From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePolish Government Support Drives Optimism in European Rail Steel Market Despite Fluctuations

Europe’s steel market displays a positive outlook, particularly in the rail sector, driven by potential government support in Poland, while activity levels fluctuate across various plants. The news articles “ArcelorMittal Poland may receive PLN 1 billion for modernization,” “ArcelorMittal Poland in talks with government regarding state funding for modernization,” and “ArcelorMittal enters into negotiations on state aid to Poland: reports” indicate a strong commitment to maintaining domestic steel production, specifically rail steel. These articles potentially foreshadow increased future production at ArcelorMittal Poland’s Dąbrowa Górnicza plant, although no immediate direct impact on the observed activity levels can be established via satellite.

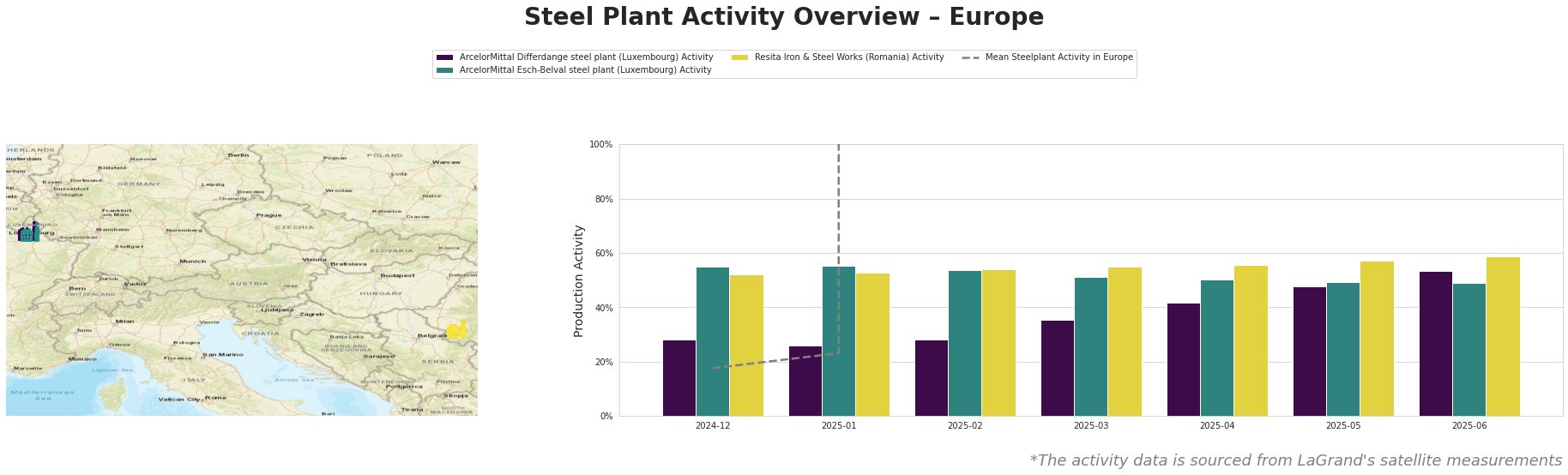

Across Europe, the average steel plant activity shows considerable volatility, peaking in May 2025.

ArcelorMittal Differdange steel plant: This Luxembourg-based plant, equipped with an EAF and a capacity of 2 million tonnes, specializes in sections, sheet piles, and rails for building and infrastructure. Activity increased steadily from 28.0% in December 2024 to 53.0% in June 2025. No direct link between this increase and the Polish government discussions can be established.

ArcelorMittal Esch-Belval steel plant: Another Luxembourg facility focusing on similar products with a 1 million tonne EAF capacity. Its activity remained relatively stable near 50%, with a slight decrease to 49.0% in June 2025. There is no indication that the Polish government funding talks have a direct impact.

Resita Iron & Steel Works: This Romanian plant, producing a diverse range of products, including heavy rails and wheels, saw its activity increase consistently from 52.0% in December 2024 to 59.0% in June 2025. No direct correlation to the Polish news can be established.

The potential state aid to ArcelorMittal Poland, specifically highlighted in “ArcelorMittal Poland may receive PLN 1 billion for modernization,” “ArcelorMittal Poland in talks with government regarding state funding for modernization,” and “ArcelorMittal enters into negotiations on state aid to Poland: reports,” suggests a bolstered supply of rail steel in the medium term. However, given the absence of immediate satellite-observed increases in activity levels that may take time to be reflected in production output, steel buyers should:

- Monitor ArcelorMittal Poland Developments: Closely track news and official announcements regarding the finalization of state aid and the subsequent modernization plans for the Dąbrowa Górnicza plant. This is particularly important for buyers relying on rail steel.

- Diversify Rail Steel Sourcing: While the Polish government support is a positive sign, procurement professionals should maintain diversified sourcing strategies to mitigate potential delays or disruptions during the plant modernization process. Consider suppliers like Resita, which shows consistently rising activity.

- Factor in Potential Future Price Adjustments: The modernization efforts could eventually lead to enhanced efficiency and potentially more competitive pricing. Keep this in mind when negotiating long-term contracts, but note that market dynamics could shift during the modernization period.