From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimistic Steel Market in Asia: Significant Activity Increases and Strategic Developments

Rapid developments in the Asian steel sector signal a positive market sentiment. Recent projects, including Danieli to supply water treatment plant for JSW Steel’s Dolvi hot strip mill and Primetals commissions ultra-thick slab caster at Baosteel Zhanjiang, indicate a surge in plant activities, as confirmed by satellite data trends. The improvements in operational capacities are closely aligned with the enhanced production capabilities and efficiency reported in these news articles.

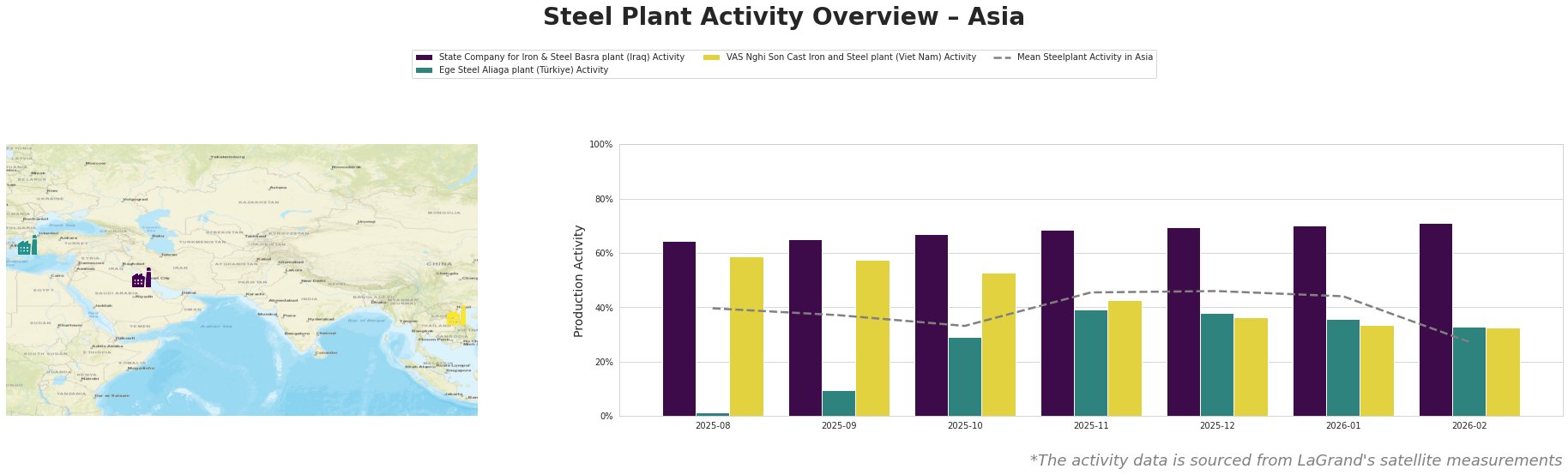

The State Company for Iron & Steel Basra plant in Iraq has shown impressive consistency, with recent activity peaking at 71% in February 2026. This trend suggests stable operations in a high-demand environment, possibly linked to regional steel supply needs. However, Ege Steel Aliaga plant in Türkiye has faced a significant downturn in productivity, plunging to 1% in August 2025, although it rebounded to 39% by November 2025. No direct connections to the cited news articles were established for this volatility. Conversely, the VAS Nghi Son Cast Iron and Steel plant in Vietnam demonstrated resilience, maintaining activity levels near the mean despite slight fluctuations, underscoring operational reliability amidst potential market demand shifts.

The initiatives around Danieli’s upgrades at Abul Khair Steel and the commissioning of advanced casters at Baosteel also reflect strategic expansions aimed at improving efficiency and product quality, which could offset any potential regional supply constraints as production ramps up.

Given the ongoing enhancements observed in plant activities, steel procurement professionals should prioritize sourcing from the Basra plant, which boasts stable operations and increasing activity rates. Meanwhile, while Ege Steel Aliaga offers potential for future supply as they address operational challenges, close monitoring is advised.

Retailers should be aware of looming supply stability from the upgraded Baosteel Zhanjiang as this may enhance availability for offshore and industrial applications, supporting procurement strategies. Analyses of supply trajectories suggest that buyers should position themselves to leverage the upgraded capabilities correlated with these announced projects while remaining vigilant of broader supply chain dynamics impacted by fluctuating operational levels across the region.