From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Dynamics in European Steel Market: Thyssenkrupp’s Renewable Commitments and Strategic Moves by Salzgitter

Driven by recent developments in the European steel sector, particularly the news surrounding Thyssenkrupp Steel expands renewable electricity sourcing via new PPAs to cut emissions (2026-02-05) and Salzgitter, thyssenkrupp reach agreement on future of HKM (2026-02-09), the market sentiment is very positive. Notably, satellite data indicates increased operational activity levels at several plants, with Thyssenkrupp demonstrating a particularly robust commitment to decarbonization.

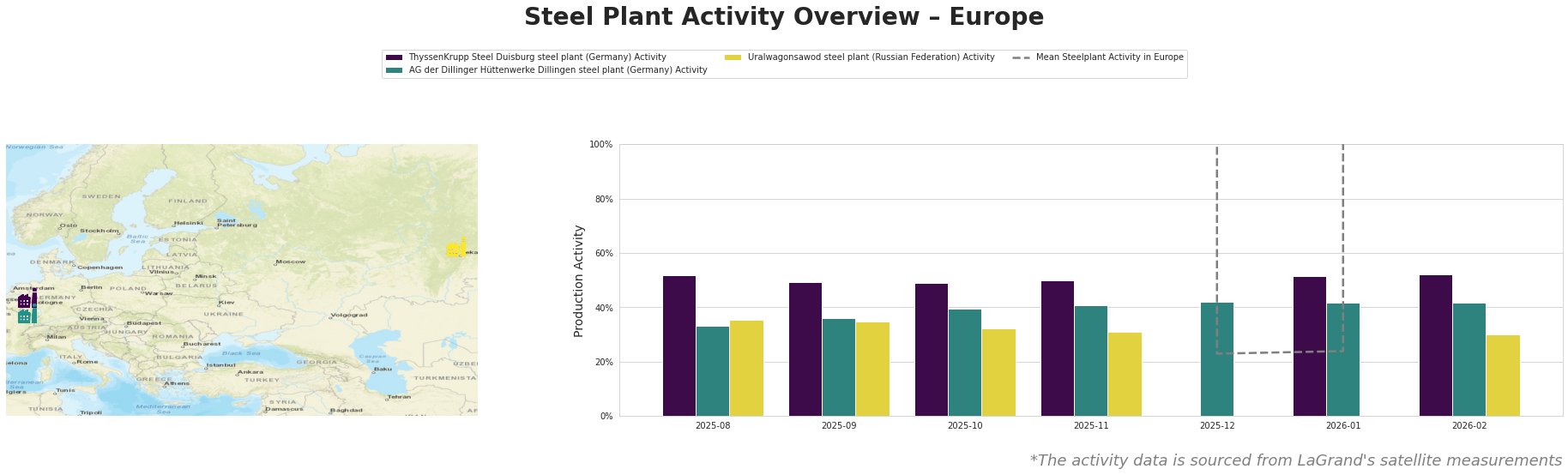

ThyssenKrupp Steel Duisburg’s activity levels recently peaked at 52% in February 2026, coinciding with the ramp-up to renewable energy initiatives, enhancing its sustainability profile. The plant remains above the mean European activity level, reflecting growing productivity driven by renewable sourcing from PPAs—part of a strategic realignment following the Thyssenkrupp Steel expands renewable electricity sourcing via new PPAs to cut emissions article. Meanwhile, AG der Dillinger Hüttenwerke has shown stable performance, maintaining activity levels around 42%, consistent since January, likely benefiting from steady demand in structural steel segments.

Despite fluctuations, the Salzgitter, thyssenkrupp reach agreement on future of HKM article highlights ongoing consolidation activities, suggesting potential challenges in slab pricing that could affect future operations. As Salzgitter assumes control of the joint venture, the market could experience slight contractions in slab availability, signaling procurement caution for steel buyers.

Given the upward activity trend at ThyssenKrupp and stable levels at Dillinger, steel buyers should consider locking in supply agreements early, particularly for specialized and finished products, before any potential disruptions emanating from the HKM transition or pricing adjustments. The proactive shift towards renewable energy integration at ThyssenKrupp could foster enhanced positioning in the market, offering a competitive edge that may reflect in price adjustments.

Overall, steel buyers in Europe should leverage the positive momentum from these developments while maintaining vigilance over emerging supply chain dynamics from ongoing corporate restructuring.