From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimism Prevails in Italy’s Steel Market: Strong Demand and Stable Prices Bolster Activity

Italy’s steel market remains buoyant, driven by robust demand as highlighted in the articles “European steel heavy plate prices flat amid fresh Italian bookings, muted northern Europe market“ and “Prices for rolled steel products in Europe remained unchanged amid new orders in Italy and subdued growth in the Nordic market.“ Both reports demonstrate that recent activity changes in Italian steel plants closely align with these emerging trends, particularly as prices stabilize despite broader market fluctuations.

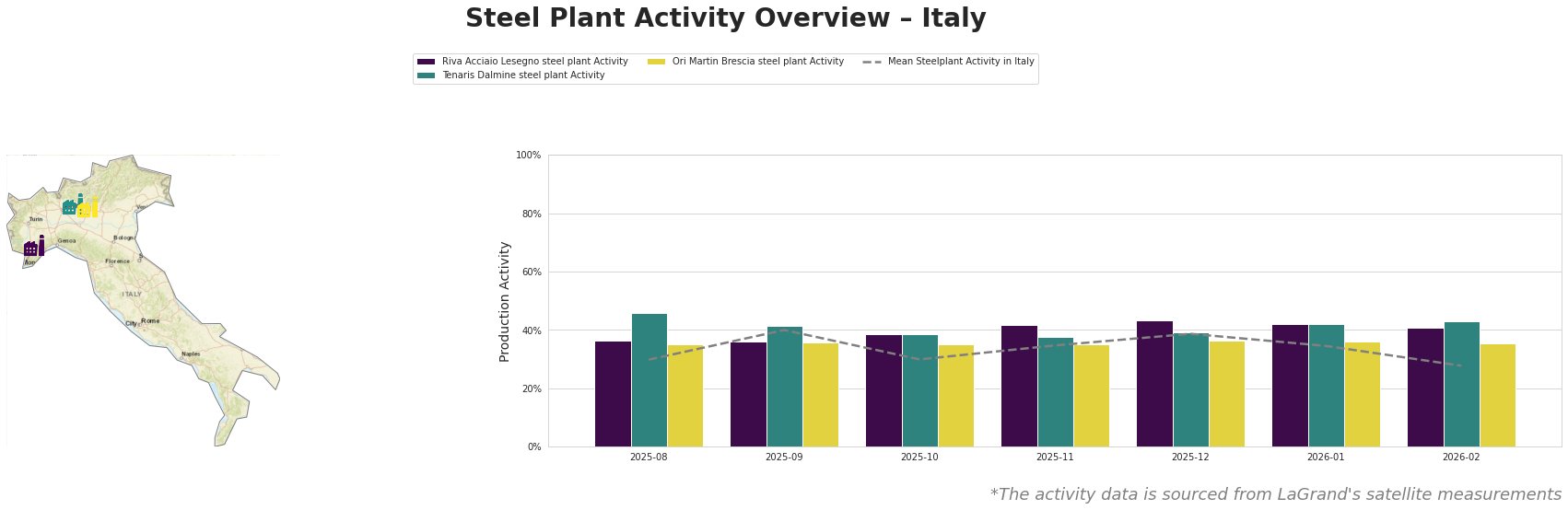

Recent observed activity levels indicate a generally stable situation across the sector, with individual plants exhibiting varying degrees of fluctuations. For instance, Riva Acciaio Lesegno experienced a peak of 43.0% in December but then dipped to 41.0% in February 2026. Meanwhile, Tenaris Dalmine peaked at 46.0% in August and later increased to 43.0% by February. Ori Martin Brescia has shown consistent activity levels around the lower bands.

Riva Acciaio Lesegno Steel Plant

Riva Acciaio Lesegno, operating in the Province of Cuneo, focuses on electric arc furnace technology to produce semi-finished and finished rolled products. The plant’s activity peaked at 43.0% in December 2025, driven by strong bookings, as noted in “European steel heavy plate prices flat amid fresh Italian bookings, muted northern Europe market.” However, a decline to 41.0% by February correlates with overall market stabilization as reported. Further, with fresh bookings around €700-720 per tonne contributing to pricing stability, the outlook remains positively skewed.

Tenaris Dalmine Steel Plant

Tenaris Dalmine has a capacity to produce around 700 tonnes of crude steel, also utilizing EAF technology. With the activity fluctuating between 38.0% to 46.0% over the observed period, the plant showed vibrancy bolstered by new orders reported in “Prices for rolled steel products in Europe remained unchanged amid new orders in Italy and subdued growth in the Nordic market.” This indicates ongoing demand solidifying Tenaris Dalmine’s role in the market.

Ori Martin Brescia Steel Plant

Ori Martin Brescia employs similar EAF technology with a slightly lower activity level, maintaining steady operations. Despite the lower productivity levels around 36.0%, the plant’s performance aligns with larger market trends where terminated quarters seem to stabilize pricing. No direct link can be established from the news articles to specific shifts in the plant’s activity, signaling that external market forces impact its performance.

Evaluating the current landscape, procurement professionals should note that ongoing demand signals future supply disruptions might emerge due to strategic planning for the second quarter, as emphasized in recent articles. To mitigate risks, buyers should consider securing contracts for semi-finished and finished products now, while current pricing appears favorable—particularly as exports from Italy to Germany are observed at advantageous rates. Balancing immediate requirements with the anticipated uptick in activity could enhance supply chain stability in the coming months.