From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Strengthens Amidst Rising Global Prices and Localized Production Shifts

Oceania’s steel market demonstrates positive momentum, influenced by global pricing trends and localized production adjustments. Supply chain dynamics at individual plants play a critical role in current market conditions. The provided news articles focusing on Europe, such as “Prices for Italian fittings are rising,” highlighting material shortages affecting rebar prices, and “Prices for thick steel sheet are rising amid steady expectations of rising CBAM costs.” which discuss rising thick steel sheet prices due to the anticipated Carbon Boundary Adjustment Mechanism (CBAM) costs, show how global factors affect regional markets, and how price changes of semifinished goods affect steel supply chains. The effects of these articles on the activity of Australian and New Zealand plants has yet to be determined.

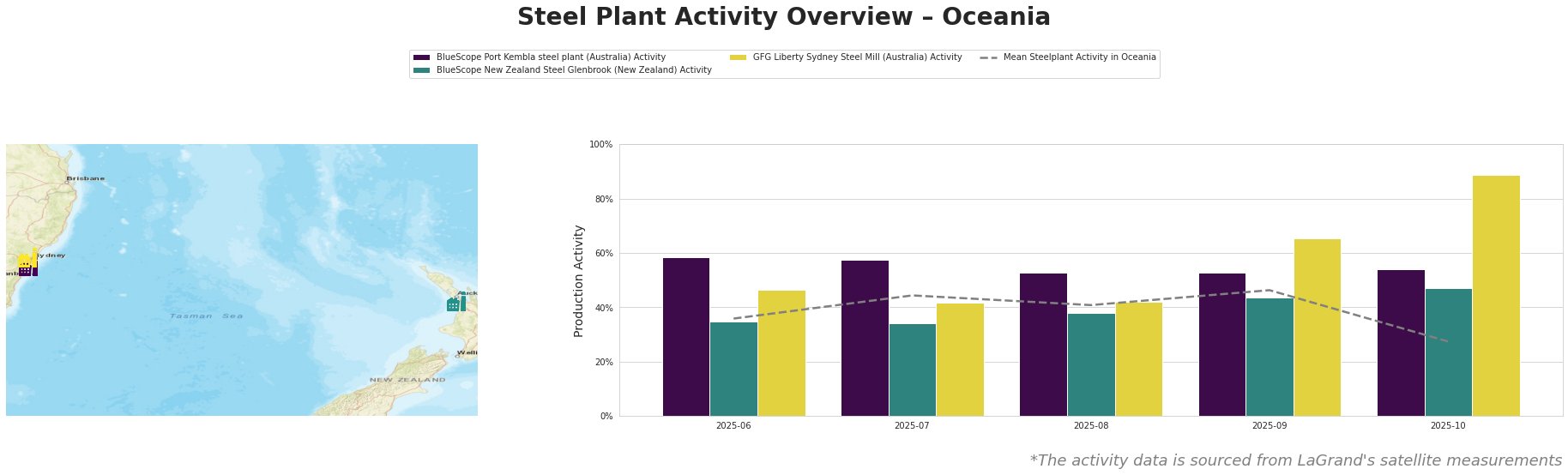

The mean steel plant activity in Oceania experienced fluctuations, peaking at 46.0% in September before dropping significantly to 27.0% in October. BlueScope Port Kembla in Australia maintained a relatively stable activity level throughout the observed period, ranging from 53.0% to 59.0%, consistently exceeding the mean. BlueScope New Zealand Steel Glenbrook showed a gradual increase in activity, rising from 35.0% in June to 47.0% in October. GFG Liberty Sydney Steel Mill demonstrated the most significant change, with activity increasing from 46.0% in June to a high of 89.0% in October.

BlueScope Port Kembla, an integrated steel plant in New South Wales, Australia, operates with a 3.2 million tonnes per annum (ttpa) BOF capacity, producing slabs, hot rolled coil, and plate primarily for the building and infrastructure sectors. Its activity remained relatively stable at approximately 53-59% between June and October. No immediate connection to the European market reports can be established, as the Port Kembla plant focuses on different products and regional markets compared to the rebar and thick sheet products discussed in “Prices for Italian fittings are rising” and “Prices for thick steel sheet are rising amid steady expectations of rising CBAM costs.“.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-based steel plant in South Auckland, New Zealand, has a 650,000 ttpa crude steel capacity. It produces slabs, hot rolled, and cold rolled products. The plant’s activity has steadily increased from 35.0% in June to 47.0% in October. Similar to BlueScope Port Kembla, no direct relationship can be established between the activity of the BlueScope New Zealand Steel Glenbrook, and the European market events reported in the provided news articles.

GFG Liberty Sydney Steel Mill, an EAF-based steel plant in New South Wales, Australia, has a 750,000 ttpa crude steel capacity. It produces long products, including reinforcing bar. The mill’s activity showed a substantial increase from 46.0% in June to 89.0% in October. This rise in activity, while significant, has no clear or immediate connection to the “Prices for Italian fittings are rising” article despite both addressing rebar products. The Italian rebar price increase seems to stem from localized supply issues in Italy, while the GFG Liberty Sydney Steel Mill’s increased activity doesn’t necessarily correlate with directly offsetting this shortage.

The European news articles indicate a potential increase in global steel prices due to CBAM and supply chain disruptions. The simultaneous increased activity at GFG Liberty Sydney Steel Mill, may allow it to capitalize on potential price increases.

Evaluated Market Implications:

- Potential Supply Disruptions: The news article “Prices for Italian fittings are rising” points to specific regional supply disruptions of rebar products that may not necessarily be related to Australian/New Zealand production.

- Recommended Procurement Actions:

- Steel buyers should closely monitor global price trends of thick steel sheet, especially from East Asia, given the potential impact of CBAM as described in “Prices for thick steel sheet are rising amid steady expectations of rising CBAM costs.” .

- Steel buyers that are sourcing rebar products should be prepared for potentially higher prices due to supply chain constrictions as reported in “Prices for Italian fittings are rising“.

- Buyers sourcing long steel products should monitor the output of GFG Liberty Sydney Steel Mill (89.0% in October) to evaluate the possibility of increased local supply in Oceania.