From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePolish Steel Market Optimistic: ArcelorMittal Modernization & Stable Plant Activity Signal Positive Outlook

Poland’s steel sector shows a positive trajectory, driven by government support and consistent plant activity. The potential for modernization, as reported in “ArcelorMittal Poland may receive PLN 1 billion for modernization” and “ArcelorMittal Poland in talks with government regarding state funding for modernization“, signals a commitment to sustaining domestic steel production. These discussions are further detailed in “ArcelorMittal enters into negotiations on state aid to Poland: reports,” although no direct link can be established between these news items and the observed activity levels in the subsequent satellite data.

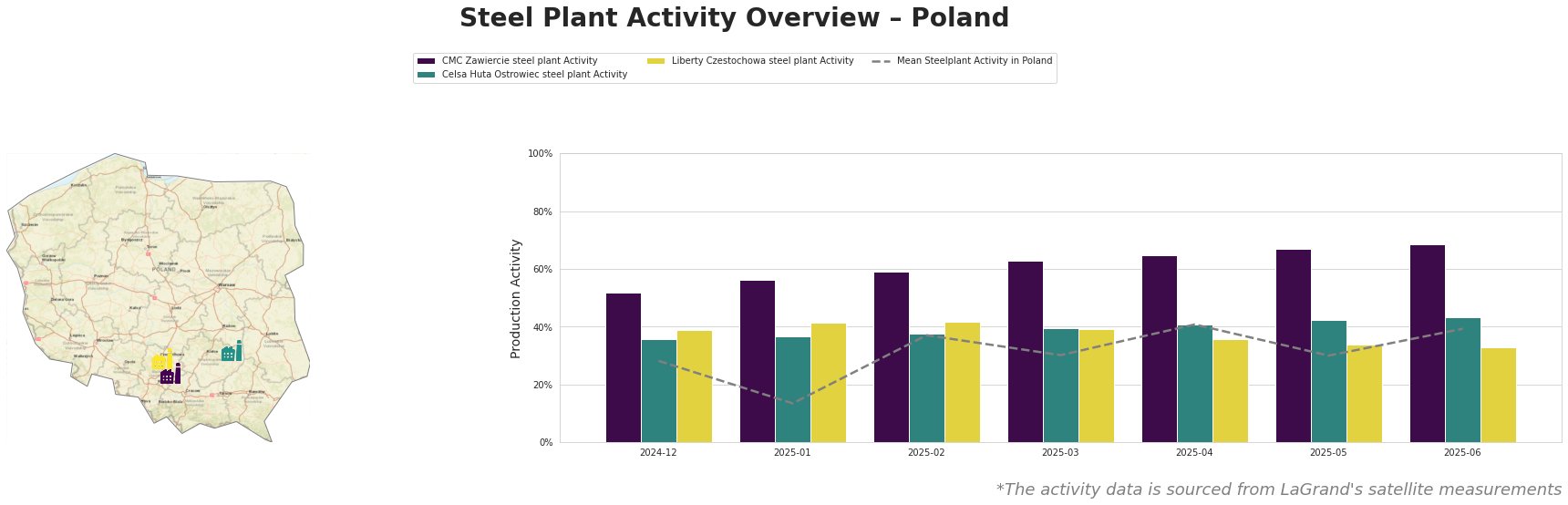

Monthly activity levels across observed Polish steel plants present a mixed but generally stable picture.

The mean activity level across all observed plants fluctuated, reaching a low of 13% in January 2025 and a peak of 41% in April 2025. However, individual plant activity tells a more nuanced story.

CMC Zawiercie, an EAF-based plant in Silesia with a crude steel capacity of 1.7 million tonnes, consistently operated above the Polish average. Activity steadily increased from 52% in December 2024 to 69% in June 2025. This continuous upward trend suggests robust demand for its products across automotive, building and infrastructure, and other sectors. There is no clear link to the provided news articles.

Celsa Huta Ostrowiec, located in Świętokrzyskie, focuses on finished rolled products like bars and rebar for the building and infrastructure sector. Its activity saw a gradual rise from 36% in December 2024 to 43% in June 2025. This consistent, moderate increase could reflect steady demand in the construction industry. There is no clear link to the provided news articles.

Liberty Czestochowa, another EAF-based plant in Silesia producing semi-finished plates, displayed fluctuating activity. After a peak of 42% in January and February 2025, activity decreased to 33% in June 2025. This fluctuation warrants monitoring, although no immediate concerns arise due to a general pattern of mean steel activity increase in Poland. There is no clear link to the provided news articles.

Given ArcelorMittal Poland’s potential modernization and the consistently high activity at CMC Zawiercie, steel buyers should:

- Secure supply contracts with CMC Zawiercie: To capitalize on their consistently high production levels and avoid potential disruptions elsewhere.

- Closely monitor ArcelorMittal Poland’s modernization progress: The government’s potential PLN 1 billion investment, as detailed in “ArcelorMittal Poland may receive PLN 1 billion for modernization,” indicates a strong commitment to maintaining domestic steel production and could improve long-term supply stability. This warrants close monitoring for the long-term planning horizon.