From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Stable Plant Activity Amidst European Price Volatility, Procurement Focus on Domestic Supply

Oceania’s steel market shows stable plant activity amidst fluctuating global price dynamics. While European markets face differing expectations between buyers and sellers as indicated in “The expectations of buyers and sellers in the European HRC steel market differ” and “Buyers’, sellers’ expectations vary in European steel HRC market“, these reports do not directly explain the satellite-observed activity changes in Oceania’s steel plants. Furthermore, price volatility in Europe (“European HRC market in wait-and-see mode“) has no immediately obvious relation to Oceania steel plant activity.

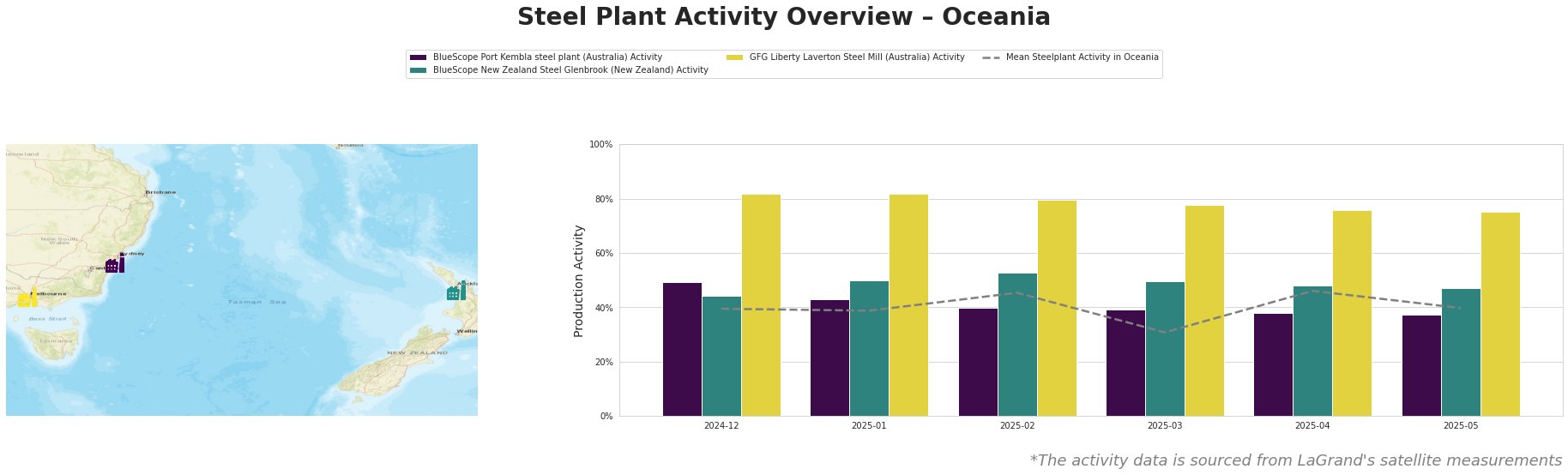

The mean steel plant activity in Oceania fluctuated between 31.0% and 46.0% over the observed period, ending at 40.0% in May 2025. GFG Liberty Laverton Steel Mill consistently showed the highest activity levels, ranging from 75.0% to 82.0%. BlueScope New Zealand Steel Glenbrook exhibited relatively stable activity, fluctuating between 44.0% and 53.0%. BlueScope Port Kembla steel plant showed a gradual decline in activity, from 49.0% in December 2024 to 37.0% in May 2025.

BlueScope Port Kembla steel plant, an integrated steel plant in New South Wales, Australia, with a crude steel capacity of 3.2 million tonnes per annum (ttpa) produced via the BOF route, experienced a decline in activity from 49.0% in December 2024 to 37.0% in May 2025. This plant primarily produces slabs, hot-rolled coil, and plate for the building and infrastructure sectors. There is no direct connection that can be established between the observed activity decline at BlueScope Port Kembla and the provided news articles concerning European HRC price dynamics.

BlueScope New Zealand Steel Glenbrook, an integrated steel plant in South Auckland, New Zealand, utilizes DRI technology and BOF to produce 650,000 tonnes of crude steel annually. Activity at this plant remained relatively stable, fluctuating between 44.0% and 53.0% over the observed period. The plant produces slabs, hot-rolled products and cold-rolled products for building and infrastructure, steel packaging, and the tools and machinery sectors. No direct link can be established between its stable activity and the provided news articles.

GFG Liberty Laverton Steel Mill, an EAF-based plant in Victoria, Australia, with a crude steel capacity of 660,000 tonnes, showed consistently high activity compared to the other plants, although activity decreased slightly from 82.0% in December 2024 and January 2025 to 75.0% in May 2025. This plant focuses on steel long products, including reinforcing bar, reinforcing mesh, and tubular sections. The observed activity levels show this EAF plant is operating at relatively high capacity, despite some fluctuations. No direct correlation can be established between activity at GFG Liberty Laverton Steel Mill and European market trends mentioned in the provided news articles.

Despite the trends toward stable roll prices in Northern Europe as reported in “The prices of rolls in Northern Europe are stable compared to import offers,” heavy steel plate prices in Italy are under downward pressure as indicated in “Italian heavy steel plate prices under downward pressure; Northern Europe market unchanged“, but the effect of European steel prices on the Oceanic market is not completely clear, no direct connection can be established in provided data.

Given the observed stability in activity at BlueScope New Zealand Steel Glenbrook and GFG Liberty Laverton Steel Mill, and the lack of direct connection to European market volatility, steel buyers in Oceania should prioritize securing supply contracts with these domestic producers. Given the recent decrease in observed activity at BlueScope Port Kembla steel plant, buyers should actively monitor their supply chain and consider diversifying sources for hot rolled coil and plate. While European price fluctuations do not directly impact Oceania based on the current data, staying informed on global market dynamics remains crucial.