From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive European Steel Market Insights: Voestalpine’s Strategic Moves and Plant Activities Point Towards Growth

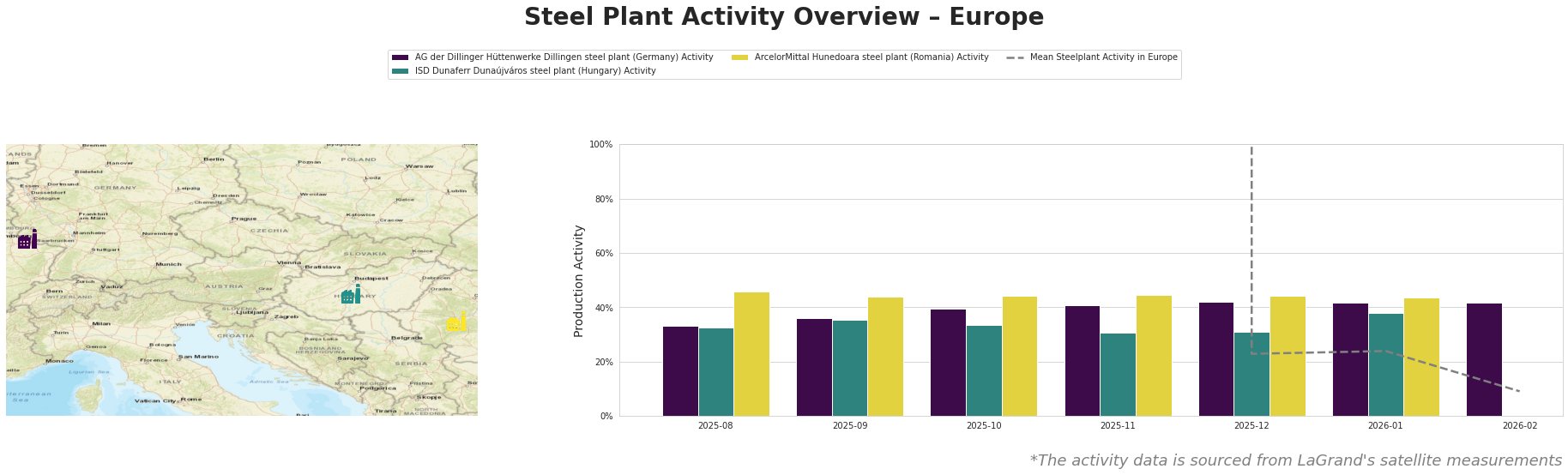

Recent developments in Europe’s steel market indicate a positive sentiment, particularly following the article “Voestalpine sells Böhler Profile to Massachusetts company.” This sale is part of Voestalpine’s broader restructuring strategy, which has effectively streamlined operations. Notably, the strategic divestment aims to optimize high-performance metal sectors, reflecting resilience amidst changing market dynamics. Satellite-observed activity data confirms increased engagement across selected plants, with AG der Dillinger Hüttenwerke and ISD Dunaferr showing noticeable activity trends.

AG der Dillinger Hüttenwerke’s activity peaked at 42% in December 2025, aligning with stronger productivity signals in the market, whereas ISD Dunaferr showed fluctuations with a high of 38% in January 2026. The activities appear stable overall, with ArcelorMittal Hunedoara maintaining a consistent 44% during the same period. These observations suggest resilient operational capabilities, although a significant dip to 9% in February 2026 indicates potential seasonal or external impacts, which cannot be linked directly to the aforementioned sale.

AG der Dillinger Hüttenwerke, situated in Saarland, capitalizes on integrated steel production with a capacity of 2,760 kt/year. The plant’s ongoing stability and recent activity uptick suggest robust demand, likely spurred by the market’s encouraging developments, although no direct connection with Voestalpine’s divestiture exists.

Conversely, ISD Dunaferr, operational since the mid-20th century, has remained vital in the production of semi-finished products with consistent output. Its activity drop in December to 31% indicates strain, which doesn’t directly align with recent news but hints at potential localized market challenges.

The ArcelorMittal Hunedoara plant, focused on value-added steel products, has maintained steady performance despite fluctuations in regional demand and suggests strong customer partnerships are in play beyond the emerging trends from Voestalpine’s strategic actions.

As a result, steel procurement professionals should prepare for potential localized supply fluctuations particularly associated with the ISD Dunaferr plant. Recommendations include:

– Prioritize sourcing from AG der Dillinger given its current productivity expansion and operational stability amidst restructuring.

– Evaluate contingencies for ISD Dunaferr and similar facilities anticipating reduced output or seasonal adjustments.

Investing in robust supplier relationships with plants that showcase upward activity trends could mitigate risks while capitalizing on Europe’s overall positive steel market outlook.