From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePolish Steel Production Surges Amidst Import Pressure, Select EU Plants Show Mixed Activity

Europe’s steel market is experiencing a complex dynamic of increasing production in Poland alongside import pressures and fluctuating plant activity levels. The temporary shutdown of ArcelorMittal Poland’s blast furnace, as reported in “ArcelorMittal temporarily shuts down blast furnace in Poland due to import pressure,” “ArcelorMittal Poland to idle BF No. 3 amid deteriorating market,” and “ArcelorMittal Poland prepares to shut down blast furnace No. 3 amid growing steel imports,” contrasts sharply with the production increase detailed in “Poland increased steel production by 25.7% y/y in June,” suggesting a potential shift in regional supply dynamics. The increase of scrap exports from Ukraine, highlighted in “Scrap exports from Ukraine reached 47.7 thousand tons in June,” may be influencing the availability of raw materials, but no direct relationship to individual plant activity levels could be established from the provided information.

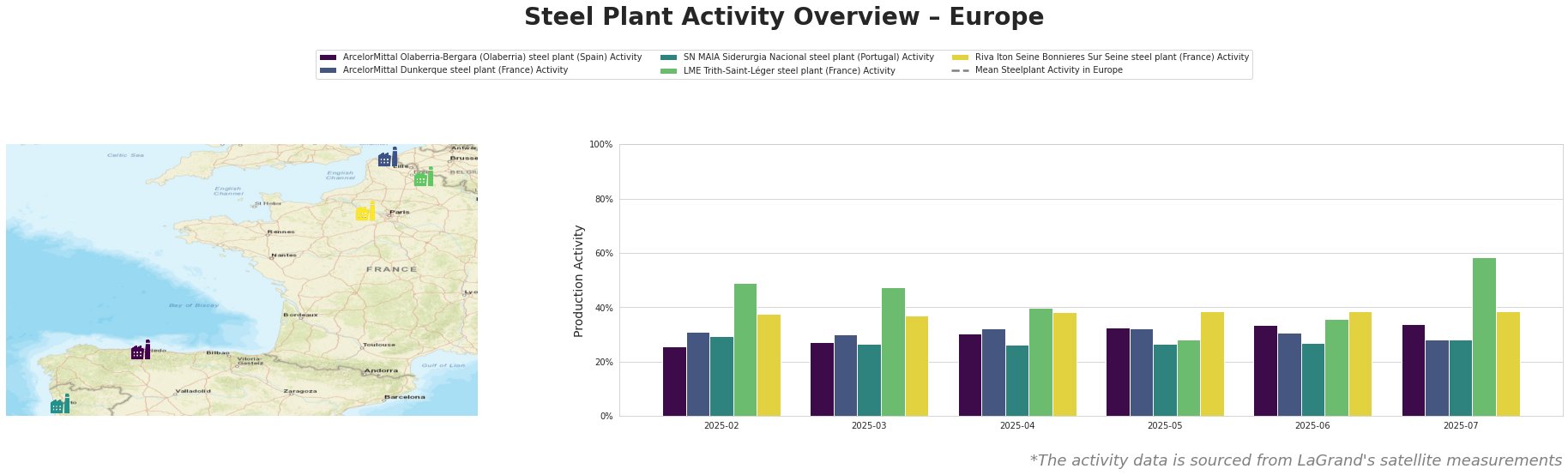

Observed activity levels vary across the selected European steel plants. The mean steel plant activity levels are not meaningful due to large negative values, preventing a comparative analysis. ArcelorMittal Olaberria-Bergara shows a steady increase from 26% in February to 34% in July. ArcelorMittal Dunkerque’s activity remained relatively stable until a decrease to 28% in July. SN MAIA Siderurgia Nacional’s activity remained consistent at around 27-29%. LME Trith-Saint-Léger shows significant volatility, with a peak of 59% in July following a low of 28% in May. Riva Iton Seine Bonnieres Sur Seine shows stable activity between 37% and 39%.

ArcelorMittal Olaberria-Bergara (Olaberria) steel plant, located in Spain, operates with a 4,200 ttpa BOF capacity, producing semi-finished and finished rolled products, including flat products, galvanized coil, and tin plate. Its activity has steadily increased, reaching 34% in July, but no direct link to the provided news articles could be established.

ArcelorMittal Dunkerque steel plant in France, an integrated BF-BOF plant with a crude steel capacity of 6,750 ttpa, primarily produces slabs and hot-rolled coil. Its activity decreased to 28% in July. No direct link to the provided news articles could be established.

SN MAIA Siderurgia Nacional steel plant in Portugal, an EAF-based plant with a 600 ttpa capacity specializing in rebar, has maintained stable activity around 27-29%. No direct link to the provided news articles could be established.

LME Trith-Saint-Léger steel plant in France, an EAF-based producer with a capacity of 850 ttpa, manufactures slabs and hot-rolled coil. The plant exhibited a significant activity increase to 59% in July. No direct link to the provided news articles could be established.

Riva Iton Seine Bonnieres Sur Seine steel plant in France, an EAF-based plant with a 550 ttpa capacity producing billets and rebar, showed consistent activity levels. No direct link to the provided news articles could be established.

The news regarding ArcelorMittal Poland shutting down blast furnace No. 3, as reported in “ArcelorMittal temporarily shuts down blast furnace in Poland due to import pressure,” “ArcelorMittal Poland to idle BF No. 3 amid deteriorating market,” and “ArcelorMittal Poland prepares to shut down blast furnace No. 3 amid growing steel imports“, amidst increased Polish steel production as noted in “Poland increased steel production by 25.7% y/y in June” suggests a potential future supply shift in flat products, potentially impacting availability and pricing in Central and Eastern Europe.

Given the impending shutdown of ArcelorMittal Poland’s blast furnace and the increase of scrap exports from Ukraine, steel buyers should:

1. Diversify Suppliers: Actively explore alternative flat steel suppliers, particularly within the EU, to mitigate potential supply disruptions arising from the ArcelorMittal Poland shutdown.

2. Monitor Scrap Prices: Closely track scrap export trends from Ukraine, as increases may affect steel production costs, especially for EAF-based mills. Consider forward purchasing strategies where appropriate.