From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Growth in Asia’s Steel Industry: Satellite Insights and Market Developments

Growing activity levels in Asia’s steel production facilities reflect a robust market sentiment. Notably, the articles titled “EU issues minor Chinese tinplate anti-dumping duties correction“ and “EU amends AD on tinplate from China“ indicate adjustments in anti-dumping duties impacting Chinese steel, potentially influencing trade dynamics. These developments coincide with rising activity at several key steel plants in the region.

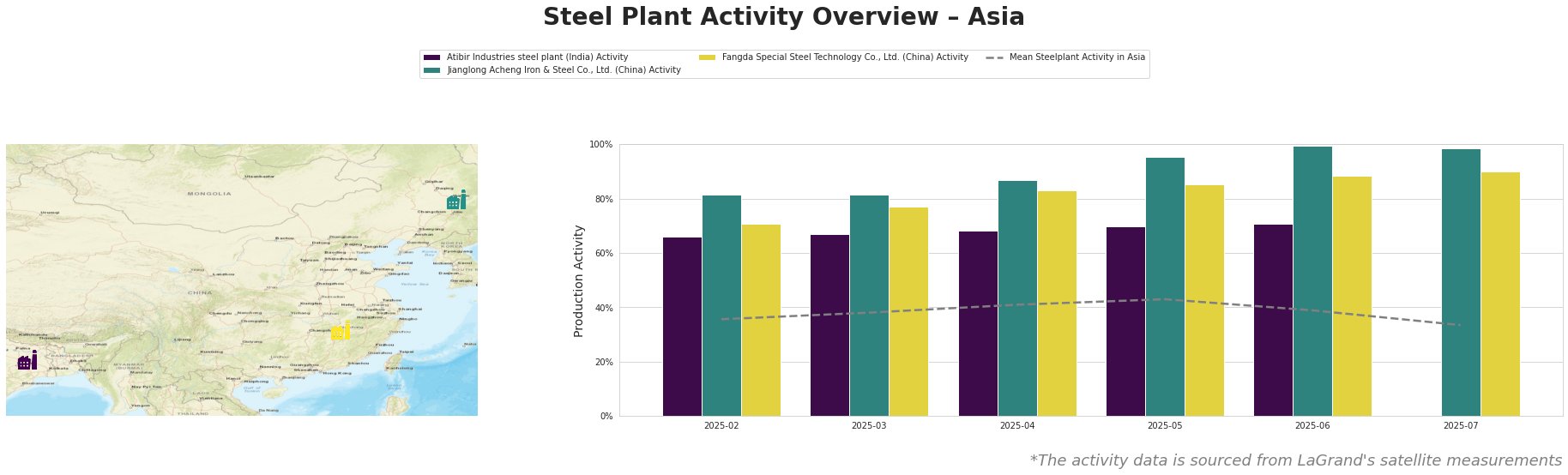

The overall mean activity across steel plants remained at a healthy 39%, with some individual plants demonstrating notable variances. For example, Jianglong Acheng Iron & Steel saw peak activity at 100% in June 2025, likely bolstered by increased demand for finished rolled products aligned with the automotive sector’s recovery. In contrast, Atibir Industries registered consistent performance, with a slight uptick reaching 71% by June, potentially reflecting stable local demand. The engagement with effective anti-dumping measures, highlighted in the recent EU articles, suggests strategic positioning that could fortify Chinese exporters while indirectly enhancing the competitive landscape for Indian manufacturers like Atibir.

Atirib Industries, located in Jharkhand, exhibits a steady production capacity of 600,000 tons of crude steel via traditional blast furnace methods, showing a gradual activity increase to 71% by June 2025. This improvement occurs despite recent global trade tensions affecting tinplate imports, establishing the plant’s resilience. Any direct link to recent anti-dumping news remains unestablished.

In contrast, Jianglong Acheng Iron & Steel reached full operational capacity in June with significant investments in production technology. The 100% activity level reflects positive demand in the automotive and machinery sectors, likely aided by market adjustments in European imports and diminished competition from the EU’s corrective duties. Fangda Special Steel, while sustaining a solid 90% activity in July, hints at a strategic advantage from maintaining a diverse product portfolio primarily focused on automotive steel applications.

The intersection of these developments signals firm procurement considerations for buyers. Given fluctuations in activity levels and current market correction measures, steel buyers should prioritize securing contracts with Jianglong and Fangda, considering their solid operational capabilities and product reliability. With the shifting regulatory environment regarding imports, staying informed on EU modifications could also prove advantageous, particularly for sourcing finished steel products.

Buyers should remain vigilant for potential supply disruptions, particularly in light of fluctuating activity levels observed in July at Atibir Industries, suggesting possible localized triggers or short-term market shifts that could impact availability.