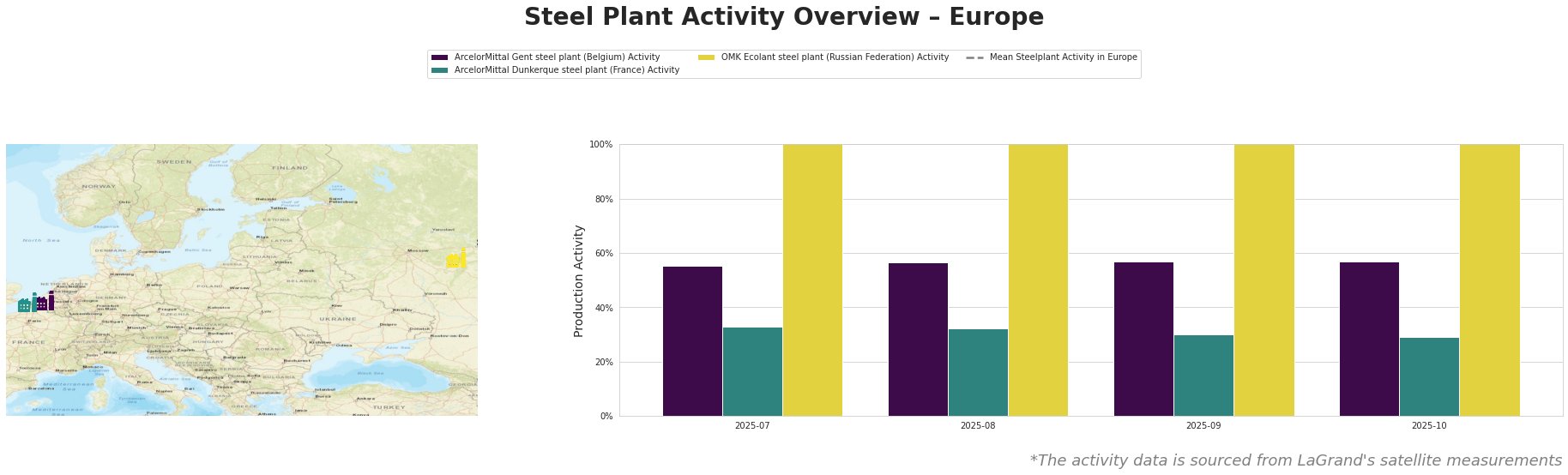

The data indicates that the ArcelorMittal plants in Gent and Dunkerque have maintained steady activity levels despite slight fluctuations; Gent remains notably higher than Dunkerque. The activity in Gent remained stable at 57% through August and September, while Dunkerque saw a decrease to 30% by October. In contrast, OMK Ecolant consistently reported a high activity of 61.8%, reflecting robust performance possibly linked to ongoing production demands.

At ArcelorMittal Gent, the plant utilizes an integrated blast furnace and BOF technology, producing a variety of semi-finished and finished products. Its productivity is bolstered by a steady workforce, and the consistent activity level of 57% suggests stable operational capacity, particularly in response to rising demand crises as stated in relevant articles. The latest upgrades in Austria’s steelmaking processes offer potential cross-benefits; while no direct connection was established between the latest news and observed changes, the modernization efforts in Austria could influence downstream demand that Gent will serve.

Meanwhile, ArcelorMittal Dunkerque has experienced drops to a 29% activity level by the end of October. With a production capacity of 6,750 tons for crude steel, its lower activity may indicate production challenges that could reflect demands in the automotive sector, which focuses heavily on hot rolled products and slabs. Again, no direct correlation with recent news articles was identified for these fluctuations.

The OMK Ecolant plant’s high activity, supported by DRI-fed EAF processes, shows resilience in operations, catering to infrastructure demands as reported consistently. Its maintained 61.8% activity rate aligns well with production needs across energy and building sectors, although no specific recent articles were linked to shifts in its efficiency.

The overall market sentiment is favorable, and the strategic upgrades and technology investments suggest that potential supply disruptions in 2026 may be mitigated due to enhanced production processes. Steel buyers should focus their procurement strategies on ArcelorMittal Gent and OMK Ecolant, as they appear well-positioned to meet future market demands, while monitoring ongoing developments in Dunkerque. Prioritizing contracts with providers engaging in modernization efforts, such as Pittini and voestalpine, should also be considered to secure enhanced supply chain reliability moving forward.