From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimism in Russian Steel Market: EU and Türkiye Increase Imports, Satellite Data Shows Increased Activity

Recent market dynamics in the Russian Federation’s steel industry reveal a positive sentiment, significantly driven by changes in both export levels and plant activities. As reported in “EU imported 4.19 million tons of steel products from Russia in January-October”, despite a year-on-year decline of 10.7%, recent monthly figures indicate a surge in semi-finished product imports, correlating with increased activity levels in selected steel plants. This trend is further complemented by the findings in “Türkiye’s steel imports increased in January-November 2025”, where imports from Russia surged by 44%, reflecting greater demand. These developments indicate a tightening market situation with sustained export revenues.

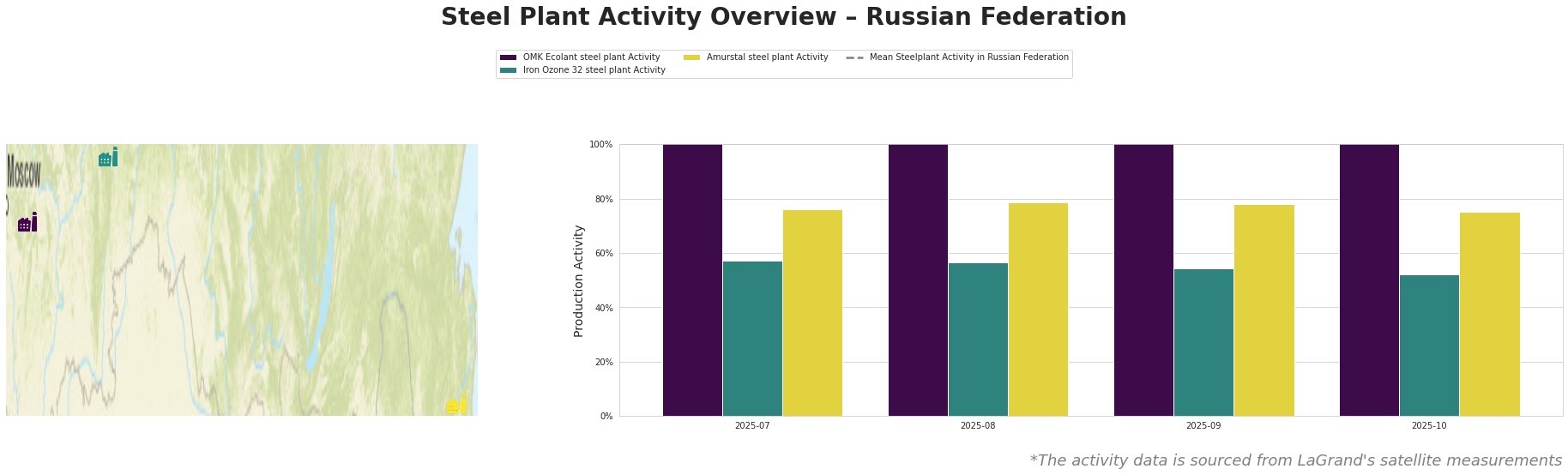

Activity levels across the monitored plants exhibit a general downward trend from July to October 2025, with mean activity reducing from 258 to 172 over this period. Notably, the OMK Ecolant steel plant consistently maintained a high operation rate, with its activity percentage remaining stable across these months, suggesting resilient operational performance amid fluctuating export conditions. In contrast, both the Iron Ozone 32 and Amurstal plants experienced moderate declines in activity, reflecting the overall market dynamics influenced by export quotas and demand shifts.

The OMK Ecolant steel plant, located in Nizhny Novgorod, operates with a capacity of 1800 tons of crude steel and remains focused on producing semi-finished products like slabs and round billets. Its activity rates have remained consistently high, corroborating strategic export efforts linked to the rising imports observed in the EU market. Although the report on scrap metal export quotas, “Russia Extends Scrap Metal Export Quotas Until 2026, Raising the Limit to 2.2 Million Tons”, relates to adjustments that could impact raw material flows, no direct relationship to its performance has been established.

For the Iron Ozone 32 plant in Sverdlovsk, which also predominantly produces billets, activity declined from 57% to 52% during the monitoring period. This drop may suggest alignment with the broader market challenges indicated by the overall decline in volumes reported. Alternatively, Amurstal in Khabarovsk has slightly decreased activity but remains pivotal given its diversified product offerings, including rebar and wire rod, essential for construction.

In light of these trends, potential procurement disruptions could arise for buyers in the EU experiencing shifts in Russian semi-finished product availability. Steel buyers should consider diversifying their sources and potentially increasing orders from the OMK Ecolant plant due to its stable activity and ongoing high performance linked with export dynamics.

Steel procurement strategies should be adjusted to reflect the recent increases in Turkish imports from Russia, securing contracts that can leverage the higher production capacity and adaptability of Russian producers amidst ongoing geopolitical challenges.